The temperature is rising in international financial markets: bubble or just a hot spell?

The gains being made by the financial assets of developed economies are shifting from a reason for celebration to a source of concern, at least for some people. Specifically, the high values enjoyed by numerous sovereign debt, corporate bond and stock markets, as well as the circumstances under which such gains are being achieved, are setting off alarm bells due to the possibility of speculative bubbles appearing. Unfortunately there's no such thing as a precise, reliable «bubble meter» based on theory, so determining whether these financial markets are entering a bubble phase in the strict sense of the term (prices much higher than those justified by their underlying variables), is inexact and debatable. Fortunately, past experience can throw some light onto the situation: there are other areas where bubbles tend to leave traces in addition to asset prices, such as low volatility, high trading volumes, a bullish market, a large number of novice investors in the market in question, increased leverage, etc. An overall evaluation of indicators for the different types of assets reveals there are more reasons to be concerned about the high yield corporate bond market than stock or government bond markets. And, geographically, the US markets are more worrying than those in the euro area.

The current situation of booming financial markets is dominated by exceptionally low nominal and real interest rates. This is reflected in the high price of the most creditworthy public bonds, such as those of the US and Germany. One factor contributing to this development is the expansionary monetary policy adopted by central banks in response to the crisis of the last few years. Certainly the quantitative measures implemented (quantitative easing, in particular the Fed's bond purchases, and the full allotment of ECB loans), together with those aimed at official interest rates (forward guidance), are pushing down and reducing volatility in the interest rate curve but their effect does not seem to be so great as to create a bubble in the Treasury and Bund markets. As explained in the article «Real interest rates and growth prospects», there are several underlying factors, some cyclical and others structural, that can explain the current low level of risk-free interest rates, which are expected to continue for some time yet (albeit with a slightly upward trend). Market climate indicators tend to suggest there is no bubble: private investors have moved away while central and commercial banks have been buying; most of them expect prices to fall and yields to rise; trading volumes are moderate.

Beyond this controversial debate regarding causes (monetary policy or otherwise), this situation of low interest rates does seem to be affecting other financial assets, essentially through the channel known as the search for yield: the readiness of investors to buy risk assets such as shares and corporate bonds, in an attempt to secure higher yields given the poor returns from monetary assets and government bonds.

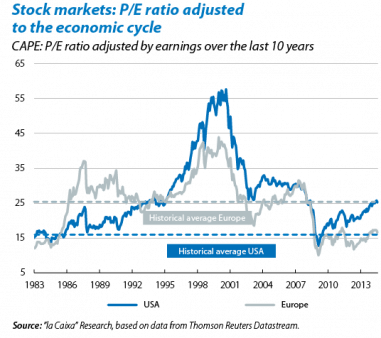

The equity of developed countries has seen substantial gains over the last few years but ostensibly more in the US than in the euro area. In 2009, the S&P 500 index began a remarkable rise that has now reached almost 200% and brought it to a level 28% above its previous all-time high in 2007. Affected by the debt and institutional crisis, the Eurostoxx 50 did not start to make any convincing gains until 2012 and, since then, it has risen by just over 50% and is still 30% below its record of 2007; in the case of the Ibex 35, this has risen by over 80% since its all-time low of 2012 but is also 30% below its record of 2007. To a large extent, this difference between the US and European stock markets is due to macroeconomic developments and trends in corporate earnings on both sides of the Atlantic, these being much more positive in the US over the last few years. But it also seems to be due to the risk premium in this country falling more quickly than in the euro area. This can be seen from the cyclically adjusted P/E ratio1 which, for the US, is above its historical average and at a level close to the one recorded in the previous upward cycle of 2003-2007, although still very far from the levels reached in the dot.com bubble of 2000. According to this indicator, the US stock market as a whole is expensive, so we should expect poor performance in the medium term, but there does not seem to be a bubble of any significant size. Climate indicators also suggest that the US market is moderately overheated but not euphoric: trading (including areas as M&As, IPOs, etc.) is brisk but within the usual parameters, as is also the case for most of the investor confidence or sentiment indicators. We must, however, mention some exceptions where new conditions have been detected that could indicate bubbles, specifically sectors related to the internet and social networks, as well as biotechnology. However, in the euro area both indicators for share prices (CAPE and others) and for the climate point to a temperate to cool temperature.

