The European Union: the keys to a rebirth

Things are not exactly going well for the construction of Europe at present. In fact, on the 60th anniversary of the signing of the Treaty of Rome, Europe seems to be facing an increasing number of challenges. Over the past few years, the EU has had to tackle several economic shocks (the Great Recession of 2008-2009 and the sovereign debt crisis), political setbacks (the rise in populism and Brexit), migratory pressures (handling refugees and mass migrations around the Mediterranean), threats to its domestic security (terrorism) and geostrategic troubles (Russia’s resurgence, heightened Middle East tensions and the US’s isolationist shift). Such immediate challenges may be overwhelming but its long-term outlook is hardly encouraging either. In a deceptively distant future lies the prospect of demographic decline and an ageing society which will affect both economic performance and the welfare state, a core feature of the European social contract.

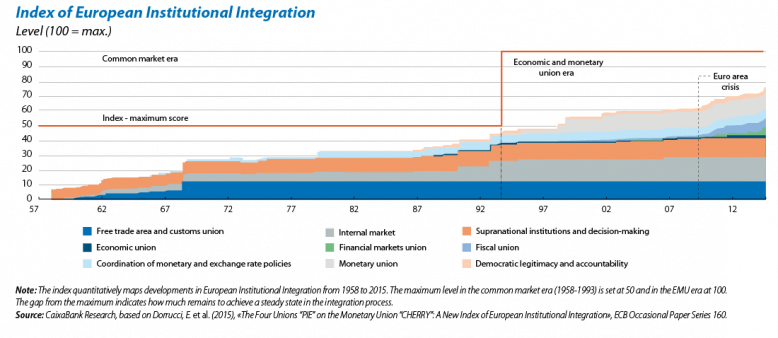

Such a situation brings to mind the words of Jean Monnet, who said that «Europe will be forged in crises, and will be the sum of the solutions adopted for those crises». Precisely the spirit endorsed by this month’s Dossier and by this first article in particular. Here our aim is to examine how a new EU might be forged that would be able to tackle its current and future challenges with some degree of success. The solutions and constitutive parts of this renewed EU may be found by analysing certain current critical areas (economic union, fiscal union, etc.). But before determining the ideal nature of this future Europe, and following Monnet’s lead, we should first examine those past solutions which have forged the EU we know today. There are several different ways to carry out such an analysis. However, one particularly useful approach is based on a somewhat stylised version of what are known as the «great visions» (sometimes also called the stories, narratives or philosophies) of European integration. According to our analytical framework, a vision consists of a set of basic premises of a conceptual nature which, in decision-making, help to tip the balance in one way or another. When, for instance, at the end of the 1980s, a decision had to be taken on how excessive public deficits should be controlled in a future Economic and Monetary Union (EMU), the final solution chosen was a combination of preferences, interests and technical reasons but also of pre-existing ideas regarding the ultimate aim of this EMU. In short, ideas are more than mere intellectual pretexts. So what are these «great visions» of European integration?

The two visions in play throughout Europe’s history

Perhaps the main vision underpinning the very nature of European integration is clearly Germanic in origin. Sometimes called the «German vision» of European integration since Germany was largely responsible for it, there can be no doubt regarding its vital role as a conceptual anchor. At different times, when critical decisions had to be taken regarding institutional design, such as extending the EU’s powers, etc., these have been directly inspired by this vision. Essentially, the German vision believes that European integration involves the creation of an order, or framework of reference, by defining a series of rules or norms.1 This general philosophy is based on three broad notions. Firstly, maximum concern for moral risk, applying what is sometimes called the principle of accountability. This means that whoever takes the risk in decision-making processes deserves any benefit resulting from their actions but they are also accountable for any negative consequences. A second key notion is that markets act as a counterweight to governments, for instance by pointing out the consequences of public decisions. In this respect, the supranational order must allow markets to carry out this signposting function without interference. Thirdly, governments must uphold the framework of stability and intervene when necessary to ensure accountability. Applying these three notions, and in line with the German vision, the «natural» political instrument to achieve integration is by creating supranational legislative frameworks, expressed politically through a federal model. In perhaps overly simplistic terms, the aim is to create a European federal order which is integrated (or is compatible) with the state federation, which is Germany.

