The figures are more encouraging but still immersed in uncertainty

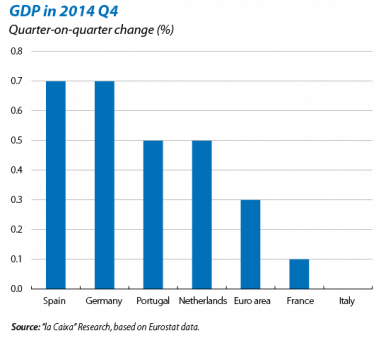

The euro area's GDP grew by 0.3% quarter-on-quarter in 2014 Q4 (0.2% in Q3), 0.1 pps more than expected. This places total growth for the year at 0.9% (–0.4% in 2013). The strong growth enjoyed by the German economy in Q4, namely 0.7% quarter-on-quarter (0.1% in Q3), exceeded expectations and was a key factor in the euro area's recovery. GDP growth in Spain, 0.7% quarter-on-quarter, and in Portugal and the Netherlands, 0.5%, also helped to speed up the euro area's rate of recovery. However, France continued to show signs of weakness with only 0.1% growth, due particularly to the bad performance of investment, and Italy has yet to completely come out of recession (0.0%). The disparity between countries therefore remains, with Spain and Germany in the leading group and France and Italy among those at the back.

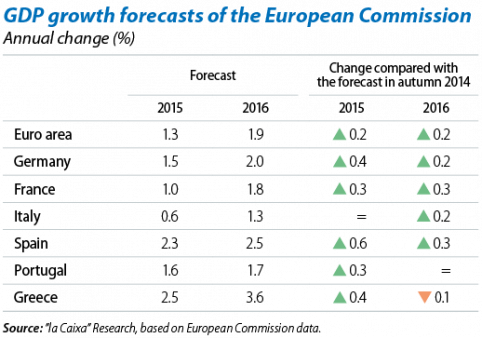

The European Commission (EC) has improved its GDP growth forecasts for the euro area to 1.3% in 2015 and 1.9% in 2016, 0.2 pps above its autumn predictions. For the first time since 2007 positive growth is expected in 2015 for all countries of the euro area, albeit at differing speeds. Part of the increase in growth in 2015 is supported by temporary factors such as the fall in oil prices, the euro's depreciation and the start-up of large-scale asset purchases by the European Central Bank (ECB). Worthy of note are the improved forecasts for Spain (+0.6 pps) and for Germany (+0.4 pps) although it is important to eliminate sources of uncertainty in the euro area, such as the Greek crisis, for this improvement to continue over the coming months.

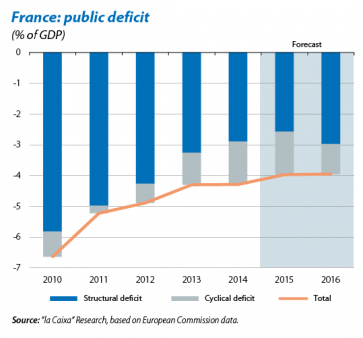

The EC allows France to delay the correction of its deficit in exchange for a larger reduction in its structural deficit. The country has until 2017 to reduce its fiscal deficit to below 3.0% of GDP. At the same time, however, the EC expects France to reduce the part of its deficit that corresponds to structural factors, currently at a high level compared with other euro area countries. Specifically the EC has urged France to make an effort to reduce its structural deficit by 0.5% of GDP in 2015, 0.2 pps more than had been demanded to date. It has also announced a revision in May to supervise the country's deficit reduction and implementation of reforms. In the case of Italy, the EC has warned of its high level of debt (133% expected in 2015) and its failure to meet the deficit target for the year (2.6% instead of the 2.2% forecast), although it has decided not to impose sanctions, recognising the difficult macroeconomic context and the effort being made by the Italian government in the area of reforms.

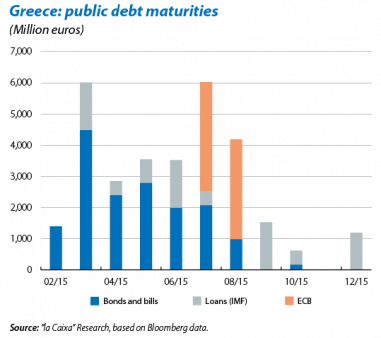

Agreement between Greece and the Eurogroup to extend the bail-out programme until June. The institutions have approved the initial list of measures presented by the Greek government which include the following: a reform of VAT and income tax; combating corruption and tax evasion; making the labour market more flexible (although the minimum wage will be increased) and continuing the privatisations already underway (although any that have yet to start will be revised). Although this all seems favourable at first sight, the lack of concrete details for these measures means that the ECB and International Monetary Fund remain cautious. In any case, the 7.2 billion euro still to be disbursed in the bail-out agreement will not be paid until Greece can show that it is implementing the proposed reforms. Uncertainty will therefore remain over the next few months. In the short term, the Greek parliament must still pass these measures and the Prime Minister will need the support of his party and its coalition partners, which might be complicated due to differences of opinion. Moreover, there will probably be an upswing in financial tension resulting from difficulties faced by the Greek Treasury to meet its imminent debt repayments and the delicate situation of the country's banking system.

