The euro area economy remains strong despite the political risks

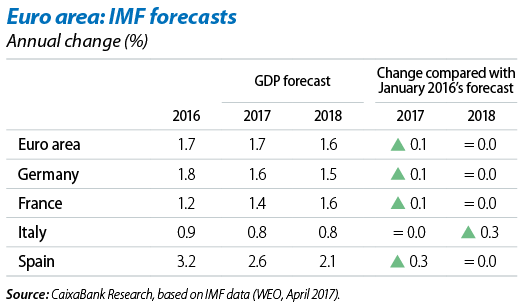

The euro area’s economic growth gains traction in spite of uncertainty. After several years of moderate but uneven growth in the euro area, the cyclical recovery has become stronger in most of its economies. CaixaBank Research forecasts point to euro area growth of 1.7%, both for 2017 and 2018. The IMF forecasts are along the same lines: 1.7% growth in 2017 and 1.6% in 2018. This is slightly higher for most euro area economies than its January forecast. Domestic demand is getting stronger in the euro area, supported by private consumption after the gradual recovery in the labour market, as well as increased corporate capital expenditure. The foreign sector is also improving, boosted by stronger global demand and a weaker euro. Some of the political risks that had threatened the recovery at the start of 2017 are now starting to fade (the outcome of the Dutch elections and the first round in France, and less support for Germany’s extreme right-wing). The Eurogroup has also reached a preliminary agreement with Greece for the upcoming payments from the third bail-out programme and an orderly start is expected for the Brexit negotiations. However, several core countries from the euro area are also about to go to the polls, the agreement with Greece does not include measures for long-term debt relief and the Brexit negotiations are likely to be long and complex. On 29 April the EU-27 countries unanimously established not only their negotiating position with the UK but also how these negotiations will take place. The second phase discussing the future basis of relations between the UK and the EU-27 will not begin until the following have been clarified: the impact of Brexit on citizens and companies and all the country’s rights and obligations as a former EU member.

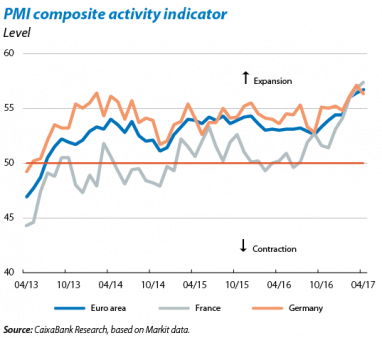

Economic activity indicators point to higher GDP growth in the first half of 2017. Pending the GDP growth figure for Q1 in the euro area, most economic sentiment indicators suggest growth has speeded up. The composite business sentiment index (PMI) for the euro area increased in the first four months of the year, up to 56.7 points in April, clearly in the expansionary zone (above 50 points) and its highest level since 2011. The economic sentiment index (ESI) reached 109.6 points in April, its highest since August 2007. This growth in economic activity indicators was widespread among the largest economies in the euro area. Regarding other hard data for the euro area, industrial production increased by 1.2% year-on-year in February, the highest rates being Spain with 2.5%, Italy with 2.2% and Germany with 1.5%. In France, a country whose Q1 GDP figure is already available, economic activity grew by 0.3% quarter-on-quarter, slightly lower than the 0.5% in Q4 2016 (the latter having been upgraded by 0.1 pp). This slower rate was partly due to a seasonal slowdown in consumption (for instance, less energy consumption because of the mild winter) and a drop in exports (particularly transport materials). April’s indicators suggest France’s economic activity has rallied slightly in Q2.

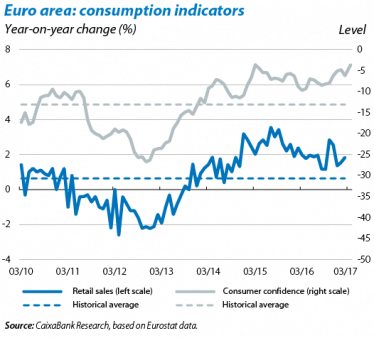

Household consumption is still strong. Retail sales in the euro area rose by 1.8% year-on-year in February (1.6% in January), a clearly faster rate than the average for the past few years. Its consumer confidence index increased during the first four months of the year to –3.6 points in April, the highest since March 2015. Positive private consumption is supporting the euro area’s solid growth, a pattern that should continue, helped by the better labour market and accommodative financial conditions over the next few months.

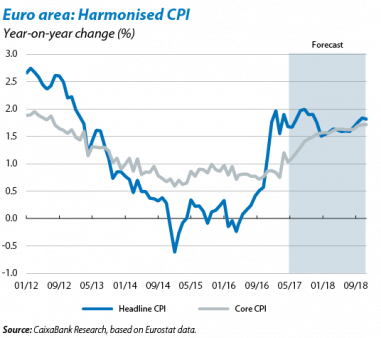

Euro area inflation is gradually getting back to normal thanks to increasing economic activity. Headline inflation in the euro area, measured by the harmonised index of consumer prices (HICP), climbed to 1.9% in April. This figure is 0.4 pp higher than the previous month, thanks to the sharp upswing in service prices due to the calendar effect of Easter, which fell in March in 2016. Beyond this one-off factor, we expect headline and core inflation to increase gradually over the coming months. Growth in economic activity will push up inflation, boosted by the ECB maintaining its rate of bond purchases (EUR 60 billion per month) until December 2017.

