Economic activity in the euro area proved higher than expected in Q1 2019

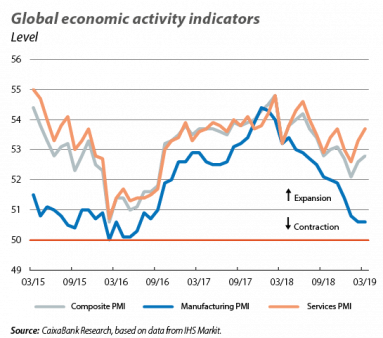

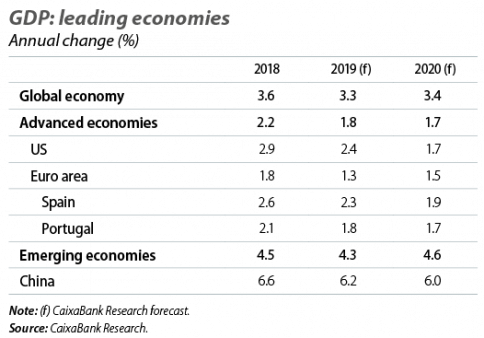

The expansion of the global economy continues, but the growth outlook moderates. As a result of the maturity of the cycle, geopolitical uncertainty, trade tensions and temporary burdens on key economies, global economic activity has been progressing at a more contained rate in recent quarters. This is reflected in indicators such as the composite Purchasing Managers’ Index (PMI) which, despite increasing slightly in March (52.8 points) thanks to the improvement in services, remains hampered by the weakness of the industrial sector (the manufacturing PMI remained at 50.6 points, barely above the 50-point threshold). This environment of more moderate growth is also reflected in the new macroeconomic forecasts that the IMF presented in April. The institution revised downwards its global growth forecasts (down to 3.3% for 2019 from the 3.5% forecasted in January), especially for the advanced economies, and maintained the balance of risks skewed to the downside. Despite this review, and as noted by the IMF itself, the rate of economic activity could show a better tone as the year progresses. This is because of the pause in the tightening of monetary policy by the major central banks, the maintenance of an expansive fiscal policy in countries such as China, the thaw in the trade dispute between the US and China, and the fading of the temporary burdens.

From the thaw in trade tensions to uncertainty over Brexit. In the sphere of trade, the US and China appear increasingly close to reaching an agreement which would favour a reduction in uncertainty at the global level. On this note, the US trade representative Robert Lighthizer and the Treasury secretary Steven Mnuchin travelled to China in late April with the goal of bringing the trade negotiations between the two countries to an end. The US has already announced that part of the negotiations cover aspects such as intellectual property, the forced transfer of technology and non-tariff barriers. But while the US and China are steering their trade tensions, the uncertainty surrounding Brexit persists. In particular, the EU granted the United Kingdom a new extension of article 50, this time until 31 October, in order to allow more time to reconsider the exit strategy. The United Kingdom will have until then to ratify the withdrawal agreement, although a wide range of possibilities remain open (ranging from repealing article 50 entirely and cancelling Brexit, to a no-deal departure). However, the extension reduces fears of a disorderly Brexit (an option that has also been rejected by a large majority of the British Parliament).

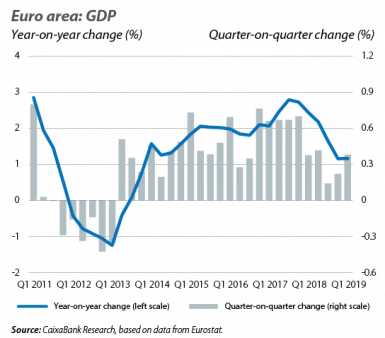

Economic activity in the euro area proved higher than expected in Q1 2019. In particular, GDP grew by 0.4% quarter-on-quarter, 2 decimal points above the figure for Q4 2018 and higher than our forecast and analysts’ consensus. The figure proved to be a positive surprise, since the modest figures recorded by some sentiment indicators and the problems experienced in the industrial sector in the first part of the year indicated that the moderation seen in the second half of 2018 would continue into Q1. In fact, the euro area economy had gone from growth rates of 0.4% quarter-on-quarter in early 2018 to levels of around 0.2% by the end of 2018. Part of this slowdown reflects the impact of a temporary factor: the disruptions in the automotive sector following the new European emissions regulations. However, two factors of a longer-lasting nature have also held back economic activity: the slowdown in global trade and political sources of uncertainty (the resolution of Brexit, the conflict surrounding Italy’s fiscal policy and the trade tensions between the US and China). As such, as some of these factors fade over the coming months, the euro area will show better performance in the second half of the year. By country for those we have data for, Spain showed particular promise, with growth of 0.7% quarter-on-quarter (see the section on Spanish Economy in this same Monthly Report), as did France (0.3%). Italy’s GDP rose by 0.2% in quarter-on-quarter terms, a modest figure but nevertheless an improvement after two consecutive quarters with negative quarter-on-quarter growth. In this context, the containment of inflationary pressures in the euro area (1.4% year-on-year in March, 1 decimal point below the figure for the previous month, largely due to the slowdown in core inflation down to 1.0%) still suggests a very gradual recovery in inflation towards the ECB’s target rate (~2%) and reinforces the view that the institution will maintain an accommodative policy over the coming quarters.