The rate of the euro area's recovery speeds up in 2015 Q1. The composite PMI of the euro area reached 53.5 points in February, its highest level in the last seven months. This improvement was particularly due to the strong increase recorded in services. By country, France provided a pleasant surprise with its composite PMI rising to 52.2 points, the highest value since August 2011. Moreover, the upward path of Germany's PMI ratifies that its economy is still the driving force behind the recovery. German dynamism can also be seen in the trend for IFO indicators (Germany's business climate index) and ZEW (index for investor and analyst expectations), which improved for the fourth consecutive month in February. The breakdown for German GDP in Q4 was also favourable: the contribution of domestic and foreign demand to quarter-on-quarter growth was 0.7 and 0.2 pps, respectively, while the variation in stocks deducted 0.2 pps.

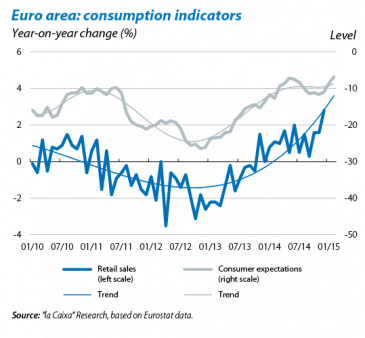

Widespread improvement in demand indicators. Judging by the figures for retail and consumer goods, whose rate of growth accelerated to 2.8% year-on-year, private consumption is on the up. This is also suggested by the strong increase in consumer confidence in February, reaching levels not observed since summer 2007. Although the labour market's recovery is gradual, it is undoubtedly helping to boost domestic demand. Employment expectations, both in manufacturing and services, continued to grow in the first two months of the year. By country, of note is the sharp increase in job creation prospects in Germany, another sign of the country's strength, and also in Spain whose labour market is gradually recovering from its nosedive. However, France saw more subdued growth, in line with its activity's moderate recovery.

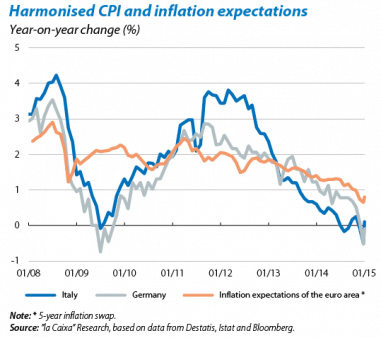

Inflation remains in negative terrain but embarks on a phase of recovery. The inflation rate is expected to have risen in February because, after their sharp fall in previous months, oil prices then increased by 18.3% month-on-month. In fact, in Germany, Italy and Spain, countries where February's figures have already been released, a clear upswing in inflation has been noted. The rise in inflation expectations in the second month of the year, after the announcement of the ECB's quantitative easing programme, also seems to back up a change in trend. We therefore expect inflation to pick up gradually as oil prices return to higher levels and growth in domestic demand intensifies. The euro area will end 2015 with average inflation around 0.4%. In 2016, this will rise to 1.6% on average, once the level effect of the energy component disappears.

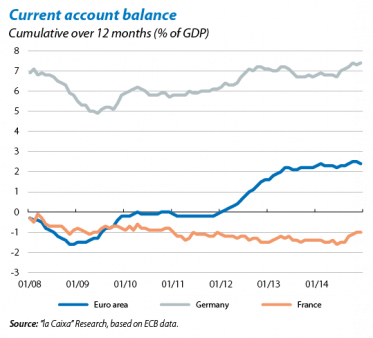

Cheaper oil and the euro's depreciation will boost the current surplus in 2015. The current account balance of the euro area maintained its good tone from 2014 and posted a surplus of 2.4% of GDP in December (cumulative over

12 months). All this has contributed, to a large extent, to the surplus in the goods account for December, thanks to

a strong increase in exports of 8% year-on-year which more than exceeded the 1% rise in imports year-on-year. Over

the coming months the current account surplus will be strengthened by two factors. On the one hand, the price of oil will remain low, helping to contain the bill for energy imports. On the other hand, exports will be helped by the euro's depreciation. In fact, one of the consequences of the ECB's large-scale government and private bond purchase programme has been that, since it was announced, the euro has depreciated by 3.6%, down to 1.12 €/$ at the end of February. We expect the exchange rate to remain at these levels for several months and depreciate further at the end of the year once the Fed starts to raise its interest rates.

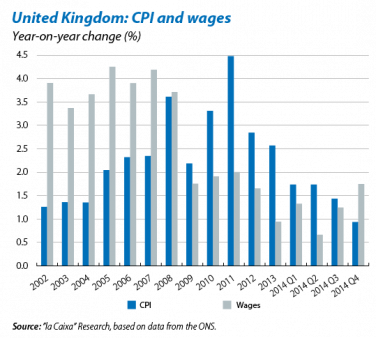

The good figures from the United Kingdom revive debate regarding the start of interest rate hikes by the Bank of England (BoE). GDP growth reached 2.6% in 2014, supported particularly by the good performance of domestic demand. The rate of growth in retail and consumer goods in January 2015, namely 5.5% year-on-year, and the low unemployment rate (5.7% in November) suggest this pattern of growth has continued in 2015 Q1, reviving debate about when the BoE will start to raise interest rates. For the moment, inflation has remained low due to falling oil prices but in 2014 Q4 wages grew above inflation for the first time since mid-2008. Over the coming months we expect inflation to get back to normal and upward pressures on wages to increase. Provided the good pace of growth continues, this should allow the BoE to gradually normalise its monetary policy as from 2015 Q3.