How financial conditions are withstanding tighter monetary policy: part I

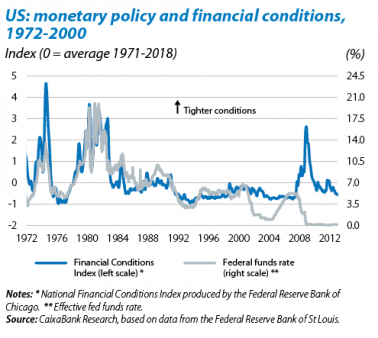

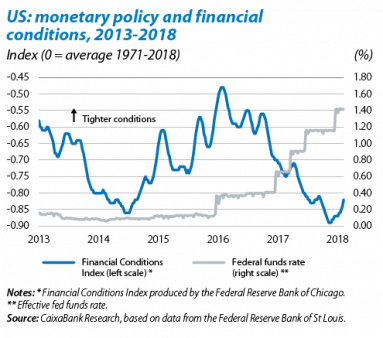

In December 2015, the Fed began to gradually tighten its monetary policy stance. Since then it has raised the fed funds rate five times (with another probable hike in March), as well as starting to reduce its balance sheet. In the past, tighter monetary policy has been passed through to economic activity via its effect on the universe of financial assets and consequently tighter financial conditions (see the first chart). In the current cycle, however, financial conditions are still highly accommodative (see the second chart).

For economists, «financial conditions» are the current state of those financial variables that influence, today, how companies, consumers, savers and investors behave, and thus affect the future state of economic activity.1 Financial Conditions Indexes (FCI) summarise the behaviour of financial asset prices and act as a «thermometer» for the financial markets. In other words, they provide information on the future state of the economy indicated by today’s financial variables. FCIs usually include variables affecting the cost of capital and investment decisions, such as interest rates (sovereign and corporate) and credit risk measures. Also important are variables affecting household wealth and, consequently, decisions to consume and save such as equity and real estate prices and consumer credit interest rates. Lastly, because of credit frictions, it is also important to monitor uncertainty using variables that capture asset price volatility and others that provide information on the state of liquidity.

One of the benchmark financial «thermometers» in the US is the financial conditions index produced by the Federal Reserve Bank of Chicago, the NFCI.2 We must look at its components in more detail to get an insight into why the NFCI, and the other alternative FCIs, indicates that financial conditions have remained highly accommodative in spite of the Fed tightening its monetary policy stance. The NFCI comprises 105 indicators for a wide range of financial conditions in money markets, debt and equity markets and the traditional and shadow banking systems. These 105 indicators are classified into three large groups: i) risk indicators, which capture volatility and funding risk such as the TED spread (difference between three-month interest rate on interbank loans and three-month US government debt) and the VIX volatility index; ii) credit indicators, which measure credit conditions for households and companies; and iii) leverage indicators, such as new corporate debt issuances.

After aggregating these 105 variables, the NFCI is negative when financial conditions are looser than average and positive when indicators reflect tighter than average conditions (always in relation to the historical average since 1971). In general, the index rises with risk indicators and falls with credit and leverage indicators. For example, an increase in the TED spread points to higher credit risk in the interbank market and therefore suggests tighter financial conditions. On the other hand, an increase in the number of households indicating easier access to consumer credit reflects looser financial conditions.

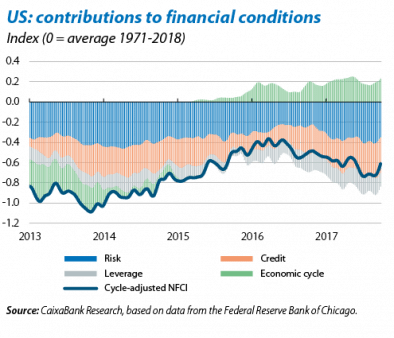

The state of the macroeconomy is also a key determinant for financial conditions. When economic activity is buoyant, good economic growth prospects reduce risk, improve credit quality, make it easier to issue corporate debt, etc. That is why the Chicago Fed also publishes a financial conditions index adjusted for the state of the economy. This is the ANFCI,3 which measures financial conditions as if the economy were always at the same point in the business cycle. As can be seen in the third chart, which separates financial components (risk, credit and leverage) from the contribution made by the economic cycle, in the past few years solid economic activity is helping accommodative financial conditions to continue: Without discounting the macroeconomy’s contribution, the ANFCI would be slightly below –0.80, a much more accommodative value than the actual figure of –0.61.

Apart from the tailwinds provided by the economy’s good performance, both the NFCI and ANFCI suggest that financial conditions are still very loose in spite of the Fed’s tighter monetary policy. Moreover, as the third chart shows, the risk, credit and leverage indicators all contribute to these loose conditions. To understand this situation better, we have looked at which of the 105 variables became more or less accommodative between July 2016 and December 2017, when financial conditions became even looser. Although 50 of the 105 variables became less accommodative, the change was very limited. As can be seen in the fourth chart, this tightening only led to a 0.06-point increase in the index. And around 50% of this rise is concentrated solely in three variables (short-term interest rate spreads in money markets) which, in any case, remain looser than their historical average. However, the aggregate index (adjusted for the economic cycle) fell by –0.36 points, particularly because of more compressed interest rate spreads (mortgage, CDS, corporate debt, etc.) and lower volatility in stock (VIX index) and bond (MOVE index) markets.

Lastly, a similar exercise can be carried out to analyse the impact of stock market corrections at the end of January and early February this year. The indicators suggest that, during these weeks, financial conditions deteriorated slightly with a 0.08-point rise in the ANFCI (excluding the cyclical component of the economy). This can almost entirely be explained by two indicators: more volatile stock markets and worse liquidity conditions in the market for options on futures for the US stock market index S&P 500. Most of the financial variables therefore remained very loose. This suggests such stock market corrections were a contained episode and did not spill over into other markets or cause a risk-off movement which would considerably tighten up financial conditions overall.

In conclusion, the economy’s current cyclical expansion is contributing to highly accommodative financial conditions. The gradual and predictable way in which the US Fed has tightened up its monetary policy may have also played its part, as well as the substantial monetary stimuli still in place in other locations such as Europe and Japan. This has encouraged an environment of low volatility and narrow credit spreads.4 The Fed’s tighter monetary policy stance has now started to be felt in short-term financial assets. Consequently, continued interest rate hikes, in addition to less monetary stimulus in Europe, should help financial conditions to normalise over the coming quarters.

1. See Hatzius, J. et al. (2010), «Financial Conditions Indexes: a Fresh Look after the Financial Crisis», NBER Working Paper.

2. National Financial Conditions Index.

3. Adjusted National Financial Conditions Index.

4. See «A paradoxical tightening?», BIS Quarterly Review, December 2017.