US Treasury term premia: not yet, but likely

Throughout of the last quarter of a century, there has been a continued downward trend in long-term, risk-free nominal interest rates in developed countries. Many different factors lie behind this situation, affecting one or more of the three components that make up this interest rate: expected inflation, expected short-term real interest rates and the term premium. The role played by the latter has been as silent as it has been important and this role

is likely to continue in the future.

The term premium should be seen as the recompense or benefit of a return demanded by investors for investing in a bond (or another fixed yield instrument) over a long period instead of investing in a short-term security (and reinvesting during the life of the long-term bond). More precisely, the term premium is made up of two different elements: (i) a risk premium associated with the uncertainty of the expected trend in short-term real interest rates and (ii) a risk premium associated with the uncertainty of inflation expectations. Consequently, during periods of high uncertainty concerning the central bank's intentions regarding its official interest rate and/or when the central bank does not set specific, credible inflation targets, the term premium for long-term bonds will tend to be higher.

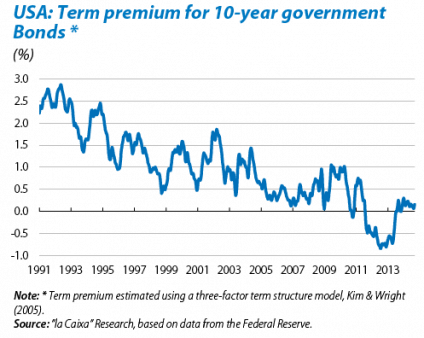

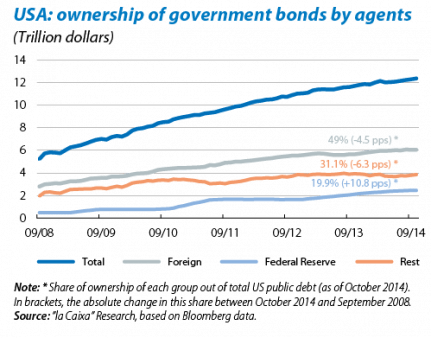

Although this premium cannot be observed directly, it can be estimated using econometric techniques or via surveys. Several studies agree that there was a considerable drop in the term premium for US government bonds (Treasuries) between 2010 and 2013. They also agree about the main cause: the Fed's massive asset purchases (QE1, QE2 and QE3), the increase in the average maturity of its bond portfolio and its forward guidance strategy all pushed the term premium down to negative figures, an unusual situation in historical terms. However, other factors also contributed to this situation and the relative scarcity of assets considered to be safe after the outbreak of the global financial crisis was one of these, especially given the growing demand for financial institutions to meet new regulatory requirements in terms of solvency and liquidity.

Bernanke's advance notice of tapering in May 2013 resulted in a sudden upswing in the term premium until it returned to positive figures, remaining stable over the subsequent months. During 2015 we expect this upward trend to pick up again because of two factors; one short-term and the other medium-term in scope. Firstly, the (historically) slow upward path taken by the official interest rate, which is currently being ignored by agents, may change suddenly as the Fed is likely to bring forward its date for what will be the first interest rate hike in eight years. Such action will increase uncertainty regarding any subsequent decisions. Secondly, the design and implementation of the Fed's strategy to sell off bonds from its portfolio is an extremely important element that will soon become a cause of concern for investors. Since the start of its quantitative easing programme, the Fed has increased its balance sheet fourfold, acquiring close to 4 trillion dollars in bonds. Moreover, a very large proportion of these are long-term (10 years or more). This means that the average life of outstanding public debt in the market (excluding the Fed's holdings) is currently much shorter than in previous years. Consequently, any expected rise in the number of Treasuries in the long tranche of the curve will push up long-term interest rates. After the calm that has prevailed in the Treasuries market in 2014, next year could see episodes of instability due to a probable upswing in the term premium and the size and duration of these episodes will largely depend on how specific and clear the Fed can make its communication policy.