The greater traction now enjoyed by the Spanish economy, together with the end of the adjustment to house prices, are resulting in a more encouraging panorama for real estate. At a national level valuation figures indicate that prices almost stabilised in 2015 Q1 (changing by –0.1% year-on-year) and even started to grow in real terms. Nevertheless large differences can be seen at a sub-market level. Below we analyse the main factors behind such divergence.

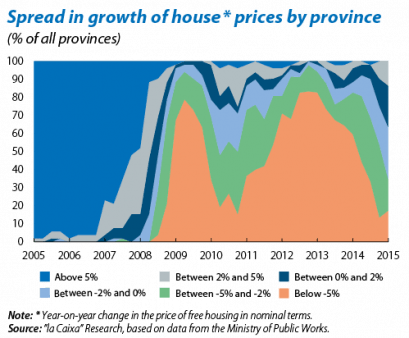

The markedly heterogeneous evolution of prices becomes clear when we look at the different situations by province. Prices are already growing in those provinces with large cities (such as Barcelona and Madrid) and key tourist destinations (such as the Balearic and Canary Islands) but still contracting markedly in other regions. Specifically, in 2015 Q1, 18 provinces saw drops in house prices of more than 2% year-on-year while 13 provinces recorded growth in excess of 2%.

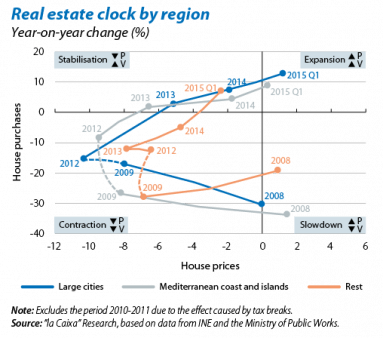

These differences in house price trends by province highlight the fact that different regions are at different points in the real estate cycle. While the sector is already at the start of an expansionary phase in large cities, on the Mediterranean coast and the islands, with positive growth rates in terms of both prices and sales, the rest of Spain's regions still lag behind, immersed in the stabilisation phase.

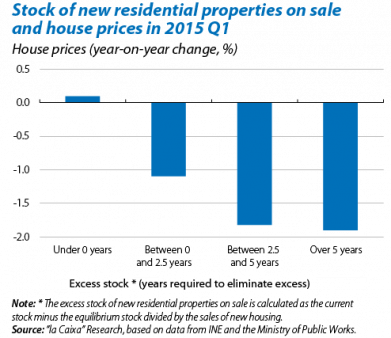

The differing speeds observed in the recovery in the real estate market can be explained by both demand and supply factors. Of note among the former is foreign demand, affecting the trend in prices in more popular areas for tourists while, on the supply side, the excess stock of empty residential properties on sale is playing an important role in the divergence between regions. As can be seen in the last graph, those regions with the highest excess stock of housing are seeing the sharpest falls in price. For example, in 2015 Q1 those provinces with such a high stock of housing that they would need more than five years of sales to bring it down saw 2% drops in price year-on-year on average while those provinces with limited stock (below the equilibrium level) saw rises of 0.1% year-on-year on average.

At an aggregate level stocks are still very high and therefore continue to have an effect on the evolution of real estate prices. However, the extent of the recovery depends on each region and greater dynamism can be seen in those areas where the stock of housing is very close to its equilibrium level.