New payment systems: a giant on the horizon

The payment system industry's landscape has changed substantially over the last few years with the adoption of new technologies and the appearance of new providers such as PayPal, Apple and Google. The expansion of online shopping and penetration of smartphones have encouraged the introduction of new, innovative payment systems that are both efficient and secure. Which payment methods are we talking about and how are they used by different countries? Does the current regulatory framework facilitate the development of new payment systems? Let's look at this step by step.

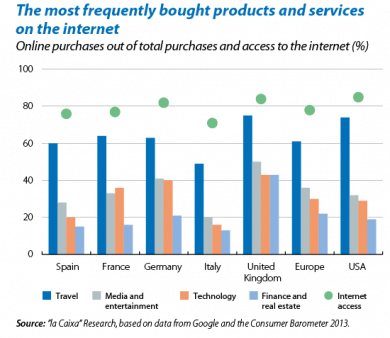

Thanks to new communication technologies it is increasingly common to shop online. According to the European Commission (EC), around 4% of the total volume of retail transactions in Europe are carried out via the internet and mobile devices.(1) For some products and services such as travel (plane and train tickets, etc.), internet purchases account for more than 50% of all purchases in this sector in Spain and in most European countries (see the first graph). The United Kingdom, Germany and USA seem to be one step ahead of the rest in terms of online shopping, also related to their populations' greater access to the internet (above 80%). The number of internet consumers in Europe has grown from 141 million in 2009 to 190 million in 2014 (35% more), while the average expenditure per buyer has risen from 500 to 600 euros a year.(2) Regarding smartphone usage in Spain, there is still a long way to go with 55% penetration in the population in 2013. At a global level, it is estimated that mobile payments will have increased tenfold between 2010 and 2014 (from 100 billion to 1 trillion dollars).

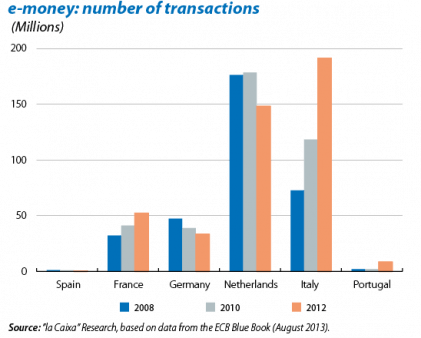

The fact that it is increasingly common to shop online has encouraged the emergence of new payment systems such as electronic money. Electronic or e-money is the digital equivalent of cash, stored on an electronic device (computer, mobile or card) and accepted by users as a means of payment. The e-money account or card is charged from a bank account via a simple transfer or from a linked credit card. In spite of its potential, the data indicate that, as of today, only a very small number of transactions are carried out with e-money at present (see the second graph) and the average value of these transactions is very low. Few consumers buy products via this method and, when they do so, they spend small amounts (although there are notable differences between countries). Despite of frequently using the internet and mobile phones to shop, consumers still mostly pay via traditional credit or debit cards or via bank transfer. The fact is, although these new systems have emerged, in principle, to offer consumers greater security in their online payments, over time users have reduced their aversion to using cards online (either because they now have more confidence in the internet or because such traditional cards have also gained in anti-fraud security by requiring, for example, dual verification using PINs and a code which the client receives via a text message when finalising a purchase). This might explain why, in some countries such as the Netherlands or Germany, the number of transactions with e-money has actually decreased over the last few years.

One of the most novel and popular e-money payment methods are digital wallets. Although this product is under constant innovation and is therefore difficult to characterise in general, it can be defined as virtual accounts where a small amount of (electronic) money is deposited for online shopping. All the consumer has to do is to previously link their bank account or credit card to this new «wallet» and therefore be able to transfer the money required to make the purchase. PayPal and Google, for example, offer this service globally over the internet or smartphone (other companies operate in a similar way locally, such as Alipay in China). But what is the advantage of these methods? Above all, security: they allow internet shopping without any credit card details being given to suppliers. Another innovative e-payment system is Bitcoin, which works in a similar way to a digital wallet but, in this case, without intermediaries (peer-to-peer) and which also acts as a digital currency (see the next article in the Dossier for more details).

Financial institutions have also developed similar models to digital wallets, taking advantage of their greater economies of scope (synergies between products, use of know-how, etc.). One example are electronic or virtual cards exclusively for internet transactions (also known as prepaid cards). These are small virtual moneyboxes, separated from the rest of a person's savings, in which a small amount of money is deposited to spend on online purchases. As with digital wallets, they are useful because they allow consumers to shop online without having to pass on details of their credit card or bank account and they also minimise the risk of loss by fraud since they are only provided with the amount required to purchase the desired product. Financial institutions have also developed powerful digital platforms to offer online banking services and which facilitate the transfer of funds from one account to another, thereby making it easy to use electronic cards and encouraging consumption via the internet or mobile devices. In the case of CaixaWallet, the digital wallet by "la Caixa", users can decide at any time, via Línea Abierta, which account or card they want to link with their digital wallet and activate or deactivate it as required.

Apart from electronic money, other payment systems have also appeared related to smartphones. In this area of m-payments, of note is the use of NFC technology (Near Field Communication), used by financial institutions in collaboration with telephony firms, in which payments are made by placing the mobile device, with the account holder's information stored on the SIM card, near the point of sale (POS) terminal at a store. Some institutions have opted for PayTags: a chip or card-chip linked to credit, debit or prepaid cards that's attached to the back of the mobile device and also allows payments via contactless technology. There are also mobile applications that act like digital wallets, storing the data from a card and transforming this information into a barcode which is then scanned to make the payment (like Lemon Wallet or Google Wallet). It could be argued that some of these payment methods have, in practice, evolved from the traditional credit card (which now also offers contactless operations).

The regulatory framework is also in the process of adapting to new payment methods. In Europe there is still no overall framework covering all electronic payment mechanisms. There has been greater convergence in the market of direct debits and bank transfers in Europe (see the article «The SEPA: a step towards integrating European payment systems» in this Dossier), but this has yet to happen in the market for card, internet and mobile payments. Given this situation, in 2012 the EC drew up a Green Paper, a document used to consult with industry, consumers and retailers with the aim of discussing and identifying the barriers to greater integration.(3) Some of the aspects highlighted were the current differences between cross-border and domestic payments (or interoperability), the functioning of consumer-retailer relations (use of discounts, surcharges or other similar practices) and interchange fees between payment service providers. The conclusion is that greater cooperation and harmonisation is required between the current European standards, including traditional technology (credit cards) and emerging technology (internet or mobile). Greater coordination is also required between the regulators of different markets such as telecommunications, banking and internet.

Decades ago, palaeontologist Stephen Jay Gould became famous for his evolutionary theory of punctuated equilibrium. According to this theory, evolutionary change occurs relatively quickly but is punctuated by long periods of stability. He found that, after centuries without any change, in just a few generations the panda had developed a «thumb» to pull leaves off bamboo shoots more effectively. Similarly, the traditional payment system industry, more based on the physical use of money, seems bound to make way for new payment systems based on electronic instruments and money. A landmark structural change that could become firmly established in just a few years.

Gerard Arqué

Economic Analysis Unit, Research Department, "la Caixa"

(1) European Commission. Green Paper. Towards an integrated European market for card, internet and mobile payments. Brussels: 2012. <http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2011:0941:FIN:EN:PDF>. [Consulted: February 2014].

(2) Ibid.

(3) Ibid.