Economic activity is advancing at a good pace

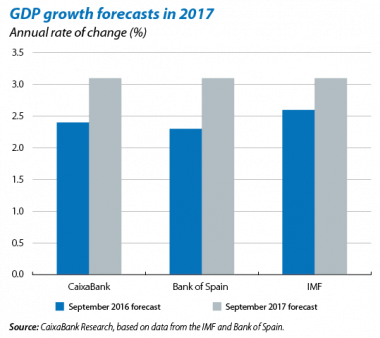

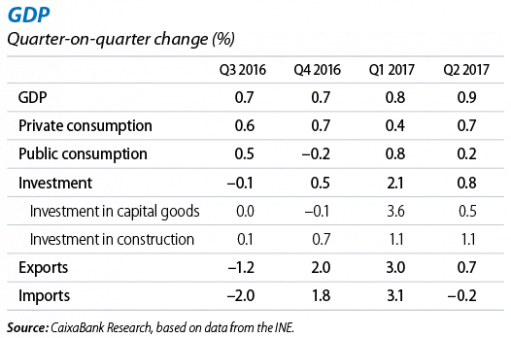

GDP growth is gaining ground. In Q2, the Spanish economy’s growth rate accelerated to 0.9% quarter-on-quarter, 0.1 pp faster than in Q1. CaixaBank Research predicts 3.1% growth for the year as a whole, a forecast that coincides with those of the Bank of Spain and the IMF, after the latter raised its growth forecast in July (by 0.5 pp). This exceptional performance by Spain’s economy, which has grown by more than 3% for the last three years, has been helped by both external and internal factors which show no signs of weakening, at least for the time being. Domestically, structural reforms and competitiveness gains are having a long-lasting positive effect on economic growth. Externally, the favourable environment is also helping Spain’s economy to perform well. The increasing economic expansion in other euro area countries, oil prices remaining relatively low and the fact that monetary normalisation in the euro area should be gradual are all important factors. For the coming year, CaixaBank Research expects GDP to remain strong at 2.7%.

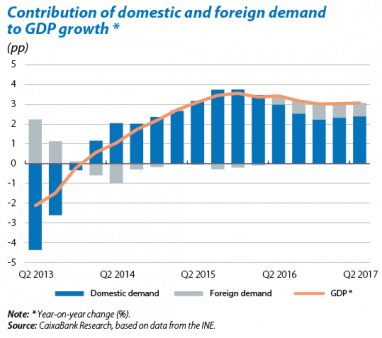

Private consumption regains centre stage. The breakdown of GDP in demand terms shows that domestic demand contributed 2.4 pp to year-on-year growth in Q2, 0.1 pp more than in Q1 and in line with the CaixaBank Research forecast. As expected, private consumption once again came to the fore, up by 0.7% quarter-on-quarter after a temporary slowdown in Q1. Investment slowed down its growth, however (0.8% quarter-on-quarter), owing to a dip in capital goods investment. However, as the series is typically variable, this slowdown does not alter the favourable medium-term view. Investment in construction maintained a similar growth rate to Q1. External demand continued to make a positive contribution to year-on-year growth in GDP, namely 0.7 pp, in spite of both exports and imports being weaker than expected, both of which tend to be highly variable.

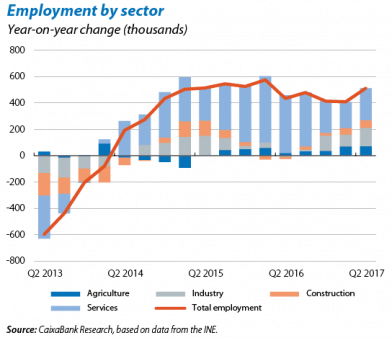

The labour market is still positive, consistent with the growth in economic activity. According to the LFS, in Q2 job creation increased notably by 0.9%, seasonally adjusted. The number of employed has now reached 18.8 million, as suggested by the good Social Security registration figures over the past few months. The year-on-year rate of change in employment therefore rose by 2.8% (2.3% in Q1). This rise in employment has helped to considerably reduce the unemployment rate to 17.2%, with a cumulative fall of 2.8 pp over the last year. The total number of unemployed has now fallen below four million for the first time since the crisis began. That said, Q2 tends to record a notable drop in unemployment due to the start of the tourist season. In fact, the services sector generated 75% of all jobs created in Q2. Although permanent employment contracts continue to rise (1.8% year-on-year), there was higher growth among employees on temporary contracts, pushing the temporary employment rate in Q2 up to 26.8%.

The labour market continues to perform well in the second half of the year. The rate of increase in registered workers affiliated to Social Security stood at 3.6% year-on-year in July, the largest increase in the month of July since the beginning of the crisis. Registered unemployment also posted good figures, down by 9.4% (10.7% in June). Given Spain’s economic growth, the labour market is likely to remain positive over the next few months. This should help to create more than 500,000 jobs between Q4 2016 and Q4 2017.

