No-one said it would be plain sailing

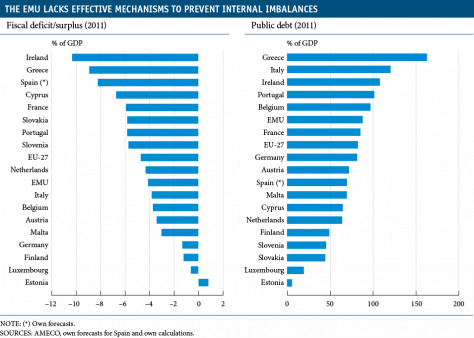

The international financial crisis and its sequel in Europe, the sovereign debt crisis, uncovered structural deficiencies in the euro area's institutional framework that were ignored for too long. Specifically, the European Monetary Union (EMU) lacks effective mechanisms to avoid the accumulation of excessive fiscal imbalances

– the Stability and Growth Pact has been proven insufficient – or to offset giving up the nominal interest rate as an instrument to adjust external imbalances within the union. These deficiencies were known to exist since the union was created, just like it was known that, sooner or later, they would have to be amended. However, it is very human to put off tough decisions until circumstances force our hand; this explains why large confederations have tended to make the biggest advances after a traumatic episode and the euro area will be no exception.(1) In Europe, this unavoidable situation arrived together with the worst crisis seen since the Second World War; a challenging rough patch but one that is, unfortunately, necessary for the euro area to take a giant step towards its final destination: a union with a greater degree of fiscal and economic integration.

At this stage, few doubt that the euro area's future demands more Europe, this being understood as greater fiscal, economic and probably, in the long run, political integration. This necessity does not come merely from the immediate need to sort out the sovereign debt crisis, which is one reason, but also from the aim to underpin the very foundations of the EMU which, no matter how you look at it, are incomplete to ensure the viability

of the single currency in the long term. The goal is therefore highly ambitious and the process to achieve it, highly complex: taking a definite step forward towards fiscal union requires changes in European treaties and a drastic reform of economic governance which, at present, have yet to materialize with enough forcefulness or precision.

Since the bankruptcy of Lehman Brothers in 2008, 22 European Council summits and an endless number of bilateral meetings have been held and yet, although it's true that measures have gradually been taken to establish greater fiscal coordination between member states at successive summits, it is also true that, initially, these measures were too spineless. So much so that, instead of tackling the crisis, they hinted at a lack of resolve and an inadequacy in the institutional framework that swept away the confidence of investors and economic agents. It was not until the last part of 2011, when the crisis became systemic and financial tensions engulfed non-periphery economies such as France and Austria, that greater consensus was reached regarding the need to progress along these lines and measures undertaken became more far-reaching.

To date, the most decisive step in this direction was taken in December. On the one hand, with a new fiscal agreement for budgetary discipline in the euro area (christened the fiscal compact); on the other, the commencement of the 6-pack or stability pact, which includes a new directive and 5 new regulations and is the most important reform of economic governance mechanisms for the European Union since the EMU was created 20 years ago. This stability pact was proposed by the European Commission in September 2010 and approved by the 27 members of the European Union and the European Parliament in October 2011. In practice, it establishes that, as from 13 December 2011, euro area countries that are subject to an excessive deficit procedure (higher than 3% of GDP) and that do not comply with the specific recommendations to correct this excess can be penalized with almost automatic fines (of up to 0.2% of GDP), if this is recommended by the European Commission and unless a qualified majority of the group opposes it. It also reinforces the debt target, requiring countries with too much debt to reduce it progressively at the rate of one twentieth per year of the difference between the current level and 60% of GDP. On the other hand, it also introduces an excessive imbalance procedure to prevent divergences in competitiveness, unsustainable current account deficits, asset bubbles and other macroeconomic imbalances. This procedure will result in recommendations from the Commission to member states that, should they not be complied with, can also lead to financial penalties (of up to 0.1% of GDP).

The imminence of the 6-pack coming into force paved the way for the European Council to approve the principles of the new fiscal compact at its December summit. The German authorities arrived at the meeting with one objective: to incorporate fiscal rules in the primary legislation of the European Union and of the different member states that would set in stone the goal of a balanced budget under the penalty of automatic sanctions. Although they did not manage to convince all their European partners to modify the union's treaties (the United Kingdom flatly refused), they did manage to get the commitment of the EMU member states (and the backing of their European Union partners, apart from the United Kingdom and the Czech Republic) to incorporate a «golden rule» of a balanced budget in their respective main national legislation (preferably in the Constitution). This rule will restrict the public sector's structural deficit to 0.5% of GDP and failure to comply will result in automatic penalties. They also agreed that it should be the European Union Court of Justice that supervises the transposition of this fiscal rule into national legislation and that both the details of this rule and also the rest of the measures agreed in the pact (reducing excessive debt or renouncing unanimity in terms of applying automatic penalties or payments from the European Stability Mechanism) should be sealed by means of an intergovernmental agreement, which is already being drafted and is expected to be ratified before March 2012.

The new fiscal pact therefore reinforces what was established in the 6-pack. As a whole, these agreements lay the foundations for greater progress towards fiscal and economic integration. To start with, they give more leeway to the European Central Bank to acquire the public debt of peripheral countries. They also force countries with larger imbalances into greater discipline and to subject their budgets to the European Union's supervision. In turn, this will help to establish mutual trust within the union, also aiding the work of authorities from the more financially solid countries to convince their citizens that, eventually, a broader mandate for the ECB and the greater sharing of risk through some sort of stability bond would serve the general interest, as these measures would provide the single currency with a significant amount of solidity.

A common sovereign debt issuance would particularly help towards financial stability and economic efficiency in the euro area. Firstly, it would be a powerful instrument to tackle the liquidity problems currently facing some member states (allowing them to benefit from the greater credit quality of other members) and would minimize the risk of a sudden loss of market access in the future. As a considerable reserve of secure, liquid assets would be created, it would also provide the euro area's banks with a source of more solid guarantees and would help to pass on the ECB's monetary policy. On the other hand, this bond market's large size, liquidity and credit quality would lead to a relatively low interest rate, reducing financing costs both for the public and private sector in the euro area.

Europe chose its destiny years ago. Right from the start, it was assumed that the journey towards this destiny would be long, complex and stormy; that there would be a political price to pay for making progress, a price that could only be paid when there was no other choice. In order to get through the present storm we have to start paying that political price and move on towards the next port of call: European Fiscal Union. The alternative is to sink without trace as, at this stage, going back is not actually an option.

(1) See, for example, Bordo, M., Agnieszka, M. and Jonung, L. (2011), A Fiscal Union for the Euro: Some Lessons from History, NBER WP. #17380.

This box was prepared by Marta Noguer

International Unit, Research Department,"la Caixa"