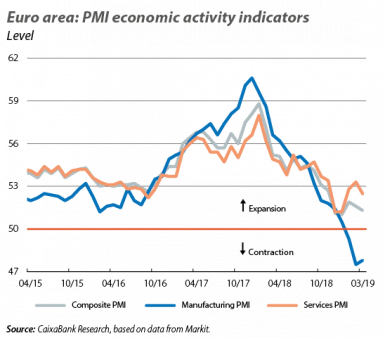

The more moderate dynamics in the growth of the euro area continue at the start of Q2. The PMIs for the euro area showed no sign of rising in April, indicating that growth in the region remains contained. In particular, the compound PMI for the euro area remained at modest levels (51.3 points in April, after the 51.6 points registered in March) and fell below analysts’ expectations. In the breakdown by sector, the manufacturing PMI remained within contractionary territory (at 47.8 points), while that of services (at 52.5 points) fell by 0.8 points. Similarly, the consumer confidence index deteriorated slightly in April, reaching –7.7 points. This figure is worse than expected and breaks the trend of improvement seen between December and March. Thus, on the whole, the latest data suggest that the euro area economy has not yet overcome its temporary burdens at the beginning of Q2.

Portugal: favourable growth, but with doubts over the external sector

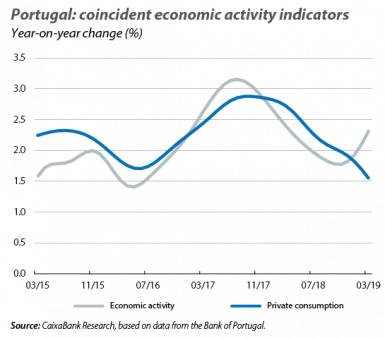

The economic activity indicators suggest a positive start to the year, despite some mixed signals. Pending the publication of GDP for Q1 2019, overall the indicators suggest that economic activity continued to grow at a steady pace in the first quarter of the year. Specifically, the coincident economic activity indicator developed by the Bank of Portugal, which historically corresponds closely to GDP growth, accelerated to 2.3% in March and stood at 2.1% on average for the quarter. In addition, the available data reflect a positive performance of investment in all its components and an acceleration in turnover in both the manufacturing and the services sector, thanks to an improvement in their economic sentiment indicators. Offsetting these encouraging dynamics, however, are some more mixed signals. The coincident indicator for private consumption continued to decline in Q1 2019, closing at 1.5% in March and with a quarterly average of 1.7% (3 decimal points less than in Q4 2018). This suggests that household consumption could have been less buoyant in the early stages of the year. On the other hand, as set out below, a more dissonant note continues to ring in the external sector, where the most recent figures continue to point towards an increase in the current account deficit which is partially restricting the country’s capacity to reduce its external indebtedness.

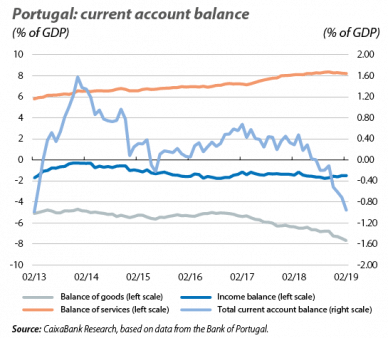

The deterioration of the current account balance continued in February. The current account deficit stood at 1.9 billion euros (12-month cumulative balance), equivalent to 1.0% of GDP, reflecting a clear deterioration compared to last year’s figure (–0.3% of GDP). This difference was due to the reduction in the deficit of goods (–7.7% of GDP), since both the balance of services (+8.2%) and that of income (–1.5%) remained practically unchanged. The balance of capital, meanwhile, remained in positive territory and more than offset the current account deficit (the overall balance stood at +0.1% of GDP in February). In this context, it is worth highlighting the importance of preserving an external surplus that allows the country to continue to reduce its net external debt (in 2018, this stood at 89% of GDP, 2.7 pps below the figure for 2017).

