Growth prospects improve

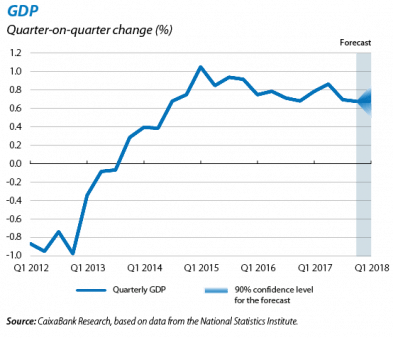

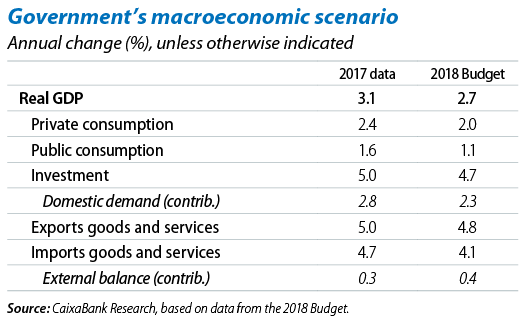

Spain’s economy continues to look very dynamic at the beginning of 2018. The CaixaBank Research GDP forecast model predicts 0.7% quarter-on-quarter growth in Q1 2018, a similar rate to the second half of 2017. Over the next few quarters, our scenario expects strong GDP growth supported by economic activity remaining solid globally, and especially in the euro area, helped by accommodative financial conditions thanks to the ECB’s expansionary monetary policy stance. In fact, in its update of the macroeconomic outlook, the Spanish government has raised its GDP growth forecast to 2.7%, an increase of 0.4 pp on the previous forecast carried out by the government in October 2017. The government forecast is therefore in line with those of the consensus of analysts and CaixaBank Research (2.8%), also raised recently. Standard & Poor’s has also improved Spain’s sovereign credit rating (from BBB+ to A–). Anticipating this revision, throughout March the Spanish risk premium fell from 90 bp at the beginning of the month to 70 bp. We expect it to remain at this level throughout 2018.

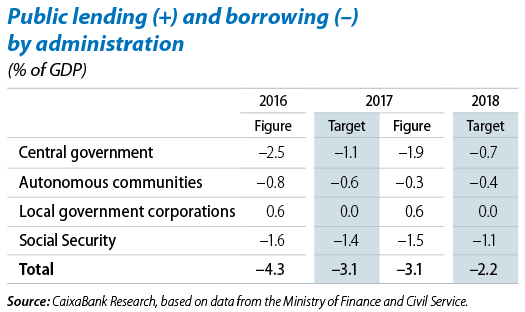

A favourable economic context helps Spain meet its public deficit target in 2017. This stood at 3.1% of GDP, in line with the stability target agreed with the European Commission. Compared with 2016’s figure (4.3% of GDP), the deficit has fallen considerably (–1.2 pp) thanks to strong growth in economic activity and a neutral fiscal policy. This correction in the public deficit is largely explained by lower spending as a percentage of GDP, specifically by 1.0 pp. Interest payments have also decreased notably, as well as payments for unemployment benefit. The deficit also fell thanks to an increase in income as a percentage of GDP (+0.2 pp), very strong due to the substantial rise in tax revenue (5.2%) and Social Security contributions (4.9%). By public administration, central government and Social Security did not meet their targets but this was offset by the autonomous communities and local government corporations, which readily met theirs, allowing the overall government target to be achieved. Nevertheless, and in spite of the significant adjustments made over the past few years, Spain is the only country in the euro area that has not yet exited its excessive deficit procedure (EDP). The good economic outlook in 2018 will help the public deficit to fall, finally, below the 3% threshold set by the EDP. In fact, with the presentation of the State Budget for 2018, the public deficit target (2.2% of GDP) seems achievable. The Budget contains several fiscal measures such as reduced income tax for the low wage-earners, a rise in minimum and widow’s pensions and wage increases for civil servants, among others.

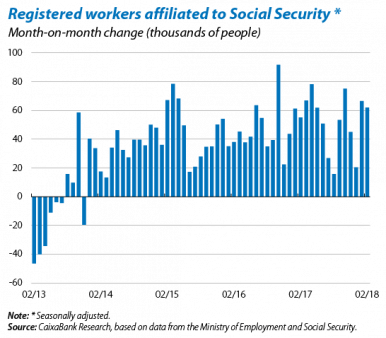

Very positive trend in the labour market. In February, the number of registered workers affiliated to Social Security rose by 81,483, a larger increase than the same month in 2017 (74,080 people). This has increased the year-on-year rate of change by 0.1 pp to 3.5%. However, it is useful to look at the seasonally adjusted series to assess just how positive these figures are. In February, the increase was 62,006 people, similar to January’s figure of 66,578, so both were far higher than the average of 59,919 monthly additions in 2017. We can therefore conclude that job creation has been very dynamic in the first few months of 2018. This good trend in the labour market is expected to continue over the coming months (see the Focus «Registered workers affiliated to Social Security: situation and outlook across sectors» in this Monthly Report).

