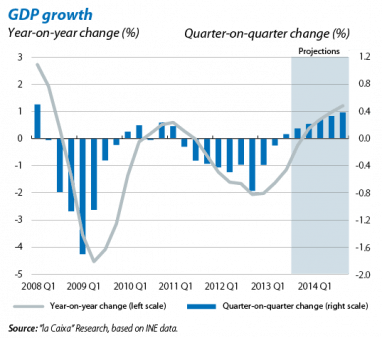

The Spanish economy gets back to growth after more than two years in recession

The Spanish economy gets back to growth after more than two years in recession. According to preliminary figures from the INE, GDP rose by 0.1% quarter-on-quarter in 2013 Q3, placing the year-on-year change at –1.2%. This marks the end of nine consecutive months of contraction which, added to the first recession of 2008-2009, have reduced real GDP by 7.5% compared with its level in 2008 Q1. This exit from the recession is being supported by the foreign sector which, according to the Bank of Spain's estimates and our projections, will have increased its contribution to quarter-on-quarter GDP growth by 0.2 percentage points up to 0.4 p.p. The good performance by tourism, which in twelve months up to September reached a new record high 59.6 million visits, and the fall in imports lie behind this larger contribution. Exports of goods, however, grew by a slower rate between July and August than in Q2. For the economy as a whole to pick up, it is vital for domestic demand to gain ground as well. For the moment, estimates point to its rate of decline stabilising, with a similar contribution to GDP growth as in Q2 (–0.3 p.p.).

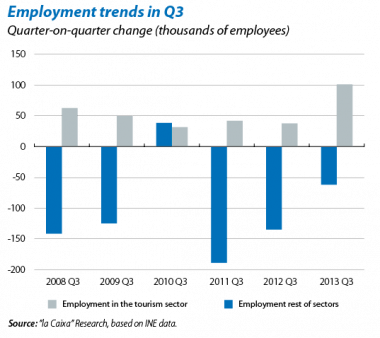

Tourism boosts job creation in 2013 Q3. The number of those in employment posted one of the largest rises in Q3 since the start of the crisis (39,400). This reflects the good performance by services which, in turn, is due both to the excellent tourist season and also to the improved performance by the rest of market services. For example, the number of employed people rose by 24,800 in trade and by 6,700 in professional, scientific and technical activities. Even those more directly affected by the crisis, such as real estate and financial services, posted a rise in employment during the quarter. However, non-market services (public administration, education and healthcare) are continuing to adjust and, as a whole, led to job losses (–76,600). Apart from services, no clear signs of improvement can be seen as yet in the rest of the sectors. Industry lost more jobs in 2013 Q3 (–14,700) than the average for the previous three years in Q3 (–6,100). Construction, however, reduced its rate of job losses. After having lost more than 1.6 million workers since 2008, all the evidence suggests that employment in this sector is stabilising at around 1 million people. We expect the improvement in the labour market to continue as the economic recovery consolidates.

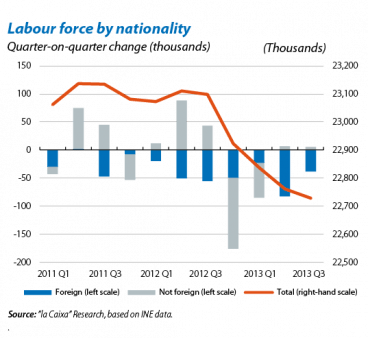

The unemployment rate fell for the second consecutive quarter and stood at 26.0% in 2013 Q3. This reduction, namely 0.3 p.p., is partly due to a further drop in the labour force (–33,300). As in the previous quarter, the foreign population is responsible for this decrease (–38,500) while Spanish workers registered a slight increase (5,200). In the coming quarters, we expect a further drop in the labour force although this will steadily moderate. The unemployment rate will also come down, but very gradually.

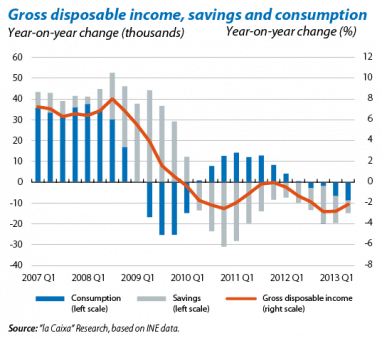

Private consumption is gaining support. On the one hand, the stabilisation of the labour market will help to halt the decline in household disposable income. The latest data available, for Q2, show that its rate of decline is slowing down (–2.1% year-on-year in Q2 vs. –2.8% in Q1). Private consumption also has other kinds of support, such as the extension of the "PIVE" subsidy plan for buying vehicles, which should maintain the good progress made by car registrations. All this has been reflected in a substantial improvement in demand indicators for Q3. Consumer confidence is now at clearly higher levels than those of Q2, although falling slightly in October. In September, retail sales recorded their first year-on-year positive change rate in 3 years. Part of this increase is because the VAT hike in September 2012, which led to purchases being brought forward, is no longer having any effect. In any case, if we compare the average for the index in the months of August and September with the previous year, the rate of decline has eased (–1.2% year-on-year).

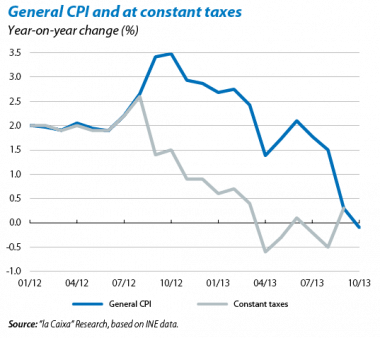

Consumers are also being supported by low inflation, helping households to maintain their purchasing power. According to October's flash estimate, inflation was negative (–0.1% year-on-year), something that hasn't happened since October 2009. This fall is higher than the figure used in our forecasts and that of most analysts. The breakdown by component has yet to be published but the bulk of the evidence available suggests that this larger decline would be due to the fall in prices of unprocessed food and the moderation in the increase in university education prices, which last year rose by 22.3% month-on-month. The dilution of this second effect should have reduced the year-on-year change in the CPI by 0.1 p.p. Moreover, low oil prices might have offset increasing electricity bills, with the energy component falling more than expected. In any case, we expect inflation to return to positive but moderate figures in the coming months.

