Calm returns to the markets

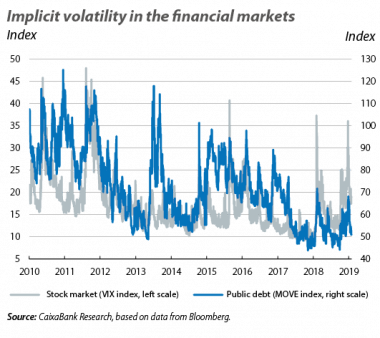

Volatility eases at the beginning of the year. Following an end to 2018 marked by stock market losses, the first few weeks of 2019 brought some calm to the financial markets. Investor sentiment found support on the negotiations to defuse the trade tensions between the US and China, as well as the display of greater patience by the major central banks. In particular, the Fed showed signs of pausing its plan of rate hikes (at least for the next few months, while it assesses the impact of the monetary tightening carried out to date), while the ECB reiterated its intention to maintain accommodative financial conditions in the euro area. Thus, in January, stability was the dominant theme in fixed-income markets, where sovereign yields remained at moderate levels and even declined slightly, while the foreign exchange market saw a slight depreciation of the US dollar. On the other hand, this calmness in investor sentiment fuelled a rally in stock markets, where the indices of the main advanced and emerging economies advanced strongly, and in commodity markets, where oil prices recovered following their sharp decline at the end of 2018.

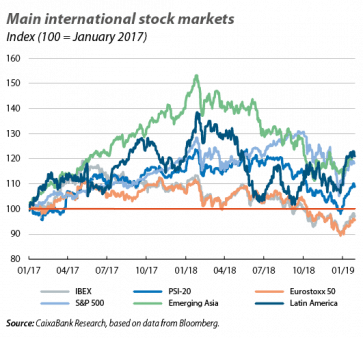

Stock markets begin the year on a positive note. The improvement in investor sentiment, together with a positive start to the earnings season relating to Q4 2018 (especially in the US), hoisted up the main international stock market indices in January. In the US, the S&P 500 index climbed around 8% over the month as a whole, while the major trading floors of the euro area saw gains of around 6% (Eurostoxx 50 +5.3%, DAX +5.8%, CAC +5.5%, Ibex 35 +6.1% and PSI 20 +8.4%). Emerging-economy stock markets also registered significant growth (MSCI index for the whole bloc +8.7%). This was especially the case in Latin America (MSCI Latin America +14.9%), with Brazil’s stock market performing particularly well (+10.8%), as well as in the Asian economies (MSCI Emerging Asia +7.3%).

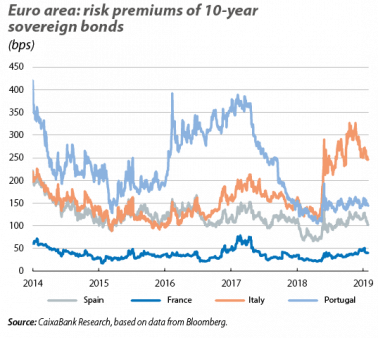

The ECB will maintain accommodative financial conditions. After bringing net asset purchases to an end in December, the ECB left its monetary policy stance unchanged at its first meeting of the year and focused on assessing the status of the euro area’s business cycle. Faced with the persistence of uncertainties surrounding global geopolitical tensions, vulnerabilities in some emerging economies and spikes of financial volatility, the ECB pointed out that the balance of risks has shifted to the «downside». In addition, the ECB was cautious after the latest economic activity indicators proved to be weaker than expected. Although Draghi reiterated that the likelihood of a recession is low and that the medium-term outlook remains well supported by the strength of domestic demand, he also noted that growth is likely to be less buoyant in the short term. With this assessment of the scenario, the ECB reiterated its intention to maintain an accommodative financial environment by keeping official interest rates at their current levels and by reinvesting the principal payments of the assets on its balance sheet for a long period of time.

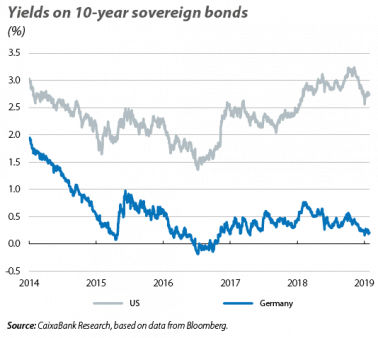

The Fed pauses interest rate hikes. At its first meeting in 2019, the Fed kept interest rates within the 2.25%-2.50% range, with a decision that was widely expected after having already increased rates by 25 bps in December. However, the meeting was more than a mere formality and the Fed sent important messages relating to the future path of monetary policy. In particular, although it gave a positive assessment of the macroeconomic scenario, the Fed placed greater emphasis on the downside risk factors (such as the slowdown in global growth, geopolitical tensions and the tightening of financial conditions), which are generating uncertainty in relation to the performance of the economy over the coming quarters. On this note, the Fed stated that it will be patient with regards to future changes to interest rates and it ceased making explicit reference to the expectation of further increases.

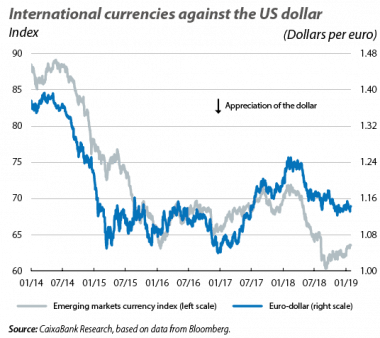

Interest rates remain contained and emerging currencies recover. The messages of patience from the central banks determined the dynamics of the fixed-income markets in January, as interest rates on both sovereign and corporate debt remained stable or even declined slightly. Specifically, in the US, yields on 10-year sovereign bonds fluctuated at around 2.70% (closer to their levels of late 2017 than to their high-point of 2018, when they reached over 3.20%). In the euro area, meanwhile, the peripheral risk premiums decreased and Germany’s 10-year sovereign yields fell below 0.20%. The foreign exchange markets also acknowledged the messages from the banks, and the signs of a pause by the Fed resulted in a moderate appreciation of the main emerging market currencies against the US dollar. In contrast, the euro remained relatively stable at around 1.14 dollars, while the pound sterling fluctuated to the sound of the votes of the British Parliament on Brexit (generally appreciating against the major currencies).

Oil prices stabilise. After collapsing more than 40% in the last quarter of 2018 (from around 85 dollars per barrel in September to 50 dollars in mid-December), in January the price of the barrel of Brent began to recover up to 60 dollars. This price increase was supported by the implementation of the new oil production cuts announced by OPEC and its partners in early December. Further support was provided by improved investor sentiment, which also drove up the prices of other raw materials, such as copper, other industrial metals and agricultural products.