Household finances after the crisis: the temptation of risk

Over the last few years Spanish households have had to handle their financial planning under abnormal conditions. Between 2003 and 2007, the formation of a bubble: strong economic expansion, easy access to credit and rocketing asset prices, especially property. Between 2008 and 2013 an unprecedented crisis after the bubble had burst: massive job losses, a credit crunch and plummeting asset prices. This year a new phase seems to be starting: economic recovery, the gradual revival in credit and, the big difference with other cycles, rock bottom interest rates, almost zero, in the traditional products for household savings. Given this complex and changing situation, households have gradually been taking decisions concerning fundamental financial issues such as how to distribute their income between consumption and savings, how much debt they should have and the composition of their asset portfolios. This new phase will also see changes in some patterns of behaviour.

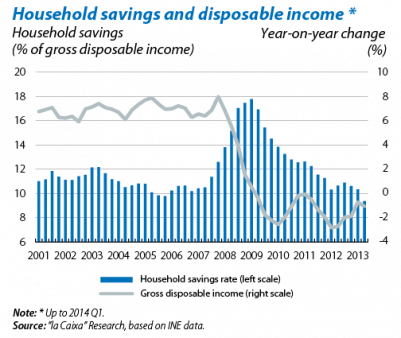

In 2014 Q1, the household savings rate fell to 9.4% of disposable income, an all-time low which is largely due to the drop in disposable income given the situation of high unemployment. In spite of the incipient recovery, no big changes are expected in the savings rate for the next year or two and the increase in disposable income will have to consolidate before any rise is seen in the savings rate towards levels close to those of the pre-crisis period. While this remains the case, other factors with currently uncertain effects will come into play, such as fiscal reform and expectations regarding state pensions.

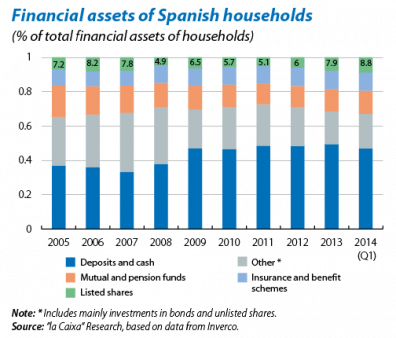

The level of debt and the composition of total household assets have a basic and common determining factor: decisions regarding the purchase of housing. The last few years have been characterised by a notable drop in income allocated to acquiring a home and associated mortgage debt. This deleveraging has made a lot of progress but has yet to be completed. Today the overriding forces seem to suggest this situation will continue. First, numerous households still have a high debt burden and will tend to reduce this. Second, few new households are being formed. Third, property prices have almost bottomed out but any future rises are likely to be very modest. Some factors are emerging, however, that could counteract this situation in the medium term. One is the easing of conditions to access credit after bank balance sheets have been cleaned up. Another are the low interest rates, which could encourage demand for housing as an investment by individuals disappointed with the almost zero returns from the traditional fixed income products. This effect, which some call the search for yield, can already be seen in the restructuring of the sub-portfolio of financial assets.

According to the Financial Accounts produced by the Bank of Spain, in 2014 Q1 the positions liquidised by households totalled almost 8 billion euros in the most liquid assets: cash and deposits. The reasons for this divestment can be found in the little yield currently offered by deposits, around 1%. Households also sold off their fixed income assets, albeit to a lesser extent, while mutual funds and shares received positive flows, totalling 9.4 billion euros.

Ultimately, the extent of this search for yield and assumption of risk will be crucial in determining whether the current phase of recovery and almost zero interest rates will give way, at last, to a period of relatively normalised conditions or whether the opposite will occur and we will see a repeat of the fluctuations of the last ten years.