Of course, decisions related to the construction of Europe are not based entirely on this vision. Although the term is perhaps somewhat imprecise, there is also an opposing stance to the German vision that is sometimes called the «French vision». We say this term may be imprecise because, while German ordoliberalism is a relatively homogeneous doctrine defended on numerous occasions by German politicians in key decisions on the construction of Europe, the French vision is not so clearly articulated. Rather it is a body of doctrine implicitly inferred by the positions very often upheld by France but also, on other occasions, by Mediterranean countries in the EU and even others aligned against the German stance. To characterise this diverse set of proposals, it is useful to compare «French-style» and «German-style» integration. So regarding the issue of how integration should be achieved, the former advocates a series of supranational institutions to which a set of previously exclusively national powers is transferred. The approach taken by the latter, remember, is integration via rules. As in the case of the German vision, the political design par excellence of the French vision is also federalist but with a different logic. The French vision tends to prefer a transfer of powers to a supranational level. But not the German vision. In this approach powers should only be transferred when necessary to create a supranational political framework. A second feature of many of the proposals inspired by the French vision (we insist: not always or only endorsed by France) is that it is not so important to strike a fine balance between public and private counterweights. On the other hand, the French vision is much more in favour of direct intervention by institutions, frequently via sector-based policies such as the common agricultural policy or industrial policy.

For a greater insight into how these very general principles have influenced the «solutions» (in Monnet’s sense of the word) adopted by the EU over time and indeed have defined it, we can examine a specific series of decisions related to the initial creation of EMU. Looking at the defining features of the original EMU, namely that established in the Maastricht Treaty of 1993, almost all its design clearly bears the mark of the German vision. It sets up a mechanism to control deficits based on rules, on the non-monetarisation of government debt, on no bailouts (the aforementioned principle of accountability), on market signposting, on relaxed coordination (i.e. based on peer pressure and on the aforementioned market signposting) and on the establishment of criteria (rules again) for nominal convergence. In other words, all EMU governance mechanisms are based on the German approach: the creation of a public finance stability framework without the need for strong institutionalisation. What was the alternative? France’s proposal at the time, repeated almost every time EMU governance has been reviewed, was to create a system of quasi European economic governance with clearly attributed budgetary control powers and the capacity to intervene in the case of a public finance crisis. As we have said, the German vision prevailed.

However, that same Treaty also created the ECB, one of the EU’s most powerful supranational institutions. This seems to be an institutional «solution» clearly in line with the spirit of the French vision. Nevertheless, the decision to create the ECB highlights the fact that the ideas embodied by these visions operate within certain limits. In this case, a kind of technical consensus predominates that a single currency has a greater chance of success if it is supported by a single central bank. Cohen (1993) found that, in seven international monetary unions prior to EMU, whenever a single currency is created a central bank is also set up, while a system that coordinates the members’ national central banks is only chosen when the aim is to maintain national currencies linked by a fixed but differentiated exchange rate.2

Ideas have therefore been very important in the past and are likely to influence the necessary reinvention of the EU in the future. This renewed EU will probably arise from a combination of challenges and ideas, taking the form of a series of proposals largely inspired by the German and French visions in the two critical areas on which the EU stakes a large part of its future: economic integration and the coordination of economic policies. But do not be fooled. Although the adjective «economic» is used for these two areas, both, and especially the second, have a fundamental political aspect, as we will see later on.

Economic integration and convergence

In the first of these areas, economic integration needs to be reinforced with policies that allow the movement of people, capital, goods and services. The euro area is still less synchronised than other monetary unions, such as the US dollar, as shown by the article «Economic synchronisation in a common economic and monetary area» in this Dossier. This factor is related to the EU’s lower degree of economic integration than the US. One key policy required to achieve a truly domestic market is the development of a («German-style») common legislative and regulatory framework. The EU has traditionally focused on regulatory harmonisation and this has certainly been productive in some sectors, such as telecommunications. But, in general, such approaches will have to be more innovative in the next few stages of economic integration. The EU’s progress towards banking union could be an indicator of how economic integration might move forward.

As noted by Arqué, Fernández and Plata (2017), banking union was actually undertaken as a result of the explicit need to remove the harmful link between sovereign risk and bank risk during the last sovereign debt crisis. This union has nevertheless become a vital cornerstone to completing the euro area’s design, in the sense used by Gual (2012) of advancing towards the efficient provision of capital at a pan-European level.3 In this construction, the instrument of harmonising bank sector regulation has been combined with the creation of other elements that reinforce, in practice, the degree of institutionalisation. Harmonisation involved the creation of a single legislative code for all financial institutions containing the necessary capital requirements and rules for handling banks in difficulty. In terms of institutionalisation, an already-existing institution, the ECB, was strengthened by turning it into a single supervisor for all euro area banks as from 2014 and by starting up the Single Resolution Mechanism (SRM), in operation since 2016. One important aspect that is, at present, still absent is a European Deposit Guarantee Fund. This is therefore an example of integration via rules plus reinforced institutionalisation, a solution that takes elements from both of the aforementioned visions, German and French.

