Currency war: much ado about nothing, at least for the time being

On many occasions and for differing reasons, the global economic and financial crisis that began in 2007 has been compared with the Great Depression of the 1930s. For example, the prior formation of a credit bubble, problems with the banking sector and debate regarding optimum monetary and fiscal policies have justified reasonable parallels between both periods. Another area subjected to comparison is foreign exchange policy, in particular regarding a possible «currency war». We can certainly see some similarities but, fortunately, the dynamics over the last few years have not been as turbulent or harmful as they were almost a hundred years ago.

The media success of the expression «currency war» can be put down to the fact that it is both ambiguous and grandiloquent. This term should be interpreted as a proliferation of actions taken by economic authorities in different countries aimed at devaluing or depreciating their own currency in order to boost exports, slow down imports and thereby combat economic weakness. «Competitive devaluations» or «beggar thy neighbour policies» are alternative terms. The means used to achieve this are wide-ranging and vary in their subtlety: from mere direct intervention in the currency markets to manipulate the exchange rate to establishing foreign exchange controls and even the design of monetary and fiscal policies.

Judging whether a country is attacking others via its currency is not straightforward, especially when the tools used are subtle. The reasons and circumstances surrounding such actions are crucial in reaching a decision. When the main aim is to stimulate domestic demand and affecting the exchange rate is only a side effect, this does not seem to be an attack. Similarly, the same measure must be considered differently depending on whether it takes place within an environment where the currency is clearly over-valued or under-valued. On the other hand, whether protectionist measures are also present is of the utmost importance given the damage that «trade wars» can cause to all those concerned.

The events of the 1930s deserve to be classified as a currency war.(1) The initial scenario contained two basic elements: the Great Depression and the Gold Standard, a system of fixed exchange rates in which each currency was anchored to gold. Hit hard by recession, the authorities of the United Kingdom decided to abandon this straitjacket towards the end of 1931, setting off a long chain of events with global effect. The Scandinavian countries embarked on the same path as the United Kingdom that very year. Initially, one of the reasons for modifying the exchange rate system was to allow more expansionary monetary policies to be adopted aimed at domestic demand, but another objective was also to depreciate the currency and improve exports. In fact, this became the main focus of action over time. A few years later, France and Germany also gave up the Gold Standard, while the United States maintained it but in a highly diluted form. Competitive devaluations became common practice. There were also capital controls, at times defensive but other times offensive in nature. Unfortunately, a trade war did not take long to break out and reached extremely harmful levels. All this took place within a climate of reproaches, accusations and a lack of coordination between countries that merely served to quash the expansionary effect of the widespread application of more expansionary monetary policies. In fact, neither did it help to calm a tense international political climate that would result in unprecedented military conflict.

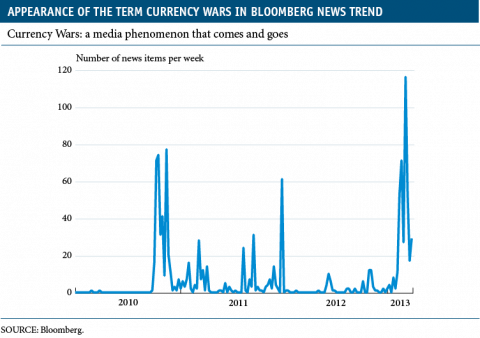

The situation of the last four years is much more reasonable. The threat of a currency war has occasionally raised its head but has, as yet, failed to materialize. Its most noticeable appearances have coincided with the announcement of «quantitative easing» programmes by the central banks of the main developed countries. In September 2010, the Brazilian Finance Minister, Guido Mantega, made the expression «currency war» popular in the press after hearing of the US Federal Reserve's QE2 plans. In the period between 2012 and 2013, agitation has become more intense in line with the ambitious monetary and fiscal policies announced by the government and central bank of Japan. Meanwhile, we have seen an assortment of foreign exchange actions. In Switzerland, the central bank established a limit to the Swiss franc's value against the euro and has intervened directly. Some other developed countries have also resorted to or threatened intervention. This was already customary in several emerging countries before the crisis and they have continued, combined with capital controls. However, all these operations and skirmishes do not constitute a currency war of the like seen in the 1930s. An examination of the reasons and circumstances reveals a relatively reassuring situation.

First of all, the Great Depression of recent years has not reached the dramatic heights of the Great Depression in the last century, while the flexibility of the foreign exchange systems that are now in force was already well established by 2008, unlike the chaos caused by the sudden abandonment of the rigid Gold Standard. Given this situation, the economic policy measures adopted have been aimed mostly at domestic targets and not at manipulating the exchange rate; in developed countries, to boost domestic demand: this seems very clear in the case of the United States with its categorical monetary policy, and somewhat less clear in the case of Japan; in the emerging countries, to preserve financial stability. This objective has become legitimate after the traumatic episodes experienced in the last few decades, such as shock wave caused by the Lehman bankruptcy and, previously, the Asian and Latin American crises of the 1990s. The use of foreign exchange controls to redirect flows of speculative capital has become accepted as reasonable practice, very different to when it was used for trade purposes.(2)

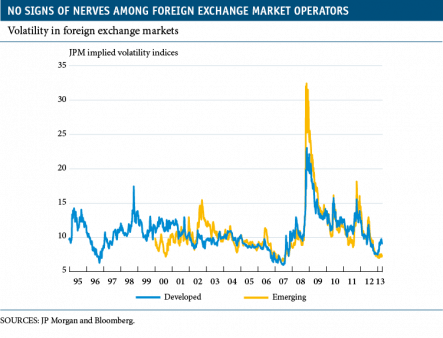

In addition, the most significant actions have occurred in countries whose currencies had appreciated not because of fundamental reasons but, in particular, due to the huge aversion to risk holding sway recently (such as in the case of the Swiss franc and the yen). In this respect, the IMF itself has stated that it has not observed any significant deviations at present regarding the fundamental equilibrium exchange rates of the main currencies.(3) On the other hand, the foreign exchange markets have operated correctly, without interruptions or dysfunctions (with the notable exception of the post-Lehman months, an event that collapsed all international financial markets). Lastly, no serious trade wars have emerged. In fact, more liberalization agreements are still being negotiated (particularly the one between the United States and the European Union), while international trade is expanding vigorously.

The climate of relations between countries has remained moderate, apart from the odd verbal outburst. Forums such as the G-20 are not wonders of harmony but they have helped to achieve some coordination, albeit tacitly and a posteriori. Along these lines, some observers(4) believe we are not experiencing an adverse currency war but a spontaneous process that is helping to coordinate internationally the application of expansionary monetary policies. Under this premise, the very success of these policies and the consequent recovery in the global economy should get rid of the threat of currency war once and for all.

(1) See, for example, Eichengreen, Barry and Douglas Irwin (2010), «The Slide to Protectionism in the Great Depression: Who Succumbed and Why?» Journal of Economic History 70, pp. 871-897.

(2) See the box «The exchange rate as an economic policy tool» in this issue.

(3) See the box: «What is the right price for a currency?», in this issue.

(4) See Eichengreen, Barry. (2013) «Currency War or International Policy Coordination?», Journal of Policy Modeling (forthcoming).

This box was prepared by the Financial Markets Unit

Research Department, "la Caixa"