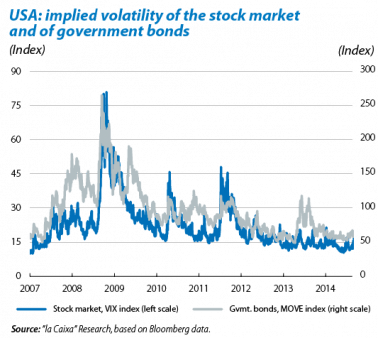

October witnessed an abrupt rise in volatility. The main trigger came from fears of a slowdown in global growth and particularly the threat of a third recession in the euro area. A series of negative cyclical indicators during the first two weeks of the month put investors on their guard, and warnings from the IMF regarding economic risks plus messages from the main central banks also contributed negatively. While the Federal Reserve (Fed) warned of the impact on US growth of the deterioration in Europe's economy, the ECB provided few details regarding its asset purchase programme. Given this panorama, investors took refuge in safe havens, damaging stock markets and corporate and emerging bonds. Fortunately such storms tended to abate towards the end of the month. Volatility is likely to remain higher than the levels observed in spring and summer, which were certainly abnormally low with latent sources of geopolitical tension and the communication strategies of central banks being the main potential sources of instability in the short term.

Nonetheless the trend over the medium to long term still looks moderately positive for risk assets as the euro area appears to be getting back on the path to recovery and the world economy as a whole advances at a satisfactory pace. High levels of liquidity will continue to support this favourable dynamic in spite of the end of monetary stimuli in the US. Intensification of bond purchases by the Bank of Japan up to 80 billion yen per year (from the current figure of 60-70 billion) provides a clear example of this pattern.

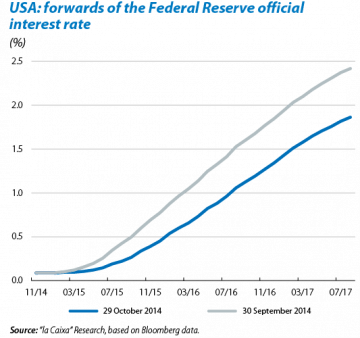

The Fed, prudent but optimistic. As expected, the US central bank has brought QE3 to an end. This decision is in line with its favourable assessment of labour market conditions (where the underutilisation of labour resources is «gradually diminishing») and with the outlook of moderate but sustained expansion in economic activity. The Fed also recognises that inflationary pressure could remain absent for some months yet. Based on this assessment, and appealing to the twofold mandate for its monetary policy, the Federal Open Market Committee announced its intention to keep official interest rates at their current level for «considerable time». However, it noted that the trend in the different indicators for activity and inflation will determine the pace of future hikes in the federal funds rate, also warning that, should both types of variable progress towards the Fed's objectives more quickly than expected, increases will probably occur sooner than currently anticipated.

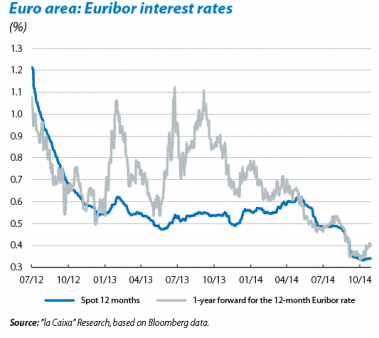

The effectiveness of the ECB's measures is in the balance. At its October meeting, in addition to keeping official interest rates unchanged the ECB's Governing Council also announced the operational details of its asset-backed securities purchase programme (ABSPP) and covered bond purchase programme (CBPP3). Similarly, and in an attempt to calm financial markets, Draghi insisted that the sum of both programmes, together with its targeted long-term refinancing operations (TLTROs), will have a «sizeable impact» on the bank's balance sheet. This should ultimately result in economic recovery and rising inflation but, if no improvements are seen in these areas, the ECB will consider the use of additional unconventional instruments. Fulfilling its promises, the bank has started a round of purchases of covered bonds from several countries in the euro area and is expected to do the same with ABS in November. However, numerous investors doubt the effectiveness of the measures adopted to date and believe that the ECB will finally opt to extend the purchase of financial assets (to include, for example, corporate bonds).

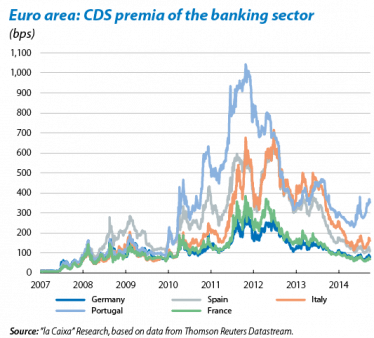

Meanwhile European banks have passed the ECB's stress tests. Only 25 banks did not make the grade out of the 130 analysed, concentrated mainly in Italy, Greece and Cyprus and with a joint capital shortfall of almost 25 billion dollars, a figure that decreases to 9.5 billion euros if we take into account the capitalisation measures already carried out in 2014. Although, in some cases, considerable punishment has been meted out in the stock markets, the tenuous impact observed on bank risk premia as a whole would suggest that this test has helped to dispel uncertainty regarding Europe's banking system, which was to be expected. All this should help the ECB to take on its new role as the single banking supervisor as from 4 November.