But this is unlikely to be enough to overcome the obstacles to achieving a sufficient degree of economic integration and convergence. In addition to banking union, the financial area is also undergoing a union of capital markets. Although progress has been made, there is a possible problem. Considering the drive to carry out such convergence was at its height when the euro area’s financial crisis was in full swing, might there be less incentive to achieve this at less financially stressful times? Essentially, this highlights one of the biggest difficulties in achieving deeper integration; namely the lack of an underlying political factor. In 2012, Gual put his finger on it: «successful deep economic integration (...) requires profound economic reforms. Indeed, they are so significant and touch upon so many aspects of the social and economic fabric that it is unrealistic to expect that they can be imposed from Brussels with the current institutional arrangements and without resorting to a radically higher degree of political union».

Coordination of economic policies

The demand for greater political integration is even more evident in the coordination of economic policies. Improving the coordination of economic policies to tackle asymmetric shocks across countries may seem to be a strictly technical issue. This is far from the truth, however, since the obstacles to achieving this are clearly political in nature.

As noted in the article «Fiscal union and the long road towards Eurobonds» in this Dossier, there must be better coordination of economic and fiscal policy across different euro area countries. So how can this coordination be improved? Surely by combining elements from the German and French visions. The ultimate need for stabilising powers that can tackle asymmetric shocks in the future is unlikely to be possible without a high degree of institutionalisation, more in line with the French approach of creating supranational instruments. But clear boundaries are also required, with strict conditions that offset any relaxation of the principle of accountability. For instance, a stabilisation system could be designed with no permanent assignment of powers but temporary transfers, limited to the moment of the asymmetric shock and with strong restrictions on unsustainable fiscal policies (such as debt ceilings in constitutions). This would reduce the moral risk (traditionally a German concern) of non-prudent fiscal policies being implemented.

Towards a combined vision: ideas, instruments and policy

In short, our review of the EU’s history and analysis of its future suggest that Europe is entering a new phase; one that is much more demanding but also much more promising than the last decade. Almost all the examples we have given reveal a combination of ideas based on both the German and French visions. In our opinion, a new combined vision is being created, capable of responding to problems that cannot be resolved using just one of these approaches. In our review of the challenges still pending and the obstacles to be overcome, we have also seen that, one way or another, the response contains elements that entail greater political integration, albeit embryonic. In such a situation, the most typical resource is what is known as «flexible integration». Whereas, in the past, the aim was to achieve an «ever closer union», as proposed by the Maastricht Treaty, at present achieving unanimous agreement in many of the aforementioned areas is not only extremely difficult but also bordering on the impossible. But the impossibility of achieving a common single goal must not impede ambitious reforms within the EU. One way of overcoming this impasse is integration at different speeds and levels.4 Many proposals to develop the EU are indeed possible provided members can opt in or out and deeper integration is achieved at several different levels. And, perhaps, as these new areas of integration prove their worth, other member states might also choose to join in.

Josep Mestres and Àlex Ruiz

Macroeconomics Unit, Strategic Planning and Research Department, CaixaBank

1. This vision is sometimes dubbed ordoliberalism. Ordoliberalism is the economic doctrine underlying the domestic economic policy of the Federal Republic of Germany when it was set up after the Second World War. The German vision of European integration would therefore be a version adapted to the supranational order entailed by the EU.

2. See Cohen, B. (1993), «Beyond EMU: The Problem of Sustainability», Economics and Politics, no. 5.2: 187-203.

3. On this issue in detail, see Arqué, G., Fernández, E. and Plata, C. (2017), «¿Un sistema europeo de garantía de depósitos?», Anuario del Euro 2016, Fundación ICO and Fundación de Estudios Financieros, and also Gual, J. (2012), «European Integration at the Crossroads», ”la Caixa” Economic Papers, no. 8.

4. See, for instance, Morillas, P. (2017), «Formes per a una unió: del “ever closer union” a una diferenciació flexible després del Brèxit», Notes Internacionals, CIDOB 166.