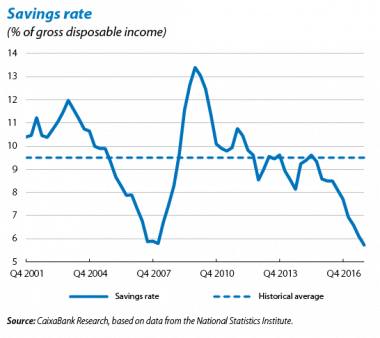

The dynamic labour market boosts private consumption. Specifically, retail and consumer goods rose by 1.9% year-on-year in February (2.2% in January), far more than the average 0.9% year-on-year increase in 2017. This figure, together with high consumer confidence in spite of a slight dip in March, indicates that private consumption was very strong in Q1 2018. Household savings should therefore remain at a historically low level, as was the case in 2017. Last year households saved just 5.7% of their gross disposable income (7.7% in 2016) as the growth in nominal consumption was notably higher than the growth in gross disposable income (4.2% and 2.0%, respectively).

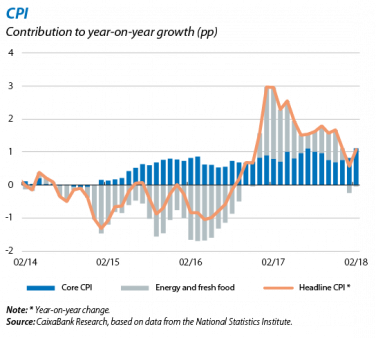

Core inflation wakes up and rises to 1.1% in February (0.8% in January) due to an increase in services, specifically package holidays and telephony services. Headline inflation, for which the National Statistics Institute has already published March’s figure, stood at 1.2% (1.1% in February). A large part of this slight price rise is probably due to the calendar effect of Easter, this year falling almost entirely in March while it was April last year. Because of this same effect, we expect inflation to moderate in April and then rise again slightly as from May, driven by oil prices and a gradual recovery in core inflation.

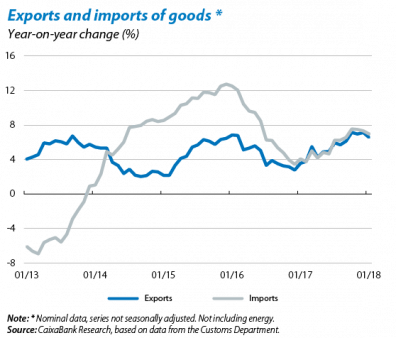

The foreign sector performs very well in spite of higher oil prices. The current account ended 2017 with a surplus of 1.9% of GDP, the same figure as the previous year. The balance of goods worsened, largely because of higher oil prices (the energy deficit went from –1.8% of GDP in 2016 to –2.3% in 2017) but also due to the increase in non-energy imports and despite exports doing well. The services balance improved on 2016 and reached 5% of GDP while the income balance also improved slightly. With a view to 2018, we expect the rise in oil prices to continue reducing the current account, as shown by January’s figures. The balance of trade for goods posted a deficit of 2.2% of GDP (cumulative over 12 months), higher than the 1.6% posted in January 2017. This deterioration was largely due to the rise in energy imports. The non-energy balance, however, which is more indicative of the underlying trend in goods trade, looks more stable. Exports grew by 6.6% year-on-year (cumulative over 12 months), offsetting the solid performance of imports (+7.0%, also cumulative over 12 months).

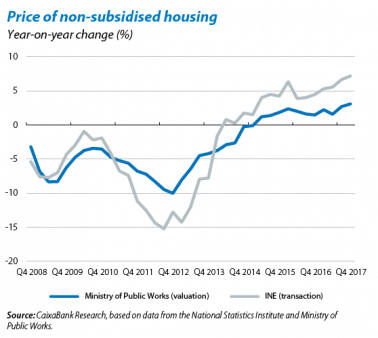

The real estate market continues to post good results. House sales rose in January by 15.1% year-on-year (cumulative over 12 months), reaching a total of 473,255 units sold. This boost in sales has affected the sale price for housing, up by 7.2% in year-on-year terms in Q4 2017 (0.9% in quarter-on-quarter terms), bringing average growth in 2017 to a considerable 6.2%. Over the coming quarters, the strong demand for housing, together with a timid recovery in supply and favourable credit conditions to buy housing, suggest that prices will continue to rise.

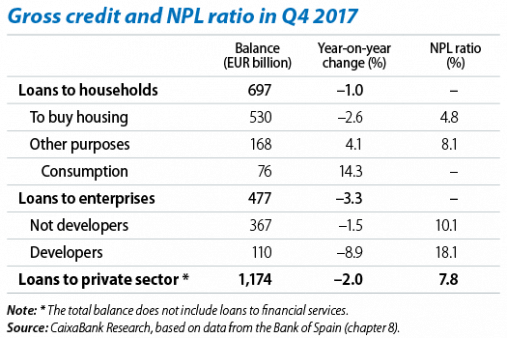

The credit trend is still favourable. New loans for consumption and to buy housing grew strongly in February: 17% and 16.5% year-on-year (cumulative for the year), respectively. Credit to enterprises also seems to have recovered substantially 2018, both in loans to SMEs (17.4% year-on-year, YTD) and large firms (12.7%). Although new loan transactions appear dynamic, the credit balance is still shrinking (–2.0% year-on-year in Q4 2017), with the notable exception of consumer credit, up by 14.3% year-on-year in Q4. The NPL ratio is also continuing to fall, especially in terms of developer credit (–7.4 pp in the last year) thanks to the sale of non-performing portfolios. Nevertheless this rate is still

at a high 18.1% and is far above the NPL rates for the rest of the segments.