Growth speeds up with the support of consumption

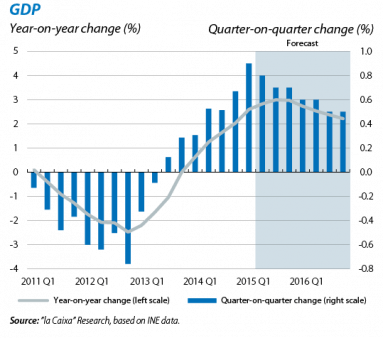

The rate of growth for the Spanish economy increased to 0.9% quarter-on-quarter in Q1, 0.2 pps more than our forecast and the figure posted in 2014 Q4. Pending details by component, early business indicators point to dynamic domestic demand especially in private consumption and corporate investment, while foreign demand is likely to have made a slightly negative contribution due to the strength of non-energy imports. Activity indicators, which already pointed to a faster growth rate in 2015 Q1, suggest the recovery is stronger than expected. This has led us to revise upwards our growth forecasts to 2.8% for 2015 and 2.5% for 2016 (up by 0.3 and 0.2 pps respectively), mainly because of the improved trend in private consumption reflecting the good performance by the labour market and savings thanks to lower oil prices. On the other hand we expect foreign demand's contribution to growth to continue being slightly negative in 2015 due to rising imports resulting from greater consumption, becoming positive in 2016 when the euro's depreciation has its maximum effect.

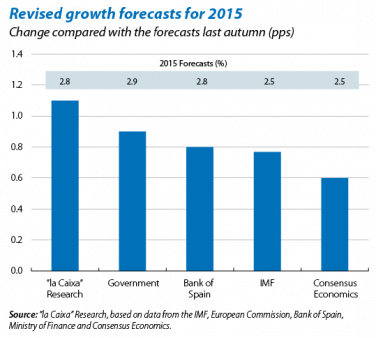

Widespread improvements in growth prospects for 2015. The good figures recorded over the last few months augur robust growth for the whole of 2015 and the main national and international organisations have improved their growth forecasts for the Spanish economy for this year. In April it was the turn of the International Monetary Fund (IMF) and the Spanish government, improving their forecasts by 0.8 pps and 0.9 pps respectively. The annual growth predicted for 2015 is between 2.5% (forecast by Consensus Economics and the IMF) and 3.0% (Funcas forecast) with the forecasts made by the Bank of Spain and "la Caixa" Research lying between these two figures (2.8%). The warning note comes from the medium-term forecasts which show a clear slowdown in the growth rate as the effect of temporary supports (low oil prices and the euro's depreciation) gradually dwindle. In its spring report, the IMF repeats the need for Spain to continue carrying out reforms and boosting investment to underpin potential growth in the medium term.

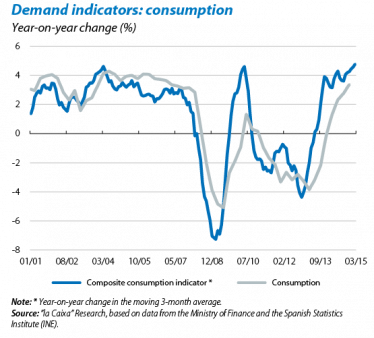

Domestic demand is the engine for growth. Demand indicators suggest domestic consumption was healthy in Q1. Retail sales rose by a strong 2.7% year-on-year in March and sales of large firms recorded an increase of 5.7% year-on-year in February, supported by a dynamic domestic market. This good trend is continuing in Q2: consumer confidence rose again in April and reached 3.6 points, a level similar to the one in 2000 (with a historical average of –12.9 points). Spanish consumers are starting to notice the improved economy which, thanks to savings due to lower oil prices, low inflation and improved labour market, is encouraging them to increase consumption and make purchases postponed during the worst years of the recession. These positive figures are reflected in the composite consumption indicator made up of various demand indicators, showing a clear upward trend and suggesting private consumption will be a key support for growth in 2015.

Inflation picks up although it is still in negative terrain. Inflation increased for the third consecutive month in April; specifically by 0.1 pps to –0.6%, boosted by the increase in electricity prices. We expect this upward trend to consolidate over the coming months and inflation to return to positive figures in the second half of the year.

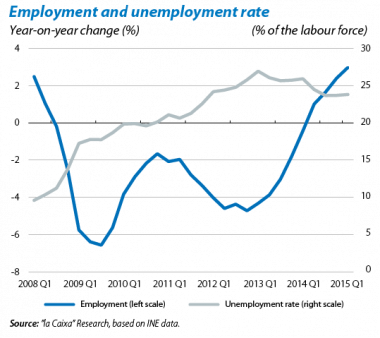

Good activity figures reinforce the labour market. The Labour Force Survey (LFS) posted its lowest drop in employment in a first quarter since 2008. During the first three months of the year, employment fell by 114,300 people (184,600 in 2014 Q1), placing the year-on-year rate of change in employment at 3.0% (2.5% in Q4). Spain's labour market is highly seasonal due to the importance of the tourism industry, so first quarters are historically weak as a consequence of the end of the summer and Christmas tourism campaigns in Q3 and in Q4. After eliminating this seasonal effect, employment actually grew by 0.4% quarter-on-quarter. The same trend can be seen in the number of registered workers affiliated to Social Security whose year-on-year rate of change speeded up by 0.5 pps in March to 3.3%, accumulating 20 consecutive months of growth.

