The foreign sector continues to be the main support for the economy

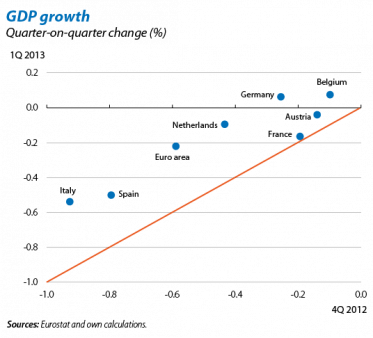

The recession is easing. As expected, the euro area continued to contract in the first quarter of the year but the rate of decline in activity slowed down (–0.2% quarter-on-quarter in 1Q 2013, –0.6% in 4Q 2012). This trend can be observed in all countries for which figures are available. The scenario of gradual recovery is therefore being confirmed and a return to positive growth rates, albeit modest ones, seems close at hand. Once again the German economy remained at the head although without having too much to boast about (its growth remained at 0.1% quarter-on-quarter). However, GDP shrank in the rest of the large countries (–0.2% in France, –0.5% in Spain and –0.5% in Italy).

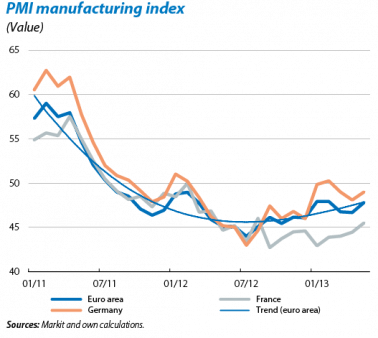

Most activity indicators point to a slow recovery for the second quarter. In May these indicators, erratic throughout the first quarter of 2011, picked up part of the ground lost over the last few months and are once again hinting at a positive although slightly volatile trend. The composite PMI for the euro area rose to 47.7 points thanks to manufacturing. Although the average of 47.3 points for April and May was below the figure for the first quarter, namely 47.7, the underlying trend is still positive and we continue to believe that the worst of the recession is now behind us. However, there are notable differences between countries. The French index remains at a standstill in the contraction zone. Germany, however, is picking up speed: its PMI is already approaching 50 points and the Ifo index increased after two months of drops.

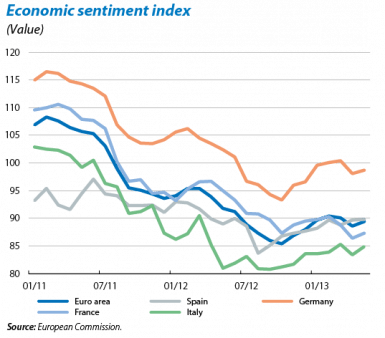

Economic sentiment improved in May, coming close to the figures achieved in February and March, once again suggesting a slightly positive trend. Although the movements over the last few months have been similar in all countries, their levels are still highly disparate. Of particular note is the increase occurring in Germany and Spain, namely 5.4 points and 6.1 points from the minimum levels reached last summer. France, however, has practically lost all the ground gained at the end of last year. These trends are expected to continue over the coming months, with Germany at the head and Spain coming out of recession little by little. France and Italy are providing some cause for concern as, although they are not presenting any great macroeconomic imbalances, growth is failing to show any sign of picking up and their agendas of structural reforms are progressing very slowly.

Consumer confidence rose in May up to the levels of one year ago. Specifically, this reached –21.9 points, better than the average for the first quarter (–23.7). Nonetheless, it is still very much below its historic average (–13), so its recovery is vital to boost domestic consumption.

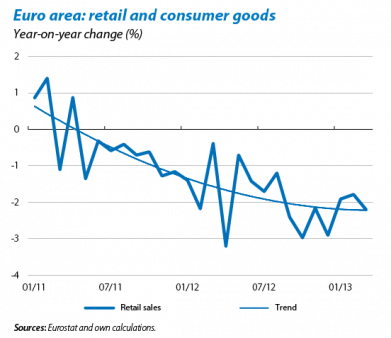

Domestic demand is failing to pick up. Specifically, retail sales for March, with a decline of 2.4% year-on-year, are still not showing any sign of improvement. The greatest drops were concentrated in the periphery countries such as Spain (–10.5%) and Portugal (–5.9%), which are undergoing severe adjustment. The core countries also declined but to a much smaller degree: Germany (–0.4%) and France (–0.7%). The continued rise in unemployment, reaching a new peak of 12.2% in April, is making it difficult for household consumption to recover. Weak demand and falling oil prices pushed April's inflation down by half a point to 1.2%. This will remain at a low level as no continual rises are expected in energy prices or any recovery in demand that might push up prices.

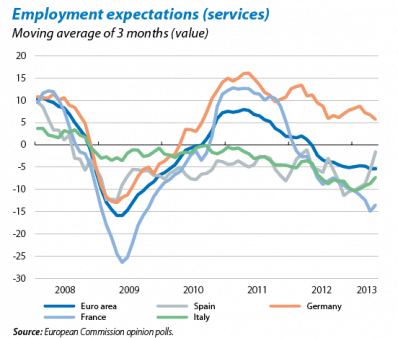

The situation of the labour market varies greatly from country to country. For the euro area as a whole, May's index for employment expectations over the next three months points to the labour market not getting any worse although, for the time being, neither is there any clear change in trend towards recovery. Spain has performed particularly well, especially in services as the average index for April and May (–3.6) is six points higher than the figure for the first quarter and close to the threshold as from which jobs are created. This variable also improved more than two points on average in the manufacturing sector during April and May compared with the first quarter, up to a negative value of 10.7 points. In Germany these indices have remained stable at clearly higher levels so that, for the time being, there is no doubting the capacity of the German economy to continue creating jobs in spite of its unemployment rate remaining at an all-time low. France, however, saw a slight upswing, but was still far below the euro area's figure of 13.5 negative points.

