On balance, a positive 2017 and good prospects for 2018

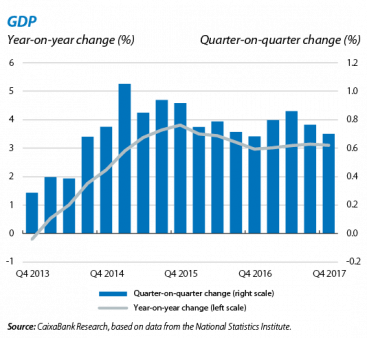

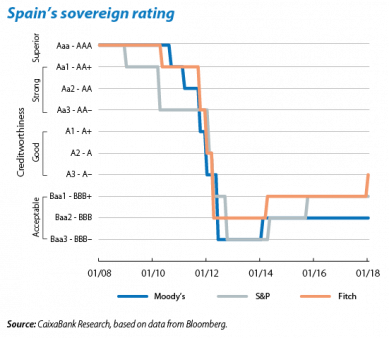

Growth remains high, boosted by an accelerating global economy. GDP grew strongly in Q4 2017, by 0.7% quarter- on-quarter (3.1% year-on-year), bringing growth for 2017 as a whole to 3.1%. Although some support factors are diminishing, such as low oil prices and the appreciation of the euro, the growth rate remained relatively strong thanks to a buoyant global economy and, in particular, the euro area’s solid recovery, boosting Spanish exports. The Spanish economy is also benefitting from continuing accommodative financial conditions. In fact, Spanish sovereign debt has been upgraded by the Fitch ratings agency (from BBB+ to A–), based on the economy’s improved growth prospects and the fiscal adjustment carried out over the past few years. Together with the ECB’s reticence to withdraw monetary stimuli in spite of the euro area’s economic recovery and the euro’s appreciation, this has pushed down Spain’s risk premium, falling below 80 bp in the last few days of January, the lowest since 2009.

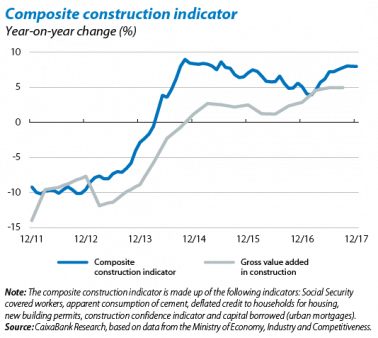

Private consumption remains firm and investment picks up. Spending indicators for the last quarter of 2017 point to a slight slowdown in growth of private consumption, which represents 57% of GDP. Q4 retail sales rose by 0.9% year-on-year on average, against 1.7% in Q3, while indicators for capital goods investment point to renewed dynamism supported by a confident business climate. The growth rate of residential investment should also have improved, given the rise in housing demand (sales grew by 15% year-on-year in November) and prices (up 6.7% year-on-year in Q3 according to the National Statistics Institute). Economic activity in the construction industry is therefore gradually recovering, as shown by the significant increase in new building permits (28% year-on-year in October, cumulative YTD). The total is now approaching 70,000 so 2017 is expected to far exceed the 64,000 permits issued in 2016. The upturn in the real estate market is therefore consolidating.

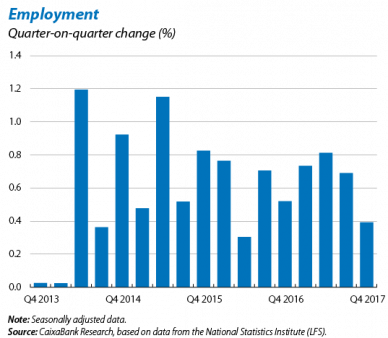

The labour market trend is positive but faltered slightly towards the end of the year. In seasonally adjusted terms, jobs were still created (0.4% quarter-on-quarter in Q4) albeit at a slower rate than in previous quarters (averaging 0.75% quarter-on-quarter in the past three quarters). 2017 has therefore been a very positive year for the labour market. The annual average number of employed rose by 483,000 people, the number of unemployed fell by over half a million (–564,000 people) and the unemployment rate fell by 2.4 pp. But in spite of this improvement, Spain’s labour market is still suffering from serious problems. This can be seen in the large proportion of temporary employment (26.7% of wage-earners were on a temporary contract in Q4 2017), the high youth unemployment rate (37.5% of people aged 16-25 who would like to work are unemployed) and long-term unemployment (50.4% of the unemployed have been so for more than one year).

