Emerging capital inflows: increasing against all odds

Capital flows towards the emerging countries recovered strongly in 2016 after slumping, in 2015, to their lowest level since the mid-2000s. This trend has continued in 2017 and capital flows are expected to remain strong

in 2018.

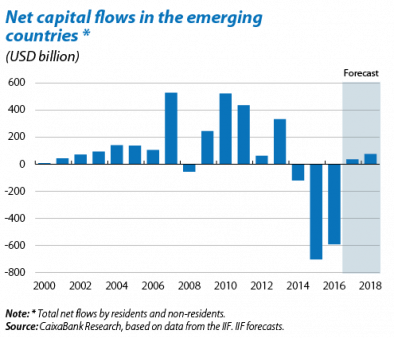

To some extent, this increase in capital flows towards the emerging countries is due to a greater appetite on the part of international investors for emerging assets. Moreover, the investment made by investors resident in emerging countries beyond their respective borders is also decreasing. Since 2017, both factors have resulted in positive net capital flows towards the emerging economies (see the first chart).

Both pull and push factors are supporting this recovery in capital flows, which began in 2016. The characteristics of the emerging countries themselves are acting as pull factors and affecting investor decisions. Dynamic economic activity in the emerging bloc is one attraction, especially when compared with the economic growth recorded by the advanced economies. Since the end of 2015, rising crude oil prices have also created a favourable environment for capital flows. In fact, the oil price is a fundamental variable for many emerging countries. Its recovery has therefore improved their economic outlook which, in turn, has helped to boost capital inflows.

Push factors, worldwide forces that affect emerging markets from outside their borders, are also boosting emerging capital inflows. A greater appetite for risk, together with highly favourable global financial conditions, are other factors pushing investment towards the emerging economies.

However, these push factors are likely to diminish in the future, with global circumstances becoming less favourable for capital flows. In particular, the monetary normalisation being carried out by the main developed central banks (especially the Fed) should result in tighter global financial conditions. Even so, this process is expected to be very gradual and any abrupt change in conditions is unlikely.

Apart from this less favourable financial environment, geopolitical tensions are another source of risk that could also hinder growth in capital flows towards the emerging economies. The impact on emerging financial markets of the recent tension caused by the North Korean crisis, for instance, reflects just how sensitive financial conditions can be to geopolitical risks.

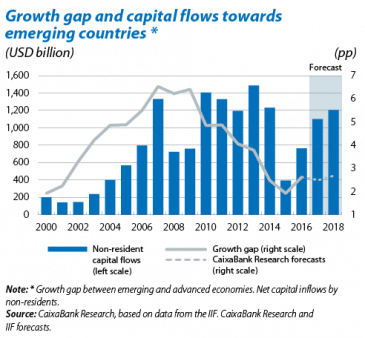

Nevertheless, although there are many sources of uncertainty, capital flows towards the emerging economies are likely to continue increasing, supported by the favourable growth gap compared with the developed economies (see the second chart) and by interest rates remaining low in spite of incipient monetary normalisation.