The recovery is gaining momentum, helped by domestic demand

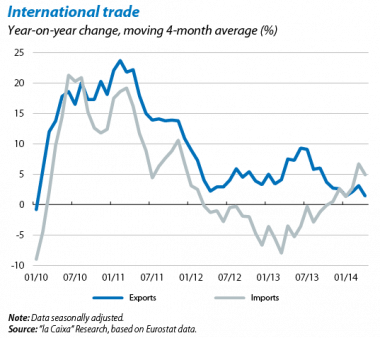

The composition of growth is shifting towards national demand. The progress made by the latest indicators for consumption, investment and the labour market point to domestic demand continuing as the mainstay for the Spanish economy's increasing dynamism. This advance in domestic demand has led to a notable upswing in imports, acting as a brake on the correction in the trade deficit. Although we expect exports to see much better growth rates over the coming months thanks to the excellent performance by tourism, we have revised slightly downwards our forecast for the current surplus for 2014 and 2015.

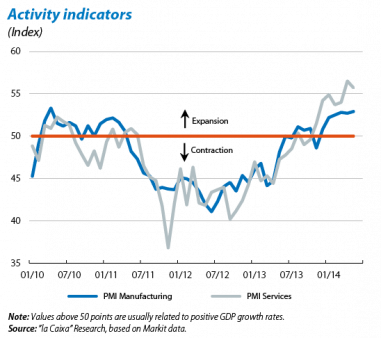

Supply indicators continue to improve and the revival in industrial activity is increasingly evident. Industrial production rose by 4.3% year-on-year in April (0.9% March) while the good performance by the production of capital goods and consumer durables (9.0% and 4.1% year-on-year, respectively) points to further advances in investment and consumption. Similarly, the PMI's for manufacturing and services are still at levels in line with a growth rate similar to the one seen in 2014 Q1 or even slightly higher.

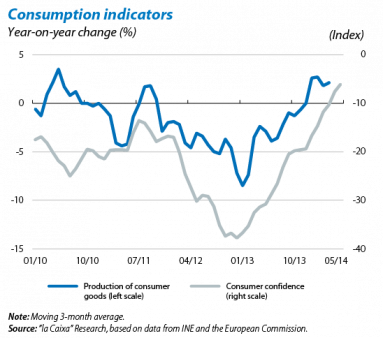

Household consumption continues its upward trend. A sustained recovery in private consumption is essential to ensure similar GDP growth rates to the beginning of the year and it is therefore a good sign that the various consumption indicators continue to improve at a good rate. Consumer confidence is on a clearly upward track and is already above pre-crisis levels. Retail sales also reflect the gradual improvement in household consumption, with May seeing an advance of 0.5% year-on-year. The figures are therefore still showing growth in household spending.

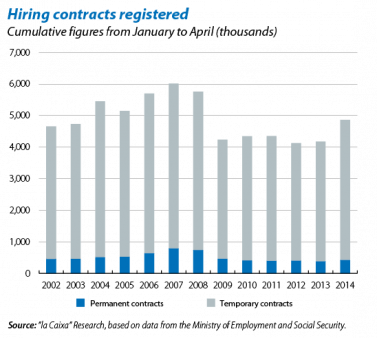

The recovery in the labour market is picking up its pace. In May the number of registered workers affiliated to Social Security increased for the ninth consecutive month (56,600 people, seasonally adjusted). This improvement in the labour market has generally been concentrated in the services sector although industry and construction also contributed positively to employment growth that month. Employment contract figures also reflect the upturn in the labour market. Specifically, the total number of new contracts between January and April this year was 16.5% higher than the figure for the same months in 2013. Although the vast majority were temporary, as is to be expected, it is worth noting that permanent contracts grew faster in March and April after the commencement of new incentives to give permanent employment contracts. If this tone continues over the coming months, it should have a positive effect on stable employment and, in turn, this should boost private consumption. This situation should also be helped by the fact that, in 2014 Q2, the expectations for unemployment over the next 12 months are at very low levels not seen since 2000, namely –3.1 points.

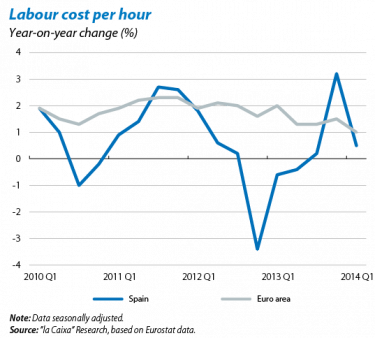

Wage moderation continues. In 2014 Q1, labour costs increased by 0.5% year-on-year (0.1% quarter-on-quarter) according to the harmonised index of labour costs, a lower rate than the euro area as a whole which was 1.0%. This means that Spain continued to gain in competitiveness but there are notable differences in wage trends between sectors. In Q1, the wage adjustment was concentrated in the private sector as the public sector posted a rise of 0.4% quarter-on-quarter. It was also noted that those sectors whose activity has recently improved, such as hotels and restaurants, recorded positive rates of growth in wage costs. The wage increases contained in new agreements (0.5% year-on-year in May) suggest that labour costs will remain contained. Nonetheless, workers' purchasing power should not decrease while inflation remains at a low level, important for the revival in domestic demand.

