Emerging debt: a weak flank given the Fed’s monetary normalisation

In 2016 Q1, global debt in the non-financial sector (companies, households and the public sector) reached 245% of GDP, an all-time high. More than two thirds of this debt corresponds to advanced countries. Does this mean that emerging debt is of no concern? Such a conclusion is probably misguided. Although the level of emerging debt is lower than the advanced countries’ debt, its growth since 2006 has been noticeable and, to a certain extent, worrying: while advanced non-financial debt has multiplied by 1.4 since then, emerging debt has increased 3.4 times. At this point in the debate it is usually argued that the aggregate figure for emerging debt is dominated by the fact that China alone accounts for 60% of the total. China is indeed a source of risk but there are still warning signs even after the Asian giant has been left out of the equation, as the debt in the rest of the emerging countries has doubled since 2006.1

Are such levels excessive? One way to answer this question is to compare the figures with their underlying trend. According to the BIS, history tells us that, when the gap between the current level of credit (as a percentage of GDP) and the long-term level is greater than 10%, there has been a financial crisis in any of the following three years.2 The countries that are currently in this vulnerable situation, or very close to it, are Chile, Indonesia, Malaysia, Saudi Arabia, Thailand and Turkey.

Another of the aspects that could play a key role in an adverse environment for international financing is external debt. Although today’s conventional view is that external debt does not represent a serious problem, unlike the situation in the financial crises of the 1980s and 90s, it is still premature to claim it no longer has any part to play. Malaysia and Poland’s external debt currently exceeds 70% of GDP, Chile’s is over 60% and Turkey and South Africa’s, 50%. All these figures are too close to the customary safety thresholds for emerging countries. Another important aspect is the time profile of their debt, which tends to be related to the availability of international reserves: Turkey appears to be the most vulnerable as its international reserves do not cover all its short-term external debt, and it is almost the same case for Malaysia and South Africa, suggesting a limited capacity to respond to tougher financial conditions.

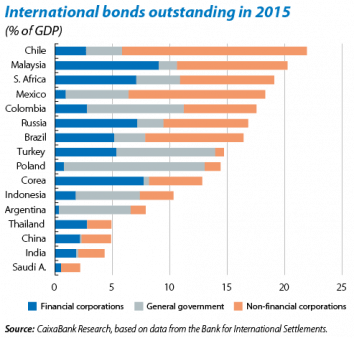

Moreover, external debt is not the only type with liabilities sensitive to tighter international financing conditions. Within a context of increasing globalisation, the BIS has repeatedly warned of the risk posed for the solvency of a firm’s parent company by its subsidiaries located abroad issuing international bonds.3 Although this cause might seem anecdotal a priori, it is not the case: for the group of emerging countries analysed, between 2006 and 2015 the total outstanding balance of their international bond issuances tripled, reaching 12.9% of GDP. As the last decade has advanced, the public sector has tended to resort less to issuing international bonds in most countries while issuances by the financial sector and especially by companies have increased. In this last segment, Chile has a particularly high level of debt (its international corporate debt totals 16.1% of GDP), as well as Malaysia (9.6%), Brazil (8.5%) and South Africa (8.2%). Although many of the indebted firms in these countries benefit from «natural» hedging (they are exporters paid in dollars), such figures are still high.

In conclusion, if we compare the three lists of emerging countries (those with high levels of debt, those with a less solid external debt position and those which have perhaps taken too much advantage of the opportunities for international financing in foreign currencies) some names are repeated (Chile and Malaysia) while others are in two of the three categories (Brazil, South Africa and Turkey). We must therefore keep a close eye on their capacity to handle such a high burden of debt, especially in a financial context that will probably become more demanding over the next few quarters as the Fed raises interest rates.

1. On China’s situation, see the Focus «China’s corporate debt: a reason for concern?», in MR10/2016. In our Focus, which does not analyse China’s problems, the group of emerging economies under study is made up of: Argentina, Brazil, Mexico, Colombia, Chile, Russia, India, Indonesia, Malaysia, Thailand, Korea, Turkey, Poland, South Africa and Saudi Arabia.

2. Specifically, the BIS estimates that, historically, when this credit-to-GDP gap has been 10% it accurately predicts 70% of the financial crises occurring in the following three years.

3. One example of such transactions would be a subsidiary of an Indian firm located in Europe that issues a bond in dollars in London.