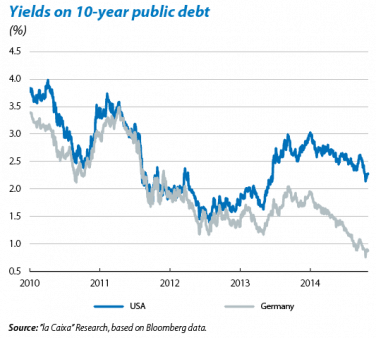

Yields on treasuries are falling (even further). In the first few weeks of October, the increase in risk aversion and financial volatility pushed investors towards safe haven assets. This is the case of US sovereign debt, whose yield fell sharply and returned to levels close to its all-time low throughout all tranches of the curve. Nevertheless a gentle upward trend in yields started to be observed towards the end of the month, boosted by the Fed's latest announcements regarding the dynamism of economic growth in the US.

Bund yields are at an all-time low. As in the case of the United States, this risk-off episode also affected German public debt. The increase in capital flows searching for a safe haven has pushed down yields, now in negative terrain for the 3-year bund and clearly below 1% for the 10-year bund. This situation has also been caused by doubts regarding the effectiveness of the ECB's financial asset purchases to avoid the threat of deflation. Also revealing is the fact, as published by the monetary authority, that European banks reached a new peak in sovereign debt holdings for the region in September (a total of 1.84 trillion euros).

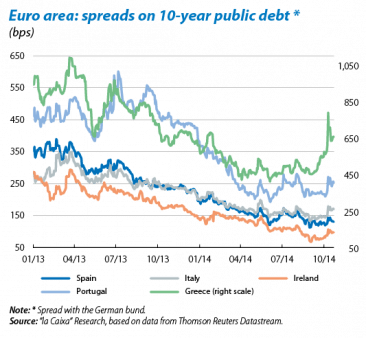

Spain, leading the periphery. In spite of a turbulent October, sovereign yields for the periphery saw very contained increases in general, although the differences between countries have become even more marked. On the one hand Spain's satisfactory rating revision, Spanish banks passing the ECB's stress tests and the improvement in the economy have all helped Spanish debt. On the other, Italy's budget deviations and the delicate situation of some of its banks, together with the threat of Greece abandoning its bail-out plan, have pushed up the risk premia for both countries.

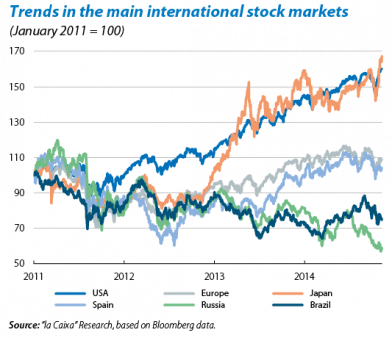

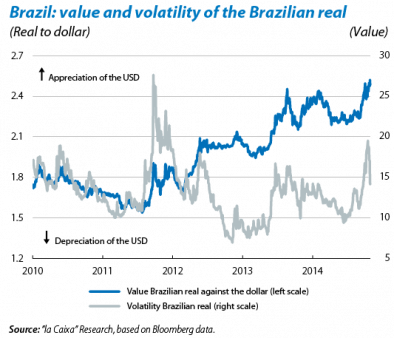

International stock markets in sharp retreat. The risk of corrections that had hovered over stock markets for months has materialised with the return of volatility. The adjustment was triggered by the deterioration in global economic growth forecasts, sufficient reason to put a stop to investors' high degree of complacency. Within a short period of time the signs of over-buying have vanished and indications of over-selling have even appeared in some markets, such as Europe's. Another aspect that has caught investors' attention is the start of the Q3 corporate earnings campaign. To date, the announcements have been encouraging. In the US the earnings of companies in the S&P 500 are far outstripping analysts' estimates, supporting the US stock market which had already recovered a large part of its losses by the end of the month. In the euro area companies are announcing tighter profits due to the weaker economic environment and temporary aspects such as the veto on exports to Russia. As far as the emerging economies are concerned, and unlike other occasions, the increased instability in October has not led to any additional deterioration in the financial environment although Brazil warrants a mention apart, where the process that has resulted in Dilma Rousseff being re-elected as the country's President has acted as a specific source of volatility.

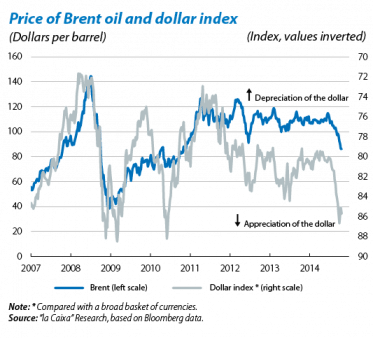

The dollar remains firm while oil prices decline further. Volatility in the foreign exchange markets has also increased as a result of the divergent monetary strategies being implemented by the main economies. Although the dollar is the currency that has appreciated the most since the summer, doubts regarding the pace of monetary normalisation in the US have slightly slowed down its rise against the euro and yen. Meanwhile the price of a barrel of oil has lost its 90-dollar benchmark due to increasing over-supply.