Economic activity in the euro area is gathering pace

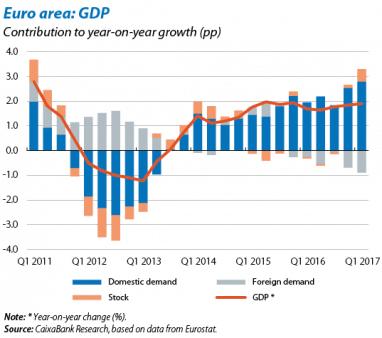

The economic recovery is spreading across countries and uncertainty is fading. Euro area GDP growth accelerated in Q1. Real GDP rose by 0.6% quarter-on-quarter, the fastest pace since early 2015 and 0.1 pp above the flash estimate, after the upward revisions of France, Italy and Greece to 0.4% quarter-on-quarter. This stronger Q1 growth rate reflects the sustained improvement of economic sentiment indicators we have seen since the end of 2016. As a result, the ECB revised its euro area GDP growth forecasts for the second time this year, from 1.8% to 1.9% for 2017 and from 1.7% to 1.8% for 2018 (in line with CaixaBank Research forecasts). In addition to this favourable outlook, some of the political risk that was affecting the euro area since last year has disappeared. In that sense, Emmanuel Macron’s party winning of absolute majority in the French parliament is particularly important, as it will make it easier to implement its agenda of reforms and could boost the European integration process. Also, the Eurogroup reached an agreement with Greece for the next disimbursement of funds under the third bail-out programme. This will help the country meet its debt repayments over the coming months although there are still doubts regarding the long-term sustainability of debt. However, despite the reduction of political uncertainty, some sources of risk remain. Some euro area countries will hold elections over the coming months (Germany and Italy). Moreover, Brexit negotiations started on 19 June and these are bound to be long and complex. On the other hand, the Italian government started the liquidation process of the regional banks Veneto and Popolare di Vincenza after the Single Resolution Board (SRB) decided that a resolution was not necessary (given that a liquidation would have no significant impact on financial stability). The European Commission authorised the Italian government to inject public funds to support the liquidation process, given the potential impact on the Veneto region’s economy if liquidation were made in a disorderly manner. The liquidation will be carried out by selling healthy assets to Intesa Sanpaolo and transferring non-performing assets to a state-supported «bad bank».

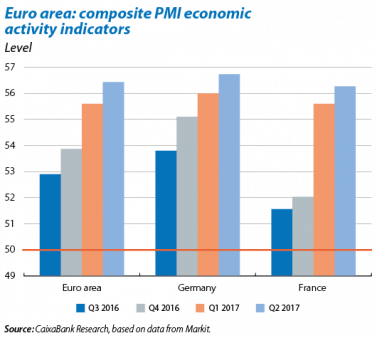

Economic activity indicators point to solid growth in Q2. Economic sentiment indicators continue to rise, and reached their highest level in the past few years. The composite business sentiment index (PMI) for the euro area as a whole stood at 55.7 points in June, slightly below May’s figure (56.8). Nevertheless, the average index for Q2 was 56.4 points, higher than the previous quarter (55.6) and clearly in the expansionary zone (above 50 points). The economic sentiment index (ESI) also rose to 111.1 points in June, its highest level since August 2007. Across countries, Germany performed particularly well, with an average PMI from April to June of 56.7 points and an IFO business sentiment indicator that reached an all-time high.

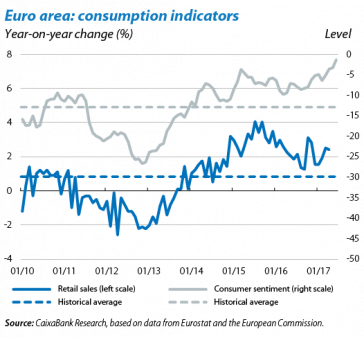

Consumption continues to drive economic growth. This can be seen in the evolution of euro area’s retail sales, which were up 2.5% year-on-year in April, the same rate as the previous month. Also, the consumer confidence index for the euro area reached –1.3 points in June, the highest figure since May 2007. This suggests that private consumption is still one of the driving forces for the euro area’s recovery, which should continue over the coming months given the low interest rates and improvements in the labour market.

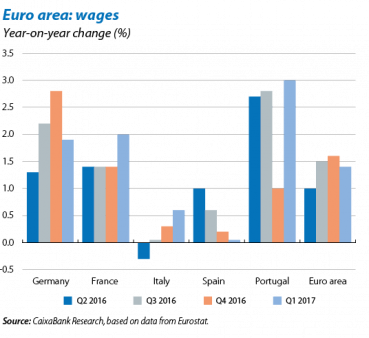

The faster growth rate is having a greater effect on job creation than wages. Euro area employment rose by 0.4% quarter-on-quarter in Q1, and the number of employed reached 154.8 billion, an all-time high. There was widespread growth in employment across countries, particularly in Portugal (1.0%), Spain (0.7%) and Germany (0.5%). The increase was more moderate in France and Italy, however, where the economic recovery is somewhat weaker. Nevertheless, wages remain contained in spite of the growth in employment. Hourly labour costs in the euro area as a whole increased by 1.4% year-on-year in Q1 2017, a similar rate to the previous two quarters. Across countries, wages rose more sharply in Germany (1.9% year-on-year), France (2.0%) and Portugal (3.0%) and at a slower rate in Italy (0.6%), while there was zero increase in Spain.