The unemployment rate has risen slightly. In spite of the job losses occurring in Q1, the unemployment rate increased by just 0.1 pps to 23.8% due to a reduction in the labour force in the same quarter. However, in annual terms the labour force recovered for the first time since 2012, specifically by 0.1% year-on-year, representing an increase of 15,500 people. Over the coming months the labour force might continue to grow as the economic recovery consolidates and the effect fades of the discouragement that has affected the labour market over the last few years. This will limit the reduction in the unemployment rate which we place at 21.7% in the last quarter of the year. However, in the longer term the labour force will tend to diminish due to the ageing population.

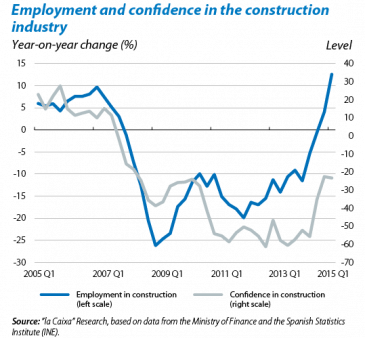

The real estate market shows signs of improving. Employment in construction grew by 12.6% year-on-year in Q1 (30,000 people) and the sector contributed a quarter of the increase in total employment in that quarter. This change in trend can also be seen in supply and demand indicators for the real estate sector. On the supply side, new building permits rose in January by 7.0% (cumulative over 12 months) while, on the demand side, house purchases were up by 11.2% in February (cumulative over 12 months). All this indicates that the sector's adjustment is complete and augurs a good 2015.

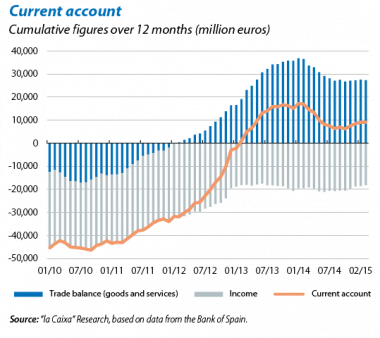

2014 ended with a larger current account surplus than had been predicted. The definitive figures from the Bank of Spain for 2014 were higher than expected, placing the current account surplus at nearly 8.5 billion euros (0.8% of GDP); this figure is an improvement of around 7 billion euros compared with the initial estimate for the balance (1.2 billion euros). The main reason for this revised figure is the balance for primary and secondary income which ended the year with more revenue and less expenditure than initially estimated, closing at –1.8% of GDP (the initial estimate was –2.3%). Nonetheless the new current account figures are still lower than those recorded in 2013 (1.5% of GDP) due to a worsening trade deficit in goods. For 2015 we expect the euro's depreciation and the fall in oil prices to support the balance of trade, in February standing at 0.9% of GDP according to the cumulative figures over 12 months. For its part, tourism continues to perform well. In March the number of tourists, cumulative over 12 months, posted a 6.7% increase year-on-year, exceeding 65.5 million.

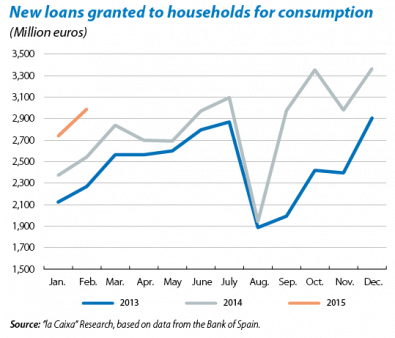

The recovery stimulates credit. The recovery in the economy is boosting both the demand and supply of credit to the private sector. New loans granted to households for consumption increased in February by 17% year-on-year and stood at 3 billion euros (34 billion cumulative over 12 months, 16% more than in the same period a year ago). Loans to households for housing also showed a similar trend with 18% growth year-on-year (21% cumulative over 12 months). Similarly, new loans granted to SMEs, also according to the cumulative figure over 12 months, improved by 0.1 pps to 8.9% year-on-year. In addition to these good figures for the last few months, financing conditions also improved as from the start of the ECB's quantitative easing programme. All the evidence therefore seems to suggest that credit will continue its recovery and provide households and firms with extra resources, encouraging consumption and investment and, in turn, bolstering the good tone of the Spanish economy.

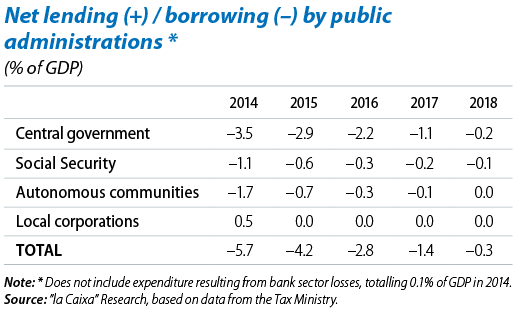

The government has published its 2015-2018 Stability Programme with substantial improvements in the macroeconomic area. According to this programme, GDP will grow by 2.9% in 2015 and 2016 and will reach 3.0% in the following two years, a forecast in line with that of "la Caixa" Research for 2015 but quite a lot more optimistic for the subsequent years. This acceleration in growth, together with the upswing in inflation and improved labour market, will help to meet the deficit target in the coming years (–4.2% of GDP in 2015), almost achieving a balanced budget by 2018 (–0.3%). Compared with the programme presented a year ago, of note is the slight relaxation inthe deficit for 2017 for the autonomous communities and Social Security, representing an increase of 0.3 pps to

–1.4% of GDP. The government also presented the new National Programme of Reforms which contains structural reforms at a European level to encourage investment, growth and employment, as well as measures at a national level, most of them already approved but yet to be implemented.