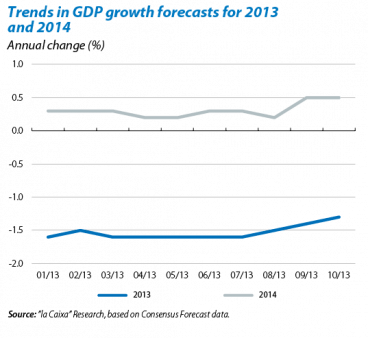

The Spanish economy's growth prospects are improving. In October, the consensus of analysts placed the annual rate of change for GDP at –1.3% for 2013 and at 0.5% for 2014, an upward revision of 0.3 percentage points in both cases compared with the forecasts of only a few months ago. These improved projections are due to greater confidence in the Spanish economy's capacity to generate growth, to the progress made in correcting macroeconomic imbalances and the credibility of the adjustments and reforms undertaken. This has also been reflected in the progressive normalisation of financing flows from abroad and the lower risk premium. Along these lines, the government has also increased its GDP growth forecasts in the medium term, now set at 1.3% for 2015 and 1.7% for 2016 (0.9% and 1.5% in the previous forecast).

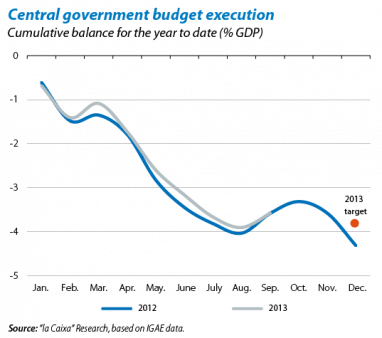

There is still a risk of a slight deviation from the public deficit target. Budget execution figures for September show that the general government deficit fell by 0.3 percentage points over the previous month, down to 3.6% of GDP (the same level as in September 2012). In spite of the possible positive effect of the economy's growth in 2013 Q4, the central government is unlikely to achieve its deficit target (–3.8% of GDP) given that, between October and December last year, when numerous measures were implemented (the VAT hike, elimination of extraordinary pay, extraordinary revenue from the fiscal amnesty), the deficit increased by 0.7 percentage points. That is why we have maintained our deficit forecast at 6.9% including bank losses (0.3% of GDP), slightly above the target for all public administration (6.8% of GDP).

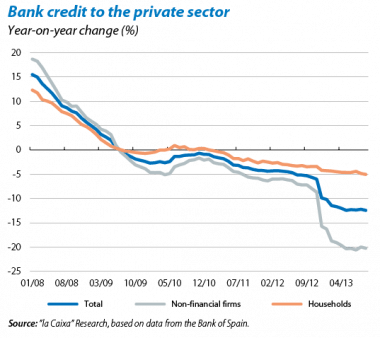

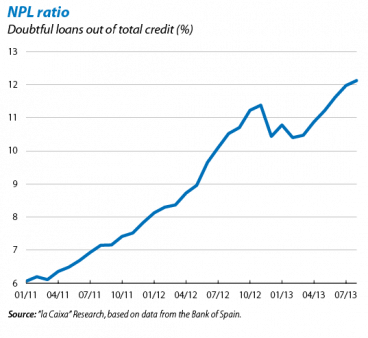

Bank credit continues to fall within a context of private deleveraging and the redressing of bank balance sheets.

In September, bank credit to the private sector fell by 12.4% year-on-year, a similar drop to the preceding months and denoting a certain stabilisation in credit flows. Part of this decline reflects the transfer of assets to the Sareb in December and February but the fall is still 6.6% even when this effect is discounted. In the case of firms, part of the drop in bank financing has been replaced by companies issuing securities other than shares, posting a growth of 12.5% year-on-year. In the case of households, a large part of the drop in outstanding credit is due to the early repayment of loans to acquire housing. The necessary process of balance sheet adjustment in the private sector makes this reduction in the level of debt unavoidable, so we expect the weakness in demand to continue for some time yet.

The conditions that limited the supply of credit are gradually easing. Spanish banks have made a significant effort to redress their balance sheets with an 11.9% rise in provisions in the last year. Moreover, the sources of bank funding are gradually getting back to normal: deposits are increasing (5.4% year-on-year), use of ECB funding is decreasing (–36% year-on-year) and the bonds issued are being welcomed by investors. Nonetheless, the bank NPL rate rose to 12.1% in August and is likely to increase further in September due to the adoption of new criteria to classify refinanced loans. These criteria will be applicable to all European banks in the asset quality analyses that are beginning this November, as a step prior to the Single Supervisory Mechanism (SSM) starting up in November 2014. 16 banks are subject to this analysis in Spain, accounting for 87% of the sector's assets. Given the great effort already made by Spanish banks to redress their balance sheets, no last-minute surprises are expected. This can also be seen in the IMF's latest Global Financial Stability report, which warns of latent non-performing loans in the business sector. Based on an analysis of the capacity of non-financial companies to return the debt they have taken out, the study concludes that, in Spain, potential bank losses would total 104 billion euros in the most adverse scenario, an amount that could be covered entirely with existing provisions. In the case of Italy and Portugal, the estimated losses are larger than the provisions, leading to additional losses that would have to be met with future profits and by consuming capital.