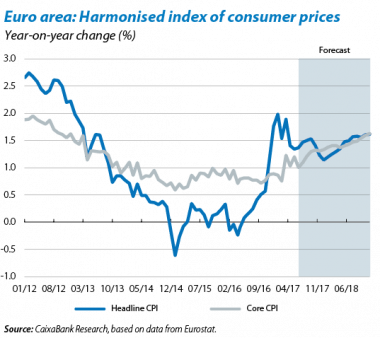

Inflation continues to increase very gradually. In June, euro area headline inflation, as measured by the harmonised index of consumer prices (HICP), stood at 1.3%, 0.1 pp lower than the previous month due to a smaller contribution from the energy component and unprocessed food. Core inflation, which excludes the more volatile components (energy and unprocessed food) and therefore indicates medium-term inflationary trends, rose in June to 1.2%, 0.2 pp above the figure for the previous month. We expect core inflation to continue its gradual recovery over the coming months supported by the recovery in economic activity and the improvements in the labour market.

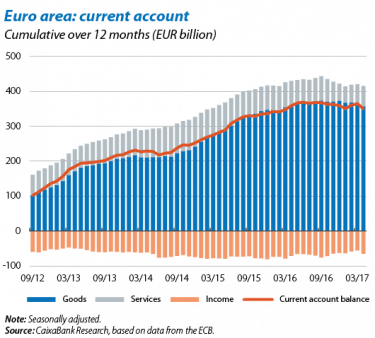

The current account balance is shrinking but remains positive. The euro area’s current account surplus (cumulative over 12 months) totalled EUR 349.9 billion in April. This is equivalent to 3.2% of GDP and lower than the EUR 358.6 billion posted in April 2016. The lower figure was due to the smaller surplus in the services account (falling from EUR 70.4 billion to 57.8) but also in goods (from EUR 359.5 billion to 357.2). We expect the external surplus to continue shrinking over the next few quarters as imports increase with the recovery in investment.

PORTUGAL

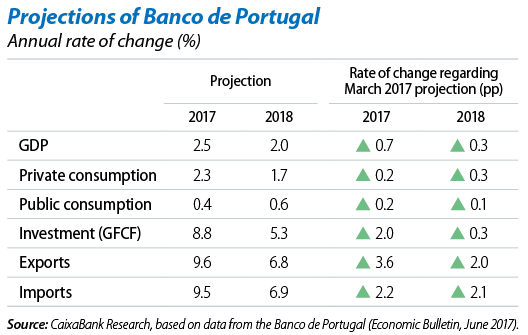

The economic recovery is gaining traction. After Portugal’s strong growth figure in Q1 (1.0% quarter-on-quarter, 2.8% year-on-year), economic activity indicators for April and May suggest that economic activity will continue to expand at a good pace in Q2. As a result, Banco de Portugal increased its growth forecasts, from 1.8% to 2.5% for 2017 and from 1.7% to 2.0% for 2018 (in line with CaixaBank Research forecasts). Over the coming months, growth will be supported by domestic demand, which will remain solid thanks to the gradual recovery in the labour market, improved business confidence and accommodative financial conditions. External demand will also boost growth on the back of strong export performance, which will benefit from a more favourable external environment and the competitiveness gains of the past few years.

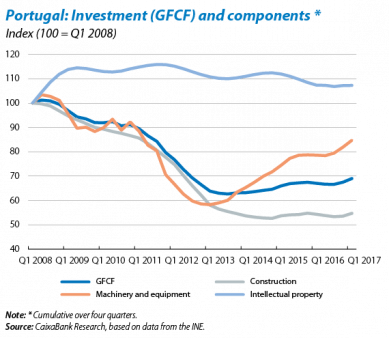

Investment is starting to pick up. Although it is still 30% below its pre-crisis level, the investment component (GFCF) has gradually come to the fore over the past few quarters. In Q1 it increased by 2.1% quarter-on-quarter (8.9% year-on-year). This can be explained by a faster growth rate of construction investment (5% quarter-on-quarter) and, to a lesser extent, of investment in machinery and other equipment (1.2%). We expect this trend in investment to continue over the coming quarters, reflecting the recovery in public investment (boosted by larger European funds) and the good performance of corporate GFCF. Investment is therefore likely to be one of the key supports for Portugal’s economic growth in 2017.

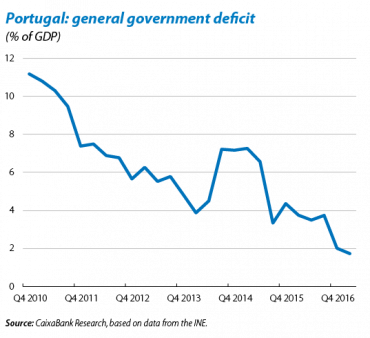

Public finances benefit from the economic situation. In Q1 the public deficit stood at 1.7% of GDP (cumulative over 12 months), significantly below the figure for Q1 2016 (3.7%). This is due to higher revenue growth, which was up 1.1% compared to the same period in 2016, as well as a 3.1% reduction in total expenditure. For the rest of the year, the economic recovery, lower financing costs, and fiscal consolidation measures should help to bring the deficit close to (or below) the target agreed with Brussels (1.6% of GDP). Given this, and after the public deficit fell below 3% of GDP in 2016, the European Council allowed Portugal to exit the Excessive Deficit Procedure. This should help to improve the country’s financing conditions. Portugal’s low public deficit and sustained nominal GDP growth should also help to gradually reduce its debt ratio over the next few years (by approximately 2 pp per year). Because of this improvement in public finances, the ratings agency Fitch revised the outlook of Portugal’s sovereign debt from stable to positive. This opens the door to a rating upgrade should the favourable situation continue over the coming quarters.