Global growth shifts down a gear

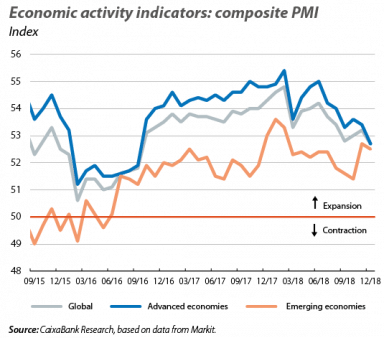

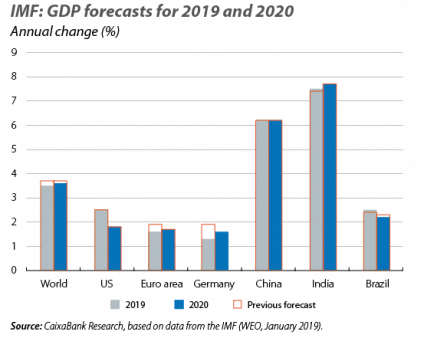

The global expansion continues at a more moderate pace. This is what the latest global economic activity indicators suggest, such as the global composite Purchasing Managers’ Index (PMI), which remains in expansionary territory (above 50 points) but fell to 52.7 points in December, the lowest level since September 2016. Likewise, the IIF Growth Tracker index, which seeks to estimate emerging markets growth, fell for the fifth consecutive month in December, although it still points to solid growth rates. This moderation in the pace of global economic activity seen in recent months is the result of a combination of factors. Specifically, idiosyncratic factors in advanced economies (particularly in Europe) have added to the tightening of global financial conditions, the deterioration in confidence due to trade tensions and uncertainty over the true extent of the slowdown of the Chinese economy. Given that these factors are expected to persist over the coming quarters, this supports a more moderate growth scenario for 2019 (3.4%, according to CaixaBank Research). Similarly, the IMF shares a similar view. In its economic forecast update in January, it revised its global economic growth forecasts for 2019 slightly downwards, to 3.5% (–0.2 pps), and to 3.6% for 2020 (–0.1 pp). The IMF also pointed out that the escalating trade tensions continue to be a source of risk, although the 90-day truce in the introduction of new tariffs between the US and China and the reasonably positive tone in the subsequent negotiations have allayed concerns about a trade war.

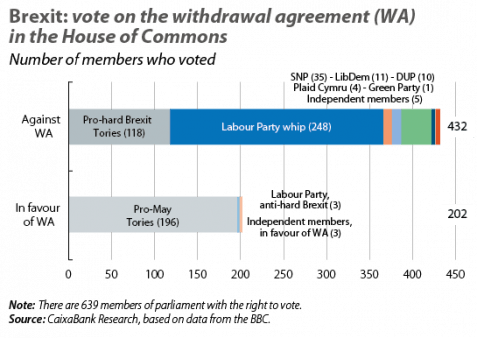

Uncertainty around Brexit persists. In the UK, the House of Commons overwhelmingly rejected the Withdrawal Agreement drawn up between the Government and the EU by a (see the third chart). Following the vote, Prime Minister Theresa May, of the Conservative Party, has to devise an alternative plan that can gather sufficient parliamentary support. In order to win the support of the Eurosceptic wing of her party and of the Irish DUP, the Prime Minister has opted to try to negotiate new concessions with Brussels on the backstop clause on Ireland. In this context, the existing difficulties to achieve a majority in Parliament increase the likelihood of the United Kingdom ending up asking for an extension to the negotiations beyond the date of Brexit (29 March). They also open up the possibility to a large number of alternatives, ranging from the ratification of an amended Withdrawal Agreement to a softer Brexit (for instance, with a permanent customs union) or even a second referendum. On the other hand, the events of the past few weeks (such as the approval in the House of Commons of several amendments) suggest that there is a clear majority in the British Parliament in favour of avoiding a no-deal Brexit.

EURO AREA

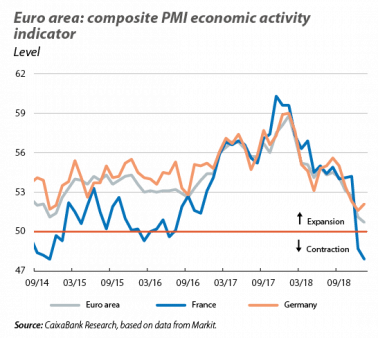

Slowdown in the growth of euro area economic activity. Specifically, the GDP of the euro area registered a 0.2% quarter-on-quarter growth (1.2% year-on-year) in the last quarter of the year, in line with CaixaBank Research’s forecasts and that adds to the gradual growth slowdown of recent quarters. For 2018, the economy expanded by 1.8%, a steady pace but far from the exceptional growth registered in 2017 (2.5%). In part, this reflects a less favourable external environment, the presence of temporary impediments that are proving more persistent than expected (such as the automotive sector’s slow adjustment to the new European emissions regulations) and the entry into a more mature phase of the business cycle (it is estimated that the euro area closed its output gap in 2018). However, domestic demand remains strong, supported by accommodative financial conditions and the good performance of the labour market. Therefore, over the coming quarters, the euro area economy is expected to continue to grow, albeit at a moderate pace that is more in line with its potential. Across countries, for which we have data on, Spain registered particularly strong growth of 0.7% quarter-on-quarter, as did France, with a quarter-on-quarter growth of 0.3% (a lower figure was expected due to the impact of the yellow vest protests). On the other hand, Italy’s GDP fell by 0.2% quarter-on-quarter, meaning that the country technically fell into recession (two consecutive quarters with negative quarter-on-quarter growth). Germany’s growth figure for the whole of 2018 was also released (1.5%), which implies that Q4 2018 growth laid between 0% and 0.3% quarter-on-quarter.