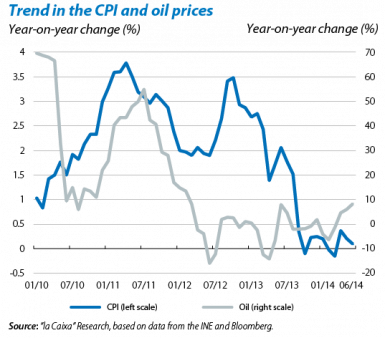

The inflation rate is still close to zero. In June, the inflation rate fell by 0.1 percentage points to 0.1%. The components with most impact were food and non-alcoholic beverages and electricity. However, the upswing in oil prices due to geopolitical tensions in Iraq and the Ukraine, as well as the gradual recovery in domestic demand, will bring about a change in trend over the coming months. We therefore predict the year will end with inflation at 0.9% in December (0.4% for the whole of 2014). For 2015 we expect the inflation rate to be around 1.1% albeit with a very high degree of uncertainty. So far the recovery in inflation is being slower than initially expected. This is particularly surprising as the gains being made by activity and the labour market are slightly better than forecast. Given this situation, it is important to highlight the ECB's commitment to price stability. In addition to specific measures (discussed in the Focus «The ECB makes a move») and their potential effects, in the press conference given by Mario Draghi last June he repeated that, if necessary, the ECB would again take action to ensure inflation returns to levels in line with its mandate.

The recovery in domestic demand boosts imports. During the first four months of the year, imports gained 4.9% year- on-year (compared with –3.5% in the same period of 2013), with particularly high growth in imports of consumer goods (12.6%), automobiles (23.6%) and capital goods (12.5%). The advance made by exports, however, was more modest (1.4% year-on-year) although the upward trend in sales to the euro area, at 4.8% year-on-year, suggests the outlook is favourable. This slight increase in the trade imbalance, together with the deterioration in capital income, lie behind the slight reduction in April's current account surplus from 0.39% to 0.34% of GDP (cumulative figures over 12 months).

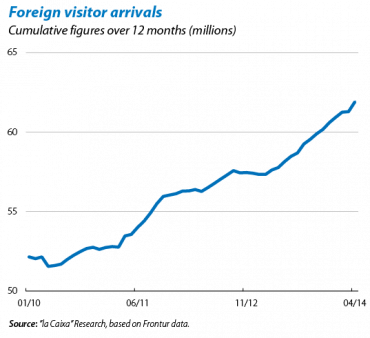

The good performance by tourism will help the foreign sector in 2014 Q2. The main indicators show that tourism has started the high season in excellent shape. 6.1 million foreign tourists came to Spain in May (62.3 million in cumulative figures over 12 months), particularly tourists from Europe, with all the evidence pointing to this trend increasing in the summer months, so that 2014 should see new records being set. It is also positive that the expenditure by international tourists is continuing to rise (3.5% year-on-year in May). Recently, moreover, there have been signs of domestic tourism starting to pick up. In May, the number of resident travellers in Spain grew at a very similar rate to that of foreign tourists (close to 5% year-on-year). This revival in tourism expenditure is yet another sign of the improved tone in consumption

by Spanish households.

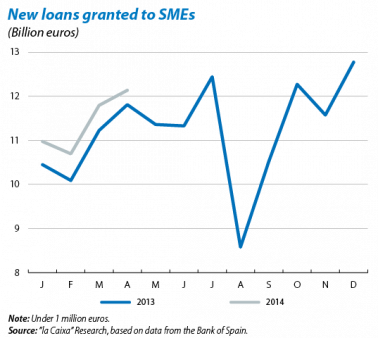

More credit is gradually being granted to households and SMEs. The completion of banking restructuring and the consolidation of economic growth are helping to support the recovery in credit. For example, new loans to SMEs continued to rise compared with last year. Specifically, during April 2.8% more credit was granted than in the same month in 2013. This revival in new loans helped to soften the rate of contraction in April's outstanding credit balance to 7.2% year-on-year (7.6% in March). The recovery in new loans is expected to take hold over the coming months as confidence in the Spanish economy's capacity to grow becomes stronger and as the asset quality review (AQR) and stress tests carried out by the ECB endorse the solvency of Spanish banks.

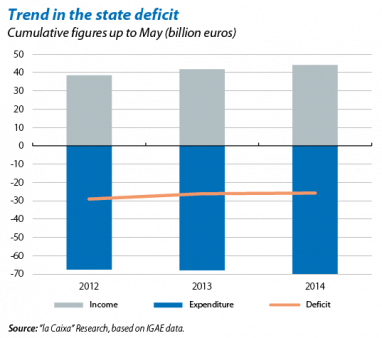

The public deficit is adjusting slowly, increasing to 2.5% of GDP in May, 0.1 percentage points less than the deficit in 2013. This slight improvement is due to tax revenue supported by the improvements seen in economic activity although expenditure increased, especially in intermediate consumption and subsidies. Having approved the tax reform for 2015, for which more details are provided in the Focus «Tax reform and public deficit adjustment», contained public expenditure will be crucial to ensure deficit targets are met. As with the state deficit, the trend in the deficit of the autonomous regions is turning out to be very similar to that of 2013. In this case, April's deficit was 0.1 percentage points more than in 2013. Given that the deficit target for 2014 is 5.5% of GDP, 1.1 percentage points less than the deficit of 2013, we should see some acceleration in the adjustment over the coming months.