The complexity of Spanish exports

Spain’s exports have seen solid growth over the past few years. Moreover the range of destinations has broadened and the products exported diversified. But there is still one important issue to resolve: the complexity of exports. What is this complexity and why is it so important? The prestigious Harvard economists Ricardo Hausmann and César Hidalgo produce an Economic Complexity Index (ECI) which, broadly speaking, classes an economy as complex when it can export a diverse range of products which very few other countries can produce.1 An economy’s complexity matters because, as shown by the authors themselves, it is closely linked to long-term growth in per capita income.

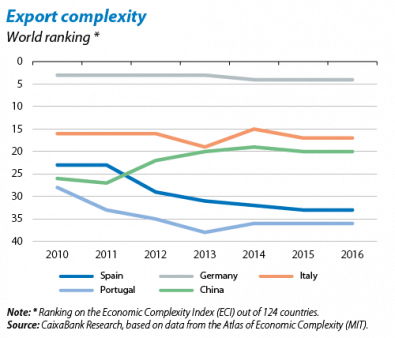

According to the ECI, the growth in Spain’s exports since 2010 has been accompanied by a decline in the country’s position in the export complexity ranking, going from 23rd in 2010 to 33rd in 2015 and 2016 (out of 124 countries). Why has Spain lost ranking in complexity terms? One initial explanation is that weak demand during the Great Recession forced a large number of firms to start exporting to offset the slump in domestic sales. Consequently, a lot of relatively small companies became exporters. Such firms tend to have lower productivity and the goods they produce are usually not very sophisticated. Secondly, economic complexity is a relative concept. An economy becomes less complex if there are increasingly more countries capable of producing what it sells. The rise in the emerging economies over the past few years has therefore reduced the complexity of most advanced economies, such as Portugal, France and the UK. The exceptions are Germany and Japan, strong exporters which have remained at the top of the ranking.

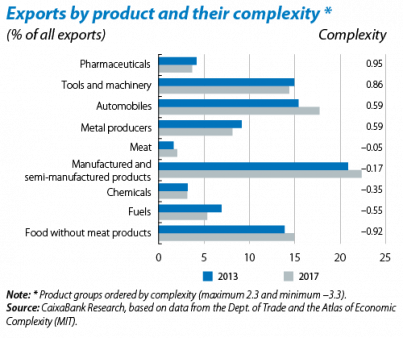

Nevertheless, a product-based analysis reveals some positive points. First, the complexity of Spanish exports is dominated by the car industry (passenger vehicles and components, and accessories). This sector is highly complex and has a large spillover capacity (thereby boosting other industries). During the Great Recession, the emergence of new exporters in other industries pushed the car industry’s share of all exports from 17.4% in 2010 to 14.6% in 2012. This was therefore a major reason for Spain’s lower complexity rating. The positive aspect is that, since 2013, the car industry’s share has increased again (reaching a cumulative figure of 17.7% up to September 2017), as well as its complexity. Another sector growing in complexity, albeit to a lesser extent than automobiles, is metal production and its products, especially iron and steel. This has an 8.1% share of all exports and an above-average complexity. The pharmaceutical industry (3.7% share) and tools and machinery (14.4% of all exports) also have a positive effect on Spain’s export complexity, although their contribution has fallen in the past few years. At the other end of the scale we find food products (17.0% of all exports), whose increasing share has reduced overall complexity, with the notable exception of the meat industry (2.1% share of exports) which has a high and growing complexity.

1. See the Observatory of Economic Complexity at https://atlas.media.mit.edu/en/.