The importance of unseen capital

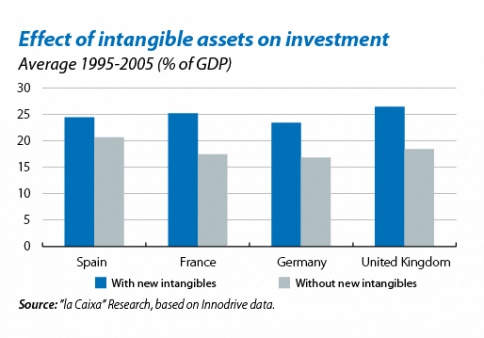

One recurring concern in recent times has been the supposed investment crisis in the main western economies. By way of example, between the 1980s and 1990s, in the main developed countries the growth rate for machinery investment was, on average, close to 6% year-on-year which, since then, has remained below 3%. To understand up to what point this trend should be of some concern, it is useful to analyse what is understood by investment and how it is measured.

Economic theory defines investment as what a company spends today to increase its profits tomorrow. One classic example is machinery investment: a firm makes a payment so that, thanks to the new machines, the workers will be more productive. Can spending on specific training offered by a company to its employees be classed as investment? Following the above reasoning, it seems evident that it should be: the company spends money today and, in the future, will produce more goods because the workers will be more productive. However, expenditure on firm-specific human capital and other kinds of capital is not included in national accounts.

Corrado et al. (2006) were among the first to attempt to identify and calculate the investment in such capital (called intangible capital) for the USA.1 Since then, several initiatives have been created to extend this study to other countries.2 The new types of intangible capital are grouped into three areas: (i) patents, (ii) brand and (iii) organisational capital. The first group includes expenditure on scientific R&D, new financial products and technical designs. The second group contains expenditure on advertising campaigns that strengthen the brand and also market studies. Lastly, organisational capital consists of spending on changing the firm's organisation (either by using its own resources or by acquiring them) and investment in firm-specific human capital. If we compare the breakdown of investment in these assets between countries, we can see that investment in organisational structure (out of the total) is much lower in Spain whereas investment in advertising in Spain is much higher.

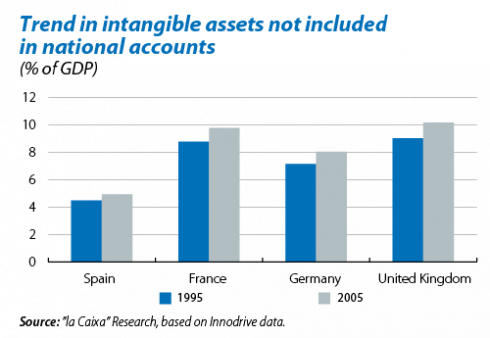

Investment in these intangible assets is significant: in 2005 it accounted for 5.0% of GDP in Spain and 10.2% in the United Kingdom. The relative weight of these assets also increased between 1995 and 2005, a trend that is likely to have continued. Lastly we should also note that, although the ranking of countries that invest the most (as a percentage of GDP) changes when we include these intangible assets, the gaps between countries narrow. In short, it seems reasonable to play down the unease produced by falling investment as this can partly be explained by an increase in the relative weight of intangible assets.

1. Corrado, C., Hulten, C., Sichel, D. (2006): «Intangible Capital and Economic Growth», NBER working paper No. 11948.

2. See, for example, Haskel and Westlake (2014): «Look to the intangibles», Free Exchange, The Economist, 20 February 2014.