South Africa: how to make your place among the large emerging countries

The party of the late Nelson Mandela, the African National Congress (ANC), won an easy victory at the elections last 7 May. Consequently, Jacob Zuma will be able to enjoy a second term as President of South Africa. Winning 62% of the votes was much more than expected as the socio-economic outcome of Zuma's first five years includes some achievements but also significant shortfalls. His challenge now is to underpin the former and remedy the latter.

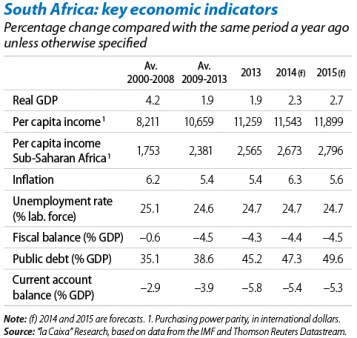

South Africa's progress has been considerable since the end of apartheid in 1994. In terms of GDP growth, the most fruitful period was between 2000 and 2008. The consequence of that boom is that the country's level of development is now clearly higher than its neighbours' (per capita income in South Africa is 4.5 times the average for Sub-Saharan Africa). In fact, the new South Africa gained a leading place on the global economic map with GDP steadily increasing its relative share of the total. Symbolically, an initial from its name became part of the famous acronym «BRICS». The country has the most developed financial system on the African continent with a deep capital market and a well capitalised banking system. On the whole, the quality of its institutions is comparable with that of the advanced economies in Asia, providing a favourable framework for foreign investment.

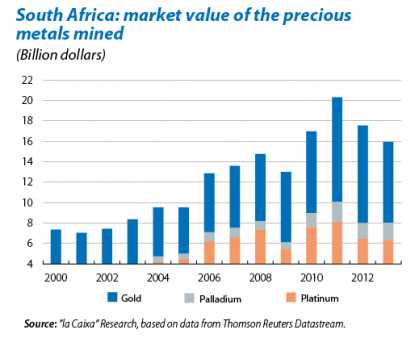

However, ultimately the country has been affected by imbalances inherited from the apartheid era and the inability of Zuma's government to sort them out. From average growth of 4.2% in 2000-2008 it went to 1.9% in 2009-2013. The country's huge inequality is the factor underlying its main imbalances and weaknesses. According to World Bank indicators, South Africa heads the global ranking for inequality, above countries such as Brazil, Chile and Colombia. The end of apartheid did not bring with it an improvement in this area because inequality continued due to an ineffective and inefficient educational system, a dysfunctional labour market (leading to high unemployment and low productivity) and a regulatory framework that hinders the creation of small and medium-sized firms. This is particularly evident in the mining industry. In 2000, South Africa extracted 11% and 75% of the world's gold and platinum, respectively. Low mining productivity meant that these figures had fallen to 3.5% and 72% by 2013. This reduction explains part of the significant deterioration in the current deficit, as well as being a repeated source of conflict. One recent example is the four-month strike by 70,000 miners which led to a stoppage of 40% of the world's mining of platinum and 870,000 ounces not being extracted (equivalent to 0.4% of South Africa's GDP).

Fortunately, improvements in the world's economic environment will enhance South Africa's macroeconomic figures in the short term (2014-2015): an upswing in GDP, a stop to rising inflation and a contained current deficit and public debt. But the government should not become complacent. Rather it should take advantage of the situation to reactivate the levers that are truly important in the long term: reforms of education and the labour market and the elimination of obstacles to setting up SMEs are essential conditions to capitalising on South Africa's evident strengths (financial system, institutions, market size). The country has the potential to become the financial centre of an increasingly attractive Africa for international investors. May's victory gives Jacob Zuma a second chance but there will not be many more.