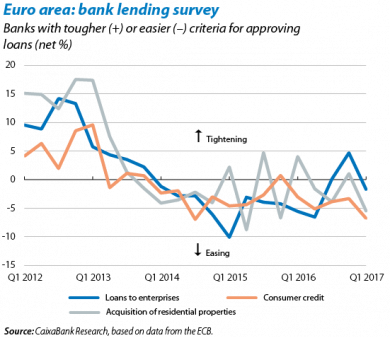

Financial conditions remain accommodative. According to the bank lending survey for Q1 2017, over the past six months the ECB’s purchase programme has improved banks’ liquidity position and financing conditions, although reducing their profits. According to the same survey, and given the relaxed monetary environment, demand for credit continued to rise in all segments in Q1 2017. Credit institutions expect this growth to continue in Q2 2017. Banks also relaxed their criteria to grant loans, both to companies and households, particularly in Germany. All this suggests financial conditions will continue to support growth in domestic demand.

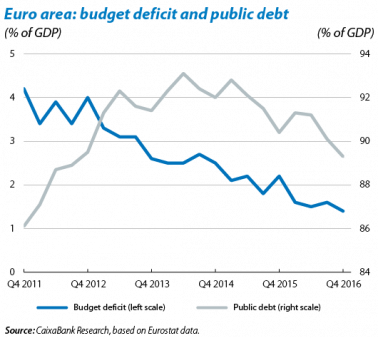

The euro area’s fiscal adjustment continued gradually in 2016. In 2016 the euro area’s average budget deficit fell to 1.5% of GDP, 0.6 pp lower than in 2015 (2.1%). Public debt in the euro area as a whole reached 89.2% of GDP in 2016, a high level although almost 1 pp lower than 2015’s figure (90.3% of GDP). But this gradual reduction in public debt hides big differences between countries. In high debt countries such as Italy, Portugal, Belgium, Spain and France, public debt has remained almost stable or even increased. It is important for these countries to decisively reduce their debt to more sustainable levels before the next cycle of economic crisis.

PORTUGAL

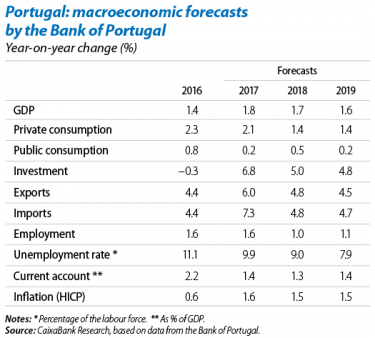

The Portuguese economy is more dynamic in the first few months of the year. After achieving 1.4% growth year-on-year in 2016, sentiment indicators suggest economic activity has accelerated in 2017. April brought good consumer confidence data, at an all-time high, as well as a good economic sentiment index, posting its highest figure since 2001. This improvement led the Bank of Portugal to revise up its GDP forecasts to 1.8% in 2017 and 1.7% in 2018 (+0.4 pp and +0.2 pp higher than the December 2016 forecasts, respectively). Portugal is also enjoying its most balanced economic growth since 2014. Private consumption will continue to grow at a similar rate in 2017, helped by the gradual improvement in the labour market, while public consumption will see subdued growth due to fiscal adjustment. Investment should also come to the fore in 2017 as uncertainty fades thanks to favourable financing conditions and more European funds available for investment. External demand will continue strong with a notable increase in exports, helping to maintain the country’s trade surplus.

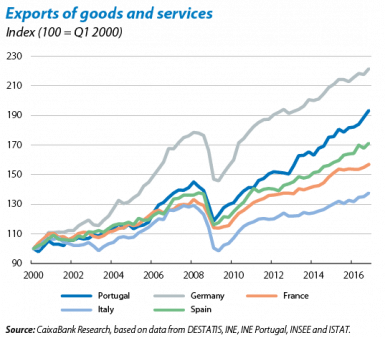

The competitiveness gains made by Portuguese exporters have led to significant improvement, on a par with their European neighbours. The competitiveness lost before the crisis has been recovered, partly thanks to several years of wage moderation. This has boosted exports, which have gone from representing 27% of GDP in 2005 to around 44% in 2016. This improvement has also occurred across a more varied range of sectors and towards a larger number of destinations. Exports should continue to grow at a strong rate in 2017, supported by increasing demand from Portugal’s major trading partners. The first data available for the year support this: exports of goods rose by approximately 14% year-on-year over the first two-month period, especially due to more trade with countries outside the EU.

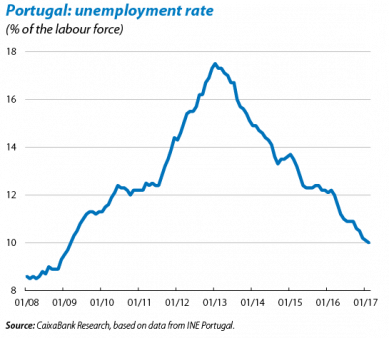

Portugal’s economic recovery is helping its labour market. The unemployment rate has fallen sharply since 2013 (by around 2 pp each year), supported partly by the ambitious labour reforms implemented since 2011. In February unemployment fell from 10% to 9.9% and, according to the provisional estimate by Portugal’s statistics institute, it will have reached 9.8% by March. Jobs are also being created at a good pace (2.8% year-on-year in February). We expect the labour market to go on improving in 2017 and 2018 as the country’s economy recovers. Not everyone is benefitting to the same degree, however. The youth unemployment rate is much higher (24.4% in February) and more than half the unemployed are long-term (over one year without work).