Central banks interrupt the calm in the markets

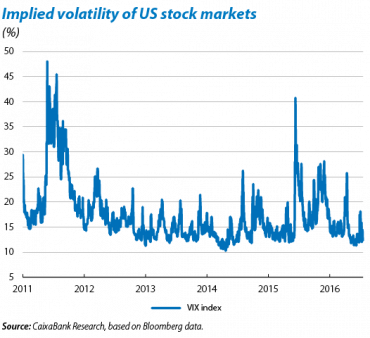

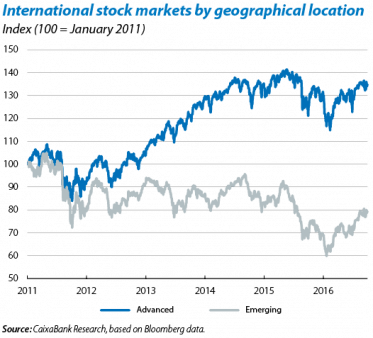

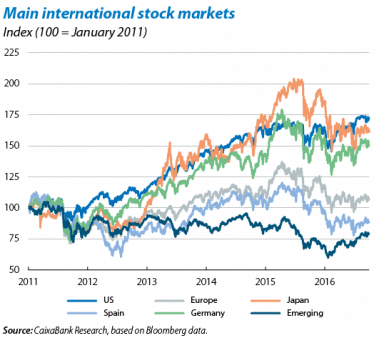

After a quiet holiday period, the month of September was hit by an outbreak of nervousness in international markets. Doubts regarding the actions of the central banks in developed countries was the main cause of this upswing in volatility. In particular, international stock markets reacted to the messages given out by several members of the Federal Reserve (Fed), which multiplied as the meeting of the Federal Open Market Committee (FOMC) was approaching. Such statements, which mostly pointed to a tightening up of the Fed’s position given the strength of the US economy, fuelled a sentiment of risk aversion. This led to asset sales, especially in the emerging stock markets which suffered from sharp losses. However, this upswing in nervousness appears to be contained and limited mainly to the equity market. With a little perspective, this episode seems less virulent than others in the recent past, such as the ones at the start of the year due to China’s problems or after the Brexit victory at the end of June.

The outlook for investment seems fragile given the multiple sources of potential instability on the horizon. There are several elements that might generate new episodes of volatility in the short and medium term. In the political sphere, the calendar is brimming with important electoral events, such as the referendum on constitutional reform on 4 December in Italy and the repeat of presidential elections in Austria. But the US presidential elections will undoubtedly monopolise the attention of investors over the coming months and the ups and downs they bring might lead to episodes of turbulence, especially if a surprising result looks increasingly likely. Lastly, the reaction to the next interest rate hike in the US will also be crucial for the performance of financial assets over the coming months although the Fed’s cautious tone will surely continue to ease the negative effects of this normalisation.

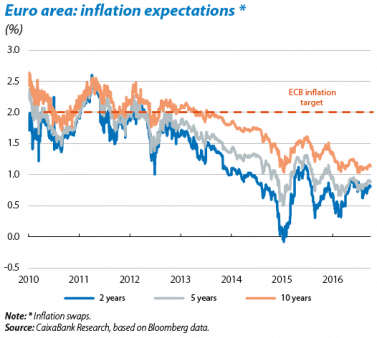

The European Central Bank (ECB) inaugurated the round of central bank meetings with few changes. The Governing Council (GC) of the euro area’s monetary authority, which met at the beginning of September, decided not to make any changes or adjustments to the parameters of its monetary policy. After pointing out the effectiveness of the measures adopted so far and the resilience of the euro area’s economy, in particular post-Brexit, the ECB President sent a clear message: no additional stimuli were being considered «for the time being». Draghi seemed confident that the ECB would meet its inflation target albeit at a somewhat slower pace than expected a few months ago. Investors, who were expecting additional measures such as the prolongation of the asset purchase programme (QE) beyond March 2017 or the expansion of eligible bonds, showed contained disappointment which led to slight losses in the main European stock markets and a temporary upswing in sovereign bond yields.

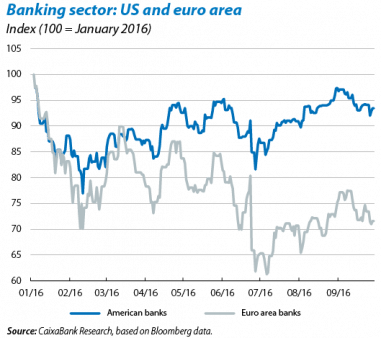

On the Asian continent, the Bank of Japan (BoJ) modified the tools of its ultra-expansionary policy so as not to penalise the financial sector. At a meeting that had aroused a lot of expectation, the BoJ decided to keep its main interest rate unchanged at –0.1% but announced it would adopt a policy of «yield curve control». Specifically this new focus will attempt to keep the yield on the 10-year Japanese sovereign bond at 0%, a level that may seem low but is higher than the one observed over the last few months. With the introduction of this new instrument, the BoJ hopes to establish a floor for yields on long-term bonds. It has justified this change as an attempt to mitigate the adverse effects of very low interest rates on bank profitability and the stability of the financial system. In spite of these new measures, the yield on Japan’s 10-year sovereign bond fell slightly (to –0.07%), illustrating the scepticism of financial markets regarding the actions of the Japanese central bank (see the Focus «Bank of Japan: at the limits of monetary policy» in this Monthly Report).