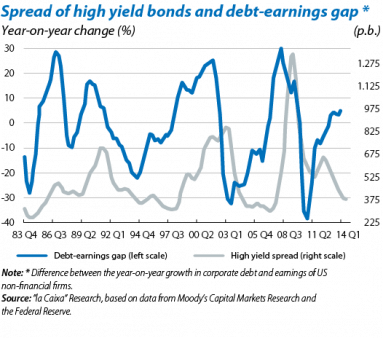

An examination of the situation in the corporate bond markets provides a more worrying picture than the stock markets, both in the US and in the euro area. The renewed appetite for risk of institutional investors (insurance companies, pension funds, etc.) and individuals is creating a scenario which, if not reversed or at least reduced, could lead to a bubble. First of all, the risk premia for credit and liquidity (the difference between yields compared with top quality public debt) have once again fallen, almost reaching the minimum levels prior to the crisis in 2007. Moreover, numerous indices are pointing in a dangerous direction, especially in high yield and junk bonds. In terms of issuances, the records are relentless: according to data from Moody's, in the second quarter of the year these totalled 88 billion dollars in the US and 102 billion in Europe, record figures in both cases although the net issuances in Europe are still negative due to corporate deleveraging. But perhaps the most worrying sign is the type and use of these funds, as well as the increasing proportion of ultra-high risk assets being issued2 compared with all high yield issuances. In the second quarter, the total number of bonds issued of this type increased by 78% year-on-year up to 60 billion dollars, an all-time high and accounting for 29% of all high yield assets issued in the period. A large part of this financing has been used to pay for mergers and acquisitions. Along the same lines, the last 18 months have witnessed renewed energy in the sale of products with zero or very little protection for bond holders, such as covenant-lite loans and payment-in-kind bonds,3 far above the pre-crisis levels. Another illustrative example of the current situation, characterised by investors taking on more risk in exchange for increasingly poor returns, can be found in cat (or catastrophe) bonds, instruments issued by insurance companies which specifically exempt, either totally or partially, the issuer from paying the principal or coupons in the case of losses caused by hurricanes or earthquakes). According to data from Bloomberg, the number cat bonds issued picked up in the first half of the year by 30% year-on-year and 15% in volume terms, totalling 6.5 billion dollars, within a context of a downward trend in yields and spreads for these products, very close to the historically minimum levels.

All the above suggests that corporate bond markets are currently vulnerable in several areas, with weaknesses that could be triggered and interact together. Firstly, the gap between the growth in corporate debt and earnings has started to show signs that suggest default rates may rise in the US, perhaps not in the short term but certainly in the medium term, albeit starting from a low level. Secondly, companies are facing high risks related to interest rates, credit and refinancing, especially if global interest rates eventually start rising and given the low risk premia for corporate bonds and growing leveraging in some sectors. Lastly, one aspect that has not attracted so much attention but has important implications is the fact that liquidity in the secondary corporate bond markets has decreased considerably due to regulatory reasons. Should there be a sudden rise in risk aversion, this would potentially amplify and lead to falls in bond prices.

In summary, the financial bubble that has repeatedly threatened over the last three decades is still there. Whereas it appeared in the stock markets in 2000 and in the real estate sector in 2007, the area it is most likely to threaten now is corporate bonds.

Carlos Martínez Sarnago

Financial Markets Unit, Research Department, "la Caixa"

1. Also called CAPE (Cyclically Adjusted Price Earnings), this measurement of value calculates the standard P/E ratio using the average earnings over the last ten years.

2. According to Moody's, assets issued with a credit rating of B3 or lower.

3. High risk bonds with conditions that affect the payment of the coupon and/or principal depending on the occurrence of certain events. In the case of PIKs, the issuer can choose to pay compensation in kind, generally in additional debt securities.