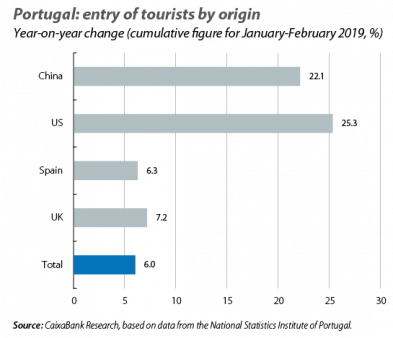

Tourism activity performs encouragingly at the start of the year. In total for January and February 2019, the number of foreign tourists increased by 6.0% compared to the same period last year. By origin, the recovery in the arrival of tourists from the United Kingdom was of particular note, growing by an impressive 7.2%, as was the marked increase in tourists from the US (25.3% year-on-year) and China (22.1%). On the other hand, the revenues of tourist accommodation establishments increased by 6.5% year-on-year thanks to the increase in the number of tourists, given that the average revenue per available room barely grew (from 25.3 euros to 25.8 euros).

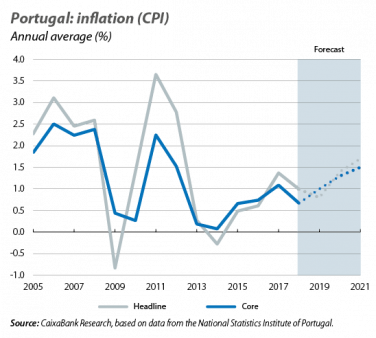

Inflation remains at moderate levels. In April, headline inflation (measured according to the consumer price index) stood at 0.8% year-on-year, while core inflation (which excludes unprocessed food and energy prices, which are especially volatile) reached the same modest figure. This puts both measures only slightly above the 0.7% registered in March. Thus, for the past 12 months as a whole, headline inflation averaged 1.0% (the same as in March).

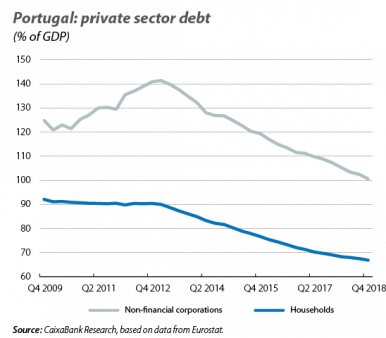

Corporations and households make progress in reducing their levels of indebtedness. In particular, in Q4 2018, the indebtedness of non-financial corporations and of households continued to decrease, reaching 100.6% and 66.9% of GDP, respectively (representing a reduction of 6.7 and 2.2 pps compared to Q4 2017). In addition, relative to the all-time highs recorded between 2009 and 2013, the debt of non-financial corporations has declined by 40.8 pps, while that of households has reduced by 25.2 pps.

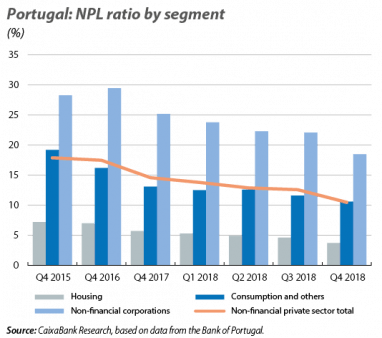

Private sector credit continues to contract. In particular, it registered a decline of 2.5% year-on-year in February, largely as a result of the contraction in lending to non-financial corporations (–5.6% year-on-year; excluding sales of doubtful loans, it would have increased by 0.5%). At the same time, lending to households fell by 0.6% year-on-year due to the contraction of lending for housing (–1.4% year-on-year, due to the fact that new lending is growing at a steady rate, albeit still not enough to offset repayments). Consumer credit, on the other hand, continued to show strong growth (9.4% year-on-year). The non-performing loan ratio for the private sector, meanwhile, fell from 14.6% in 2017 to 10.5% in 2018, thanks to a 29.0% annual reduction in doubtful loans. The segment that contributed the most to the improvement was that of companies, whose doubtful loans contracted by 7 billion euros during the year, bringing the NPL ratio among businesses down to 18.5% (–6.7 pps). The notable improvement in non-performing loans during 2018 can largely be attributed to the greater buoyancy of sales of doubtful loan portfolios, a trend that will continue during 2019.