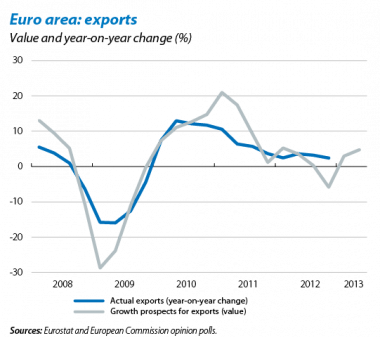

The foreign sector continues to be the main support for the economy. In March goods exports grew by 2.8% year-on-year in nominal terms (–1.0% imports), raising the goods surplus to 28.1 billion euros in the first quarter. Moreover, the index for export expectations has notably improved in the second quarter, standing clearly above the figures posted at the end of 2012. Consequently, the foreign sector does not look like running out of steam for the moment. However, what is, on the one hand, a reason to be satisfied (the recovery is based on the foreign sector partly because of improved competitiveness), on the other hand it is a symptom of the fragility of the current economic situation. In this respect, the slowdown in growth of the main emerging countries such as Brazil and India and, to a certain extent, China, is raising doubts as to how far exports can grow in the medium term. In principle, these countries will continue to enjoy high growth rates and they also have a lot of room to implement economic policies to continue stimulating their demand if necessary, although given the importance this sector is acquiring we will have to keep a close eye on developments.

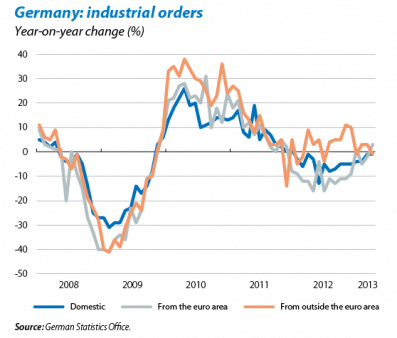

In Germany, industrial orders from outside the euro area are losing steam and, to some extent, their trend hints at how exports will perform in the future. Specifically, these orders decreased in March by 1% year-on-year. In general, this is quite a volatile series and, moreover, in January and February it grew by 3% so it would be overly hasty to predict any downward slide for the time being. What is clearer is that the high growth rates of previous years, namely 9.4% in 2011 and 3.3% in 2012, now appear quite distant.

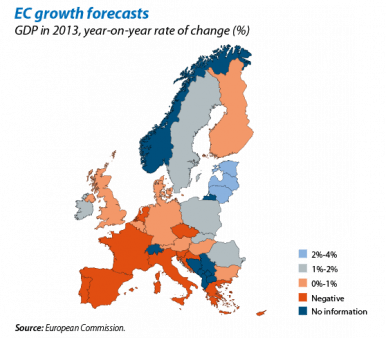

The latest EC forecasts suggest a slightly slower exit from the crisis. For 2013, the EC predicts a 0.4% drop in GDP for the euro area. The revival of the global economy will continue to be supported by exports but domestic demand will remain depressed due to the adjustments being carried out in the balances of economic agents. With a view to 2014, the EC predicts growth of 1.2% although this is subject to the different countries making headway in their programmes of reforms. The EC also recognizes the need to strengthen the euro area's institutional architecture. In this respect, crucial decisions will be taken at the European Council on 27 June regarding the process of banking and fiscal union (see the Focus «Banking union: advancing in fits and starts»).

The EC has eased the path of fiscal consolidation given the slow progress being made by the recovery. The EC has evaluated the effort made by each country according to the reduction achieved in its structural deficit (the part of the public deficit remaining after eliminating the impact of the overall economic situation). In this respect, it has shown itself to be quite satisfied with the progress made by most countries. This revision in the path of fiscal consolidation is a result of the economic decline occurring which has been greater than expected, increasing the cyclical part of the deficit. Without doubt, this revision will help to make the process somewhat easier to bear. Specifically, for Spain, France, Poland and Slovenia the EC is now granting two additional years to bring their public deficits below 3% and one additional year for the Netherlands and Portugal.

The new mantra is to speed up and extend structural reforms. This year the EC has particularly emphasized the importance of implementing an ambitious agenda of structural reforms. The adjustment process that many periphery countries still have to carry out will keep growth at moderate rates over the coming years. Moreover, in some core countries there are also serious doubts regarding their capacity for long-term growth. That is why the EC has presented a detailed agenda of reforms for each country. In France, for example, it is vital to regain competitiveness as French exports have been losing market share for several years now. In this respect, making its labour market more flexible is seen as one of the key factors to turn this situation around. Italy's extensive black economy is still a source of concern, as well as its relatively inefficient judicial system. In other words, the list is long and detailed and a clear indication that a lot of work still remains to be done.