The euro area’s recovery continues to be supported by a low interest rate environment

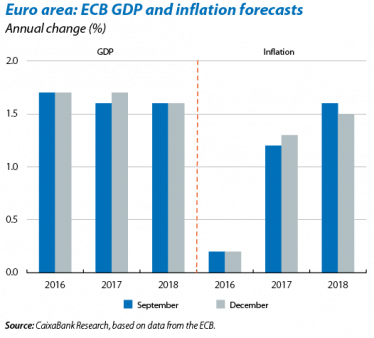

Growth in activity consolidates in 2017 but there are still risks. In spite of the many different economic and political events occurring throughout the year, the euro area economy expanded at a modest but constant rate in 2016 and this tone is expected to remain very similar in 2017. Specifically, the CaixaBank Research scenario predicts the region will have ended 2016 with 1.7% growth and forecasts a moderate 1.5% growth for 2017. The ECB agrees with these projections; in its quarterly update of the macroeconomic situation it revised its 2017 growth forecast up to 1.7% (+0.1 pps), keeping its projection of a slight slowdown in medium-term growth (1.6% in 2018) unchanged. The ECB also made a small upward revision to its 2017 projection for inflation, now at 1.3% (+0.1 pps) on account of the upward revision in projected oil prices this year. However, the monetary institution expects inflationary pressures to pick up very gradually in the medium term, posting figures it believes will not be close enough to its target for 2018 and 2019. The ECB has also warned of the high risks around its projections, both external and also related to the euro area’s political situation, such as the start of negotiations for the UK to leave the EU and important elections taking place in Germany, France and possibly also Italy. All this means that very accommodative monetary policy is still the most appropriate stance.

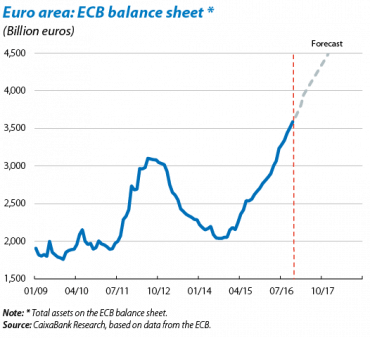

The ECB prolongs its asset purchase programme to December 2017 to ensure a very substantial degree of monetary accommodation in the medium term. Although the volume of asset purchases will fall to €60 billion a month as from April (currently €80 billion), the ECB stressed that it still believes it is necessary to keep financial conditions very favourable in order to support the recovery in the euro area’s economic activity, crucial for bringing inflation closer to the ECB’s target. One example of the extent of the measures being taken by the ECB is the fact that its balance sheet is expected to reach €4.5 trillion by the end of 2017, double the figure when QE began in March 2015. Mario Draghi also stated that inflation will not achieve the ECB’s target in the next three years, suggesting the ECB will continue to take a very accommodative monetary stance beyond December 2017. He also noted that there are still important downside risks and, if necessary, the volume of purchases may be increased further. In line with these messages, both the scenario for the CaixaBank Research forecasts and that of the consensus of analysts believe the ECB will not raise its benchmark interest rate until mid-2019.

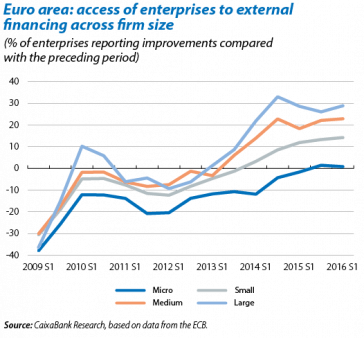

Given this situation of low interest rates, demand for credit is gradually picking up. The ECB’s monetary policy has helped to push interest rates down to an all-time low, with the aim of boosting credit and economic activity. According to the survey carried out by the ECB, SMEs have been enjoying considerably better financing conditions in the last few quarters. Companies confirmed both an increase in the availability of bank loans and in the willingness of banks to provide credit at lower interest rates. This survey also shows that, on the back of improved financing conditions, companies no longer see access to credit as one of their main concerns. Now they can focus their efforts on tackling other challenges more closely related to their business, such as finding customers or cutting production costs.

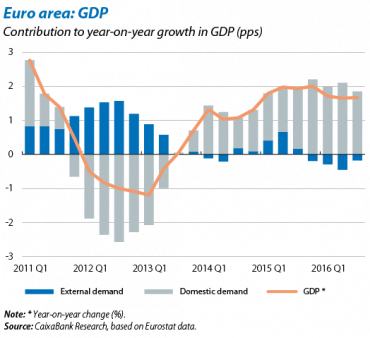

Domestic demand is still driving the euro area’s recovery. As in previous quarters, domestic demand made a significant contribution to euro area GDP growth in 2016 Q3 (+0.4 pps). This was underpinned by private consumption, up by +0.3% quarter-on-quarter, and by a strong increase in public consumption of +0.5%. However, gross fixed capital formation remained weak (+0.2%). External demand deducted from growth (–0.1 pps) owing to weak exports and a moderate increase in imports. With a view to the coming quarters, we expect domestic demand to continue as the mainstay for growth.