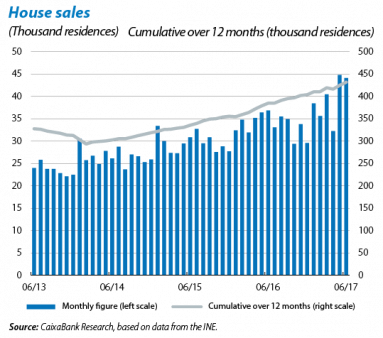

The recovery in employment and favourable financial conditions boost house purchases. Specifically, house sale transactions rose by 12.1% year-on-year in June (cumulative over 12 months), totalling 235,672 YTD. Apart from growth on the domestic front, purchases by foreigners, which account for 13% of all house sales in Spain, also continued to rise, in spite of a fall in purchases by British citizens (see the Focus «The consequences of Brexit on the real estate sector» in this Monthly Report). On the other hand, new building permits slowed down their growth (up by 14% year-on-year in May cumulative over 12 months compared with 20% in April) and are still far from the pre-crisis figures. This fact, together with the rise in demand for housing, will help push up house prices even more.

Inflation stabilises due to the trend in oil prices. The year-on-year change in the CPI was 1.6% in August, 0.1 pp higher than July’s figure after slowing down considerably compared with the figures of 3.0% recorded at the beginning of the year. Over the coming months, weak oil prices will moderate inflation in the final part of the year. Core inflation (the headline index without unprocessed food or energy products) rose by 0.2 pp in July to 1.4%, boosted by an increase in industrial prices which more than offset the slowdown in the price of electricity.

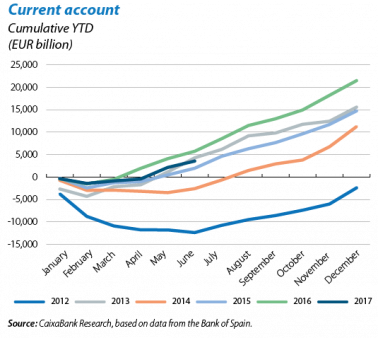

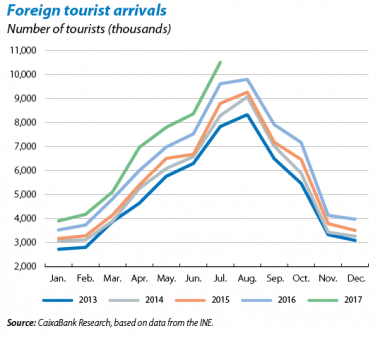

The onset of the tourist season and a more moderate rise in the price of oil are boosting the foreign sector. In June, the current account surplus totalled EUR 3.57 billion YTD, far below June 2016’s figure of EUR 5.754 billion. This worse performance is due to the deterioration in the energy balance caused by higher oil prices in the first few months of the year. However, in the second half of 2017, the more moderate rise expected in the price of oil will contain the increase in the energy bill. The income and services balances are also expected to continue in surplus. In particular, low interest rates are supporting the trend in the income balance (for more detail, see the Focus «The improvement in the income balance» in this Monthly Report). The services balance, on the other hand, continues to be boosted especially by tourism. In July, arrivals of international tourists rose by 11.1% year-on-year, reaching 46.9 million YTD.

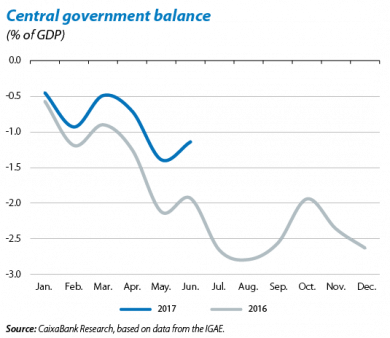

Economic growth is helping to achieve the deficit target. Good economic activity figures have increased tax revenue by around 6.6% compared with May 2016 (excluding local government corporations) while general government spending has fallen by 0.1% compared with the same month. Social Security contributions and personal income tax continue to record moderate growth, albeit slightly lower than expected. The state budget execution, with data available up to June, shows an improvement in the central government deficit of 0.8 pp compared with last year’s figure, standing at 1.1% of GDP. Moreover, it is highly likely that contingencies resulting from the motorway toll bail-out will be passed on entirely to 2018. This fact, together with the positive trend in public accounts, will help Spain to meet its deficit target of 3.1% of GDP in 2017.

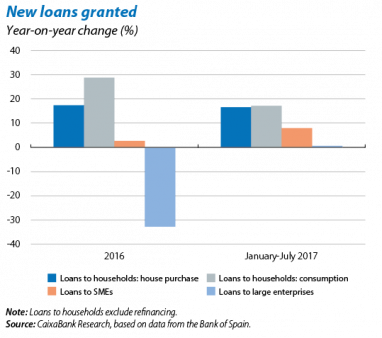

Spanish banks, now more solvent and robust, are increasing their supply of credit. In July the European Commission published its seventh post-programme surveillance report on the Spanish economy, produced after the financial bail-out carried out in 2014. This report highlights the fact that the restructuring plans for state-invested banks are well underway and should be fully implemented by year-end. It also notes that bank restructuring has gone beyond banks receiving state aid, as the banking sector in general has adjusted its business model. Spain’s banks are therefore in an increasingly better position to expand the flow of credit to households and companies, as shown by the figures for new loans granted up to July. Specifically, both loans for consumption and also to buy housing rose by 17% year-on-year, in cumulative figures YTD. In the case of non-financial firms, while loans to SMEs continued to rise significantly (8% year-on-year), new loans for large firms were only up by 0.2% year-on-year. This is because of the good conditions available for financing via corporate bonds. The trend will continue for the rest of the year given that the ECB will maintain its expansionary monetary policy. This will foster favourable financing conditions via banks and the corporate bond markets.