The use of fiscal incentives to increase the labour force participation

Maria has just received a job offer. She has been unemployed for the last two years, is single and has a 2-year-old son; she lives in subsidised housing and receives a monthly supplementary benefit to cover the most basic expenses. If she accepts the job, she will exceed the income threshold to qualify for this benefit and for subsidised housing. With her new income, she will not be able to afford a nursery or rent a flat at market rates. In her situation, it is better to reject the job offer than to accept it. Maria's case is not an isolated one. In addition to single parent families, other groups such as older workers or those who are not the main income provider are very sensitive to the different incentives provided by income taxation and social benefits.

For some years now, economists have analysed in depth how fiscal policy, the social protection system and public pension system all interact and how these interactions affect the decision to participate, or not, in the labour market. The aim is to improve the design of these policies to ensure that the tax system and social benefits do not discourage people from working. For example, if the income earned by the second earner in a household receives a neutral tax treatment, this tends to increase the number of women participating in the labour force. Similarly, limiting the generosity (or increasing the penalties) related to early retirement increases the number of older workers participating.

But perhaps the most successful measures have been those that link receiving tax breaks to employment. The United States was pioneer by implementing the Earned Income Tax Credit or EITC in 1975. More recently, other countries have also been adopting this kind of measure, such as the United Kingdom in 1999 and Sweden in 2007. Although there are notable differences between countries, both in terms of the requirements to qualify for the tax credit as well as in how generous these are, these measures do all share the same aim: to give financial aid to lower income households without discouraging them from working. To achieve this, the tax credit goes up with the household income (up to a certain threshold); in other words, the higher the income received from employment, the greater the tax credit, so that households are encouraged to work more and not less.

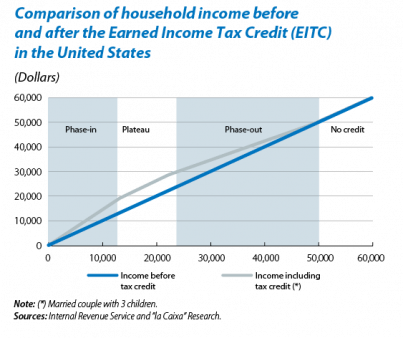

In the United States, and also in other countries, the EITC is refundable; this means that tax breaks can exceed the amount of tax paid and therefore represent a net complement to the household's income. It is structured into 3 phases depending on the household's income and composition (see the graph). In the first phase («phase-in»), the amount of EITC rises with income. For example, a household composed of a married couple and 3 children with an annual income of 10,000 dollars receives an additional 4,500 dollars as EITC, bringing their total annual income to 14,500 dollars. In a second phase («plateau»), the maximum amount of EITC is obtained within a specific income bracket. In the previous example, the maximum EITC is 5,891 dollars for households with an annual income ranging from 13,000 to 22,250 dollars. Lastly, in the third phase («phase-out»), the amount of EITC gradually decreases until it reaches a threshold, as from which households no longer receive EITC. In the previous example, this threshold is 50,200 dollars. This structure increases the progressive nature of tax on income and hence it is a redistributive measure oriented towards complementing the incomes of those households at the greatest risk of poverty.

A large amount of academic literature has demonstrated the effectiveness of such programmes regarding their objectives to boost the labour force participation rate and the incomes of such households. It comes as no surprise that the most notable effects are concentrated within those groups who, before the measures were introduced, had a low participation rate and particularly those who had a low educational level. Of note are the effects on women in single parent households and women in two parent households where their partner is unemployed. Blundell, Brewer and Shephard (2005)(1) estimate that the introduction of tax credits for working households in the United Kingdom in 1999 increased the labour force participation rate of females in single parent households by 3.6 percentage points and by 2.6 percentage points for females in two parent households where their partner is unemployed. However, these measures have the drawback of possibly discouraging labour force participation of second earners in those households where total income would exceed the threshold to qualify for the tax credit. For example, the EITC discourages labour force participation among married women when their partner is working. However, the empirical literature shows that this second effect is smaller and therefore total employment tends to increase as a result of such incentives.

The EITC directly reduces poverty by supplementing the income of low income workers. According to estimates by the Center on Budget and Policy Priorities, in the United States in 2011 the EITC helped the incomes of 6.1 million people, including 3.1 million children, to go above the poverty threshold.(2) Moreover, the advantages of the EITC can also be seen in the long term: by encouraging labour force participation, it also encourages the accumulation of human capital. At the same time, those receiving this tax credit are less dependent on social assistance, meaning that such measures pay for themselves. In other words, the cost of tax credits for the public treasury is offset by the additional revenue from income tax and lower expenditure on social benefits.

Although the advantages of EITC seem clear, its use among OECD countries is not widespread (although it is gradually being adopted). This contrasts with the high number of countries that, decades ago, established a minimum wage in order to protect lower income workers. However, the EITC is a measure much more focused on combating poverty as it is established in line with the household's total income. On the other hand, most workers on a minimum wage are not the main income providers in the household and, in many cases, do not tend to live in homes at risk of poverty (for example, students). The minimum wage could also have a negative effect on job creation whereas EITC helps to create jobs and could even help to unearth the black economy since, in order to be able to receive tax credits, workers must declare what they earn in a tax return. However, we should also remember that the introduction of the EITC could push down wages, although the final remuneration including tax credits might remain the same. Rothstein (2010)(3) estimates that, for each EITC dollar, the tax revenue from workers only increases by 73 cents as employers can reduce the wages they pay since these are boosted by tax credits.

In conclusion, designing an optimal tax system is far from easy. Taxation has a huge effect on individual decisions, particularly among those groups whose decision to work is very sensitive to different financial incentives. This becomes even more complex when we also take into account interactions with social benefits or the state pension system. In this respect, we must continue to look for creative solutions to balance the goals of ensuring sufficient income for all citizens without discouraging labour force participation, at the same time as containing the cost of public financing.

Judit Montoriol-Garriga

European Unit, Research Department, "la Caixa"

(1) «Evaluating the labour market impact of Working Families' Tax Credit using difference-in-differences». HM Customs and Revenue Working Paper 4 (2005).

(2) Center on Budget and Policy Priorities, «Policy Basics: The Earned Income Tax Credit» (2013).

(3) «Is the EITC as Good as an NIT? Conditional Cash Transfers and Tax Incidence». American Economic Journal: Economic Policy, 2(1): 177-208 (2010).