The impact of monetary policy on house prices

A new bullish cycle is taking hold of the real estate sector and the house price trend is a good example. This has been growing for two and a half years and cumulative growth has reached double digit figures in some areas. The sector’s recovery is solid, supported by a strong upswing in economic activity and a rise in demand driven by a dynamic labour market and improved financial conditions. The Focus examines this last point.

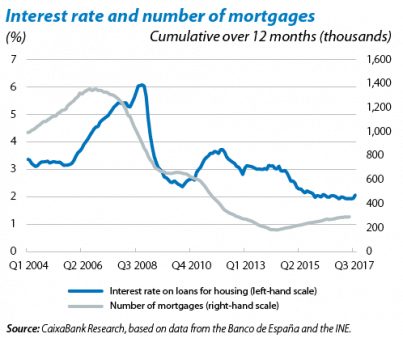

The importance of the ECB’s monetary policy in supporting those households most affected by the crisis can be illustrated by a simple example. A 1 pp reduction in mortgage interest rates offsets an 8% fall in a household’s gross income and keeps its affordability ratio unchanged.1 For instance, between 2012 and 2016 household income fell by 6.3% on average in cumulative terms while the ECB’s accommodative monetary policy helped to reduce mortgage interest rates by 1.3 pp.

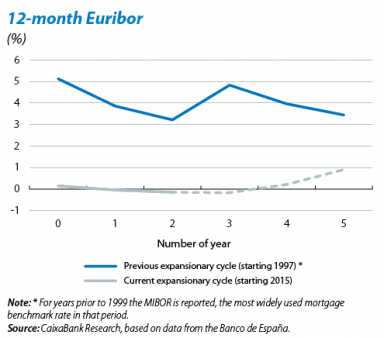

There is every indication that the interest rate environment will remain favourable. Although the ECB has started to alter its tone, interest rate hikes are not expected until mid-2019. Moreover, any such hikes are very likely to be gradual. We expect the average interest rate on the outstanding mortgage balance to remain below 2.5% over the next two years, well below the 5.0% average recorded in the previous cycle.2 Consequently, those households hardest hit by the economic crisis are very likely to continue benefitting from ultra-low interest rates.

However, this low interest rate environment is also pushing up house prices. It encourages investment in property by lowering returns on financial savings and also makes it easier to buy more expensive housing. An example illustrates this very well: a 1 pp reduction in mortgage rates means that a 10% more expensive property can be afforded.1 Shifting this example to the current interest rate environment we can see that, with a monthly mortgage payment of EUR 550 over 20 years, a 3.2% interest rate3 allows us to finance a house purchase valued at EUR 120,943, 18% higher than if interest rates were 5%, as in the previous cycle.

These examples for households with particular characteristics are illustrative. However, the overall impact of monetary policy on house prices has been shown to be considerable by academic articles attempting to isolate this effect more systematically. In developed countries in particular, a 1 pp drop in the real interest rate may push up house prices by as much as 1 pp.4

1. An interest rate drop of 3% to 2% is assumed for a 20-year mortgage.

2. Real interest rate differences are unlikely to be as wide because inflation is expected to remain lower than in the previous cycle.

3. Assuming a mortgage for 80% of the property’s value. The average monthly mortgage payment currently stands at EUR 549, the average maturity is 23.4 years and the interest rate for fixed-rate mortgages is 3.16% (Q3 2017).

4. See Kuttner, K. (2012), «Lower Interest Rates and Housing Bubbles: Still No Smoking Gun» and Jarociński, M. and Smets, F.R. (2008), «House Prices and the Stance of Monetary Policy», Federal Reserve Bank of St. Louis Review, 90.