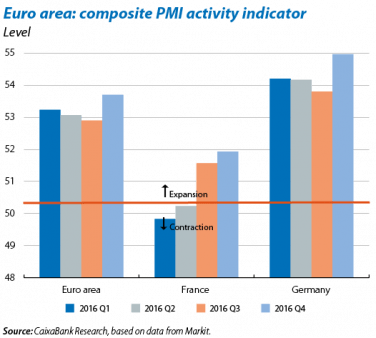

Most activity indicators point to growth accelerating in Q4. The euro area industrial production index rose by 1.5% year-on-year in October (three month average), a notably larger increase than in the first half of the year. Both the composite PMI and economic sentiment index for the euro area reached annual peaks in Q4 and are clearly in an expansionary zone. By country, Germany continues to lead this acceleration, its composite PMI reaching 55.0 points and its economic sentiment 108.0 points (average for October and November). France also posted good figures, pointing to slightly greater economic growth in Q4 (0.4% GDP growth quarter-on-quarter, higher than the 0.2% posted in Q3). Italy was the only country to post a decline in its economic sentiment in November, resulting from the uncertain political climate caused by the referendum on constitutional reform and by the weak situation of some of its banks. However, progress was made on both fronts in December: the new Prime Minister took over quickly and without tensions and the new Italian government reached an agreement with the European Commission to use public funds to bail out the weakest banks. However, the new government led by P. Gentiloni is provisional until elections can be held, probably at the end of 2017, and it will take some time to sort out Italy’s banking sector. All this means that Italy is perceived as one of the main sources of risk in 2017.

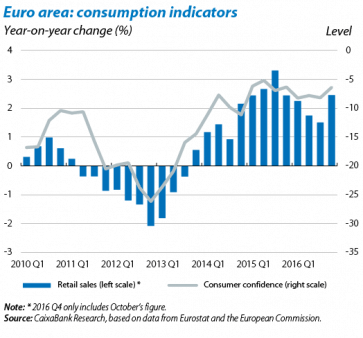

Consumption indicators point to resilient domestic demand. Retail sales rose by 2.5% year-on-year in October, higher than the figure posted in 2016 Q3 (1.5%). This growth continues to place private consumption as one of the mainstays for the euro area’s economic recovery. The consumer confidence index for the euro area as a whole rose considerably in December, reaching –5.1 points, its highest level in the past 20 months. Next year we expect household consumption to continue growing, underpinned by the improving labour market and low interest rates, thereby helping to push up inflation.

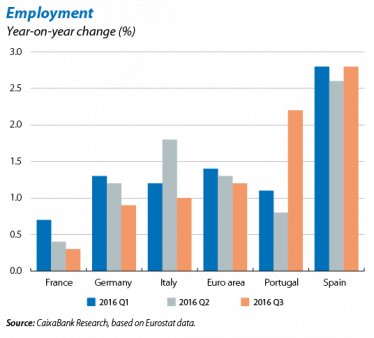

The improvement in the labour market consolidates, boosting household consumption. Euro area employment increased by 0.2% quarter-on-quarter in 2016 Q3 (0.4% in Q2), reaching the same total number of employees as before the economic recession (153.4 million). By country, of note is the employment growth observed in Portugal (1.3%), Spain (0.8%) and Ireland (0.6%), contrasting with smaller increases in Germany and France (+0.1% quarter-on-quarter) and the drop in Italy (–0.1%). Labour costs rose by 1.6% year-on-year in 2016 Q3, slightly more than the average for the first half of the year. This increase is broadly on account of the 2.4% annual rise in Germany’s wage costs, 0.4 pps more than the increase posted in the first half of the year.

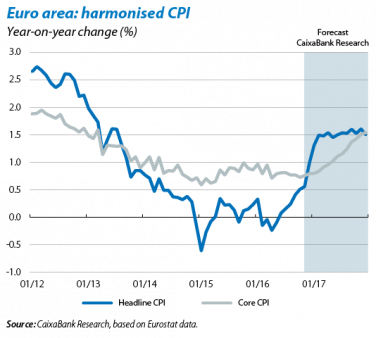

The upward trend in inflation is consolidating. In November, the harmonised index of consumer prices (HICP) increased by 0.6% year-on-year, 0.1 pp more than the growth posted in October. Along the same lines, core inflation stood at 0.8% compared with 0.7% in October. We expect this gradual increase to continue over the coming months on the back of growth in activity and labour market recovery, with both headline and core inflation reaching 1.5% by the end of 2017.

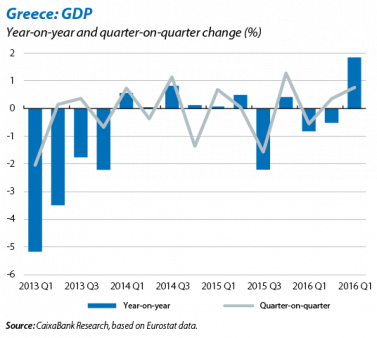

Greece continues to post positive growth figures but there is still a lot of work to be done. The Greek economy reported a notable Q3 growth rate, namely 0.8% quarter-on-quarter. However, the trend in economic activity has been highly erratic over the last few years and the economic recovery still looks very fragile. One of the issues that continue to jeopardise the sustainability of this recovery is the country’s high public debt. The Eurogroup was willing to grant some debt relief measures but Tsipras’s government has made several pledges to increase public spending not agreed with the Eurogroup, which has created tension between both sides. The Greek soap opera is far from over.