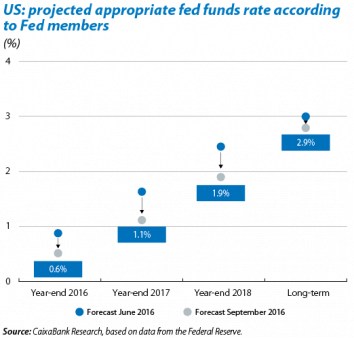

Last but by no means least, the Fed decided to keep the federal funds rate unchanged but clearly opened the door to a hike in December. The central bank opted to wait and make sure that inflation is on the way to achieving its 2% target, although noting that «the case for an increase in the federal funds rate has strengthened». The messages announced by the Fed at its last meeting repeat its plan to carry out normalisation very gradually. Specifically, the US monetary authority is now signalling its intention to ease the rate of normalisation of its monetary policy via a downward revision of its projections for the federal funds rate. The FOMC members now expect two hikes in 2017 while the projections published in June assumed three hikes during the year.

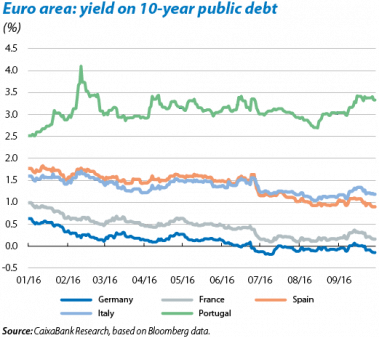

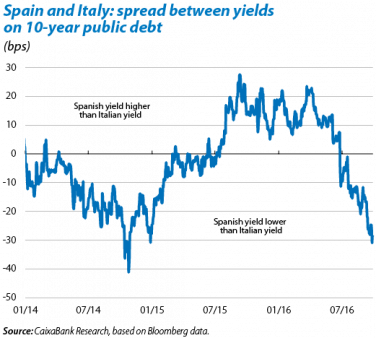

In the European bond market, the environment of very low yields continues, awaiting more specific guidance from the ECB. In the last few weeks the yields on euro area public debt have shown signs of stabilising after their post-Brexit slide, although they are still at a very low level. The factors supporting this situation, such as the ECB’s ultra-accommodative policy (continuing QE and forward guidance) and very modest inflation expectations and growth, are still very much in effect and should not undergo any significant change in the short term. However, long-term yields might pick up if the ECB decides to introduce adjustments to its QE to alleviate the shortage of eligible bonds, or if investors believe the central bank is less willing or able to extend the scope of its expansionary measures. In the periphery, debt is still being supported by the ECB’s safety net but is looking more vulnerable to changes in conditions in the external environment. The internal sources of uncertainty represented by Portugal and Italy (political uncertainty and doubts related to the banking sector) have meant that Spain’s debt has performed relatively well compared with the rest of the periphery. Lastly, on the other side of the Atlantic, yields on US sovereign debt have performed unsteadily, lacking the dynamism to begin any sustained rise.

The emerging stock markets are battling to preserve a constructive tone and the banking sector is still dragging down European stock markets. The emerging stock markets were hardest hit by the doubts that reappeared before the meetings of the central banks and in particular the Fed, although they started to pick up again after the prudent conclusions of the US central bank’s meeting were announced. This optimistic pattern might continue, at least in the short term, thanks to support from the «search for yield» in a context of high asset prices in the advanced block and slight improvement in the emerging macroeconomic outlook. Nonetheless, and probably more in the long term, the risks related to the emerging investor environment are still downward, especially if the Fed toughens up its normalisation because of inflationary pressures, a scenario the market sees as unlikely at present. In the advanced block, Europe’s stock market is still weak, once again due to a poor performance by the banking sector. But this month the main source of anxiety shifted from banks in the periphery towards Germany due to concerns regarding some institutions with notable systemic risk. Beyond individual cases, the more far-reaching weaknesses of the sector, whose profits have been hit by the prolonged environment of rock-bottom interest rates, will continue to affect European stock markets.

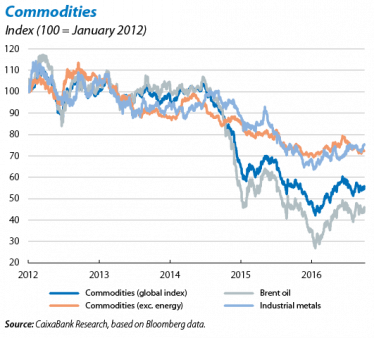

The price of oil is fluctuating within a horizontal range, failing to break through the barrier of 50 dollars per barrel for any sustained period of time. In spite of the unexpected heads of agreement between the OPEC countries reached at the end of September in Algeria to limit production, resulting in a sharp upswing in the price of crude oil, the barrel of Brent has remained within the range of 45-50 dollars since the end of April. However, prices above 50 dollars should materialise with the adjustment in production that could finally be agreed at the official OPEC meeting in November. Nonetheless, the excess supply will take some time to reduce, given the increase in unconventional oil production (shale), which will continue to limit any upward movement in price. In any case we are unlikely to see any quick or easy exit for the crude oil market from the high volatility observed over the last few months.