The latest economic activity indicators suggest that growth remains modest in Q1 2019. Specifically, the composite PMI index for the whole of the euro area, which measures business sentiment, fell for the fifth consecutive month in January down to 50.7 points, its lowest since July 2013 (but still above the 50-point threshold that marks the expansionary territory). By countries, the index deteriorated most notably in France, reaching 47.9 points (48.7 in December), which indicates a contraction of economic activity (having been affected by the yellow vest protests). On the other hand, Germany’s PMI rebounded slightly, going from 51.6 points in December to 52.1 points in January. The Economic Sentiment Index (ESI), meanwhile, stood at 106.2 points in January, below the Q4 2018 average for (108.8 points). Finally, consumer confidence, despite having weakened slightly over recent months, remains above its historical average. In this context, we expect private consumption to continue to grow at a good pace and support euro area growth.

US

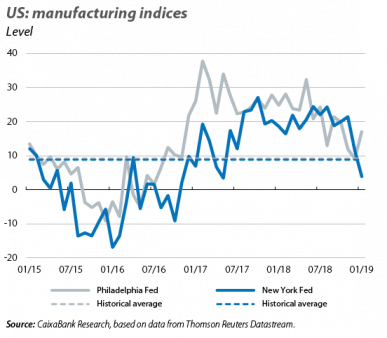

Economic activity remains strong, but some indicators point towards a normalisation of growth. On the one hand, the field survey that is regularly produced by the Fed (known as the Beige Book) continues to indicate a significant rate of economic expansion. On the other hand, a number of indicators point towards a moderation of growth over the coming months and quarters. These include the consumer sentiment index developed by the University of Michigan, which decreased to 90.7 points in January – its lowest level since 2016 –, and the manufacturing indicator prepared by the Federal Reserve Bank of New York, which in January dropped to levels of 2017 (the coincident economic activity index) and 2016 (in the case of the expectations index). As we have already been anticipating for some months, this partly reflects the fading of the fiscal stimulus as well as the maturity of the business cycle (which is why growth can be expected to approach its potential rate, slightly below 2%). However, uncertainty surrounding trade tensions and the partial US government shutdown that lasted almost the entire month of January (the longest in history) could have begun to weigh down economic sentiment.

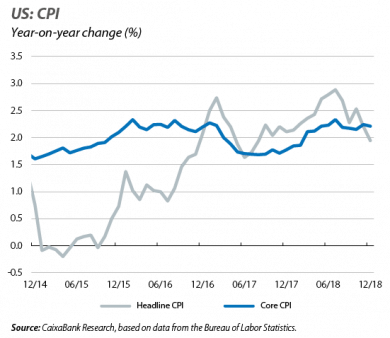

Inflationary pressures remain in line with the Fed’s medium-term target. In particular, US headline inflation moderated in December down to 1.9% (2.2% in November), largely driven by the fall in energy prices. Meanwhile, core inflation, which excludes the most volatile components such as energy and food prices, remained at 2.2%, supported by the positive tone of economic activity. Over the coming months, the energy components will probably weigh down headline inflation due to the base effect of the sharp decline in the oil price in the last quarter of 2018. However, this effect will be temporary and the dynamics of core inflation will continue to be supported by the strength of the labour market.

CHINA

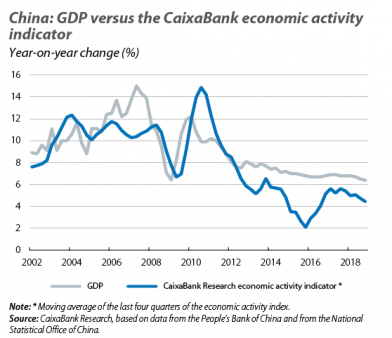

China ends 2018 confirming its economy has cooled. Specifically, GDP growth stood at 6.4% year-on-year in Q4 2018, which places the figure for the whole year at 6.6%. This is in line with the Government’s target, as well as our projections. Although the official data continue to show a gradual slowdown in the economy, as the tertiary sector takes on a more prominent role, other indicators suggest that the growth slowdown could be more pronounced than the official data suggest. These include alternative economic activity indices (including CaixaBank Research’s, as shown in the penultimate chart) and others, such as exports (which fell by 4.4% year-on-year in December) and the Purchasing Managers’ Index (PMI, which stood at 49.4 points in December, its lowest in almost three years). This suggests that the economy may have been affected by the trade tensions with the US and the tariffs imposed by the US Government on Chinese imports (which have begun to have a significantly impact on China’s export sector). For 2019, we expect the slowdown to continue, albeit gradually thanks to the implementation of new stimulus measures by the Chinese Government, such as greater public investment in infrastructure.