Together, yet apart? Separation of activities in banking

In November 1999, the United States officially repealed the Glass-Steagall Act, which it had used for more than 65 years to keep the activities of investment banking and retail banking completely separate. A mere 9 years later, subprime mortgages led to the worst financial crisis since the Great Depression. Once again, the numerous conflicts of interest entailed by the integration of both activities within the same financial institution became evident. This is why many are now demanding again their total separation, arguing that investment banking is too risky and is financed, in part, by the implicit insurance provided by the guarantee of retail banking deposits and the fact that institutions had become too large and complex. Some have gone even further and are advocating narrow banking, i.e. that institutions dealing with deposits should not be allowed to carry out any activity that involves risk, including granting credit. However, the fact that there are efficiency-based reasons to integrate activities complicates the decision to be taken by regulators. Given this situation, what alternatives are available to tackle the problem? And which factors need to be taken into account?

The integration of activities subject to regulation and other, non-regulated activities within the same firm presents significant problems not only in banking but also in other sectors. In the case of banking, the regulated activity is deposit management. However, it had not been deemed necessary to monitor the risks associated with investment banking. As this is aimed at skilled investors, and in spite of the complexity and continual innovation of its products, it was assumed (at least until now) that investors had the technical know-how and sufficient incentive to monitor for themselves the risks incurred by the investment bank in question. When the same bank carries out both kinds of activity, regulated and non-regulated, monitoring the risks that might be run by the former becomes difficult for the supervisor due to the added complexity of the investment segment. As the supervisor is less able to observe the real level of risk, there is more incentive for the bank to take too much risk and use the higher returns to expand in the market. This situation is even worse when institutional investors perceive that the institution is likely to be bailed out as a result of either its retail banking, the complexity of its structure or its size, and consequently loosen their monitoring.

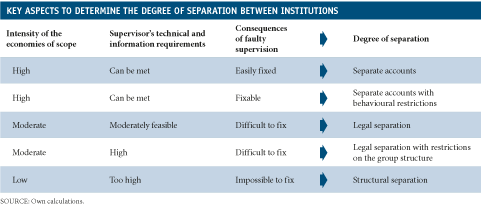

The experience of other industries with similar problems, such as electricity, gas or telecommunications, shows that the solution does not necessarily have to be all or nothing but that activities can be separated to a degree. The idea underlying the regulation of these industries is that, to a greater or lesser extent, activities are integrated essentially in order to take advantage of economies of scope. However, the resulting greater efficiency must be able to be passed on to users in some significant way, which entails limiting the integrated firm's potential to abuse its market power. In this respect, regulatory frameworks vary between industries and countries in terms of the preferred degree of separation, ranging from the mere separation of accounts to a legal separation into two companies and even structural separation, which eliminates any kind of link of ownership between the two. The greater the degree of separation, the less advantage is taken of the economies of scope but the smaller potential of abuse and the greater ease of supervision (see the table below).

When the economies of scope between the regulated and non-regulated activities are very high, considerations related to efficiency take pride of place in the decision. In this case, both activities are still integrated but, in exchange, a highly intrusive and information-intensive supervisory system is implemented, both in economic and technical terms. The supervisor's technical skill and powers needs to be very extensive, as it must be able to detect and correct any aspect that might lead the firm to use regulation for its own ends. When the economies of scope are not sufficiently significant to justify the resources required to achieve effective supervision, it is still possible to take some advantage of these by imposing a legal separation of the activities into two different companies that belong to the same group. The success of this alternative lies in minimizing conflicts of interest and stopping the regulated company from giving preferential treatment to the non-regulated company, forcing it to behave in the same way as it would with third parties. This reduces the capacity of both firms to arbitrate the regulation and, together with its more limited complexity, makes the job of supervising easier. Lastly, only when the economies of scope are not very significant or when the consequences of bad supervision are too costly has it been decided to separate these industries structurally.

Applying this conceptual framework to the case of banking, the differences between the solution adopted by the United Kingdom and the one adopted by the United States become evident.

The United Kingdom has opted to demand legal separation between activities with the introduction of retail bank ring-fencing. Activities with significant economies of scope with deposit-taking and the payment system and whose risk might be reasonably supervised are allowed for banks with a deposit guarantee. These include granting loans to households and SMEs, as combining these with the deposit business improves information gathering regarding the quality of the borrower, thus minimizing problems of asymmetric information. Similarly, most services offered by traditional retail banking are included, due to reasons of diversification and consumers' preferences to cover most of their financial needs through a single institution. These activities can therefore be carried out in the same institution, subject to greater regulation due to the essential nature of the services in question.

Those activities that are not necessary in order to provide these services and that, on the other hand, introduce unnecessary risk and complicate supervision, must be split off into another institution whose shares cannot be held by the ring-fenced bank (although both can belong to the same holding). These include all activities related to investment banking, as well as those giving rise primarily to market risk or counterparty risk. On the other hand, the operational ties between both institutions must allow the ring-fenced bank to operate normally, irrespective of the financial health of the rest of the holding. With regard to economic ties, these must avoid preferential treatment; i.e. any transaction between both banks must be valued as if it had been carried out between totally independent institutions. Together with the rest of the provisions proposed by the Vickers Committee and the new international regulations regarding so-called shadow banking, the United Kingdom trusts that this is enough to moderate investment banking's conflicts of interest.

The United States, however, has opted to reintroduce structural separation via the Volcker Rule, although this includes a much more limited range of separate activities than the English case. In particular, it bans banks from engaging in proprietary trading, as well as from investing in or sponsoring hedge funds or private equity funds. However, with the aim of preserving « robust and liquid capital markets and financial intermediation », the law allows some exceptions, such as some forms of market making or underwriting securities. In practice, however, these are difficult to distinguish from proprietary trading, so that not all risk is eliminated nor has the need for intensive supervision disappeared.

We have yet to see which of the two systems will work the best. In any case, what does seem to be true is that the supervisor's requirements in terms of information, necessary for either of the two alternatives to be effective, have yet to be met. We will just have to hope that the rest of the reforms being implemented to shadow banking change this situation.

This box was prepared by Sandra Jódar Rosell

Economic Analysis Unit, Research Department, "la Caixa"