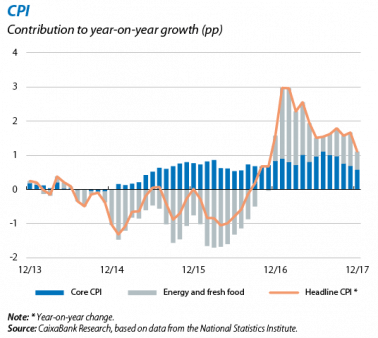

Price rises are still very moderate although the economy is improving. Headline inflation fell to 0.5% in January despite the month’s sharp rise in oil prices to over USD 70 per barrel. Although the breakdown by component has yet to be published, this price slowdown is probably due to the base effect of electricity prices (one year ago a spike in electricity prices pushed inflation up to 3% during the winter months). In fact, this component was also the main reason for inflation’s significant drop in December, down to 1.1%, 0.6 pp below November’s figure. Apart from electricity, the rest of the non-core components also helped inflation to moderate in December (fuel and unprocessed food). Core inflation remained stable at 0.8% in December, a sign of little inflationary pressure. Given the moderate prices and labour market slack, wage rises are also subdued (for more details on the outlook for wages, see the Focus «Wage trends and labour underutilisation in the Spanish labour market» in this Monthly Report).

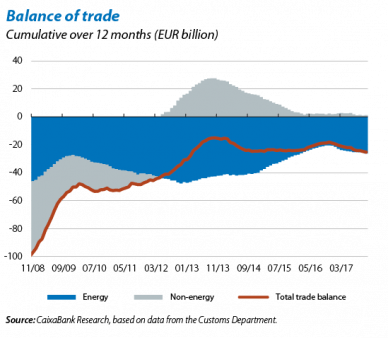

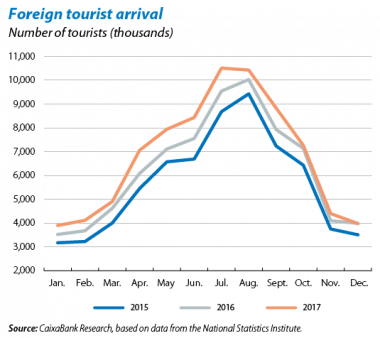

Higher oil prices continue to weaken the trade balance in spite of dynamic exports. In November, the trade deficit increased to EUR 25.14 billion (cumulative over 12 months), equivalent to 2.2% of GDP and a considerable regression compared with the 1.6% deficit in November 2016. The trade balance has deteriorated mainly because of higher oil prices, making energy imports more expensive. Dynamic corporate capital expenditure has also led to an increase in capital goods imports. This rise in imports overshadows the excellent performance of Spain’s export sector: goods exports posted very strong growth in November (8.6% year-on-year overall and 7.0% for non-energy exports, cumulative over 12 months). Service exports also performed well thanks to tourism, which continues to beat all records: Spain received 81.8 million international tourists in 2017, 8.6% up on 2016.

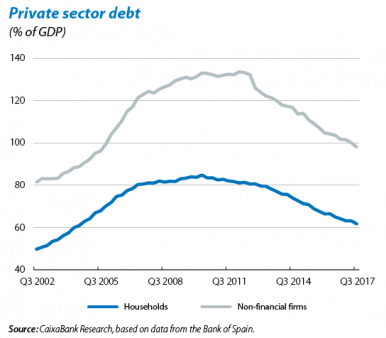

The expanding economy is allowing macroeconomic imbalances to be corrected. One highly positive aspect of this new phase is that economic growth is much more balanced than in the previous expansionary period. In fact, the Spanish economy has grown by more than 3% for the past three years in a row while maintaining a current account surplus and reducing public and private debt. According to Q3 2017 data, the households and non-financial firms debt continued to decrease, falling to 61.8% and 98.0% of GDP, respectively. These levels are similar to the euro area’s and indicate the private sector has deleveraged extensively.

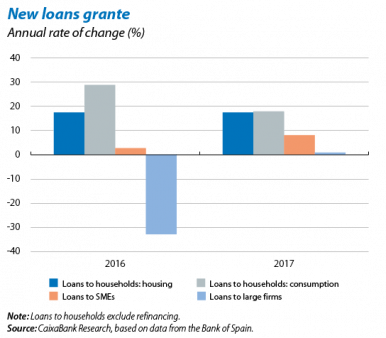

Bank credit is benefitting from this positive situation. The fact that the private sector no longer needs to deleverage so much, together with the improved economy, favourable financial conditions and a healthy banking sector, are supporting a recovery in bank credit. According to the latest bank lending survey, for Q4 2017, banks have eased their credit standards for households and kept them unchanged for companies. The continual descent of banks’ NPL ratio, down by 0.1 pp in November to 8.1%, reflects the considerable effort being made by Spain’s banks to remove non-performing loans from their balance sheets and support the granting of new, healthy loans. In this respect, credit activity was very strong in 2017: new loans granted to households to buy housing and for consumption saw considerable growth (17.4% and 17.9%, respectively). Regarding enterprises, new loans granted to SMEs continued to increase (8.1%) while those to large firms rose again (0.9%) after a sharp decline in 2016. With a view to 2018, this strong growth in new loans should continue, especially consumer credit and loans to enterprises, thanks to an accommodative monetary environment and improvements in the labour market and real estate sector.