Infrastructure: the common ground

The rivalry between F.C. Barcelona and Real Madrid is replicated in economics between demand-oriented and supply-oriented economists. In the current climate, the former support expansionary fiscal and monetary policy while the latter endorse structural reforms to make the economy more flexible and boost output. Can you imagine Real Madrid fans ever wearing an F.C. Barcelona shirt (or vice versa)? This is actually possible in economics with the common ground provided by infrastructure investment. Why does it enjoy such consensus? What is the status of infrastructure investment globally? Is it enough? What challenges are involved? The articles in this month’s Dossier examine such questions, from the US to the large emerging economies in Asia and Latin America, as well as Europe.

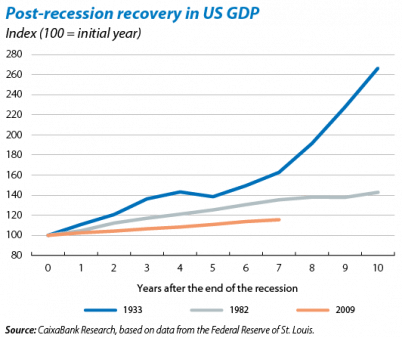

The unexpectedly weak global recovery has intensified debate in academic and economic policy circles.1 As can be seen in the first chart, US GDP would be markedly higher today if its economy had recovered from the Great Recession at the same rate as after previous recessions. This is particularly shocking for demand-oriented economists because of the aggressive monetary policies in place. According to Larry Summers, former Secretary of the US Treasury, such secular stagnation is due to structural changes that have weakened both household and corporate consumption and investment (increased inequality and hysteresis effects2 in the advanced economies, higher savings in emerging economies and an ageing population). In such a situation, Summers believes that sufficiently low interest rates cannot be achieved through monetary policy to offset the structural shortfalls in demand. The solution is therefore more expansionary fiscal policy, and one way of implementing this is by spending more on infrastructures.

Supply-oriented economists believe the weaker recovery is due to poorer growth potential than anticipated. Robert Gordon of Northwestern University suggests the digital revolution’s impact on growth has been much weaker than in other technological revolutions of the past.3 Boosting infrastructures would eliminate bottlenecks that are strangling supply and would increase production capacity beyond the effect of the digital revolution.

Finally, there is a third group of economists, including the renowned Kenneth Rogoff from Harvard, who take an intermediate stance and suggest the problem is one of a debt overhang. This is an important argument in the infrastructure debate as it emphasises the need to target high-return projects that do not compromise the sustainability of debt. The International Monetary Fund (IMF) estimates that, for the advanced economies as a whole, a 1 pp of GDP increase in public investment could raise output by 2.5% and reduce the public-debt-to-GDP ratio by almost 10% provided this investment is efficient, while there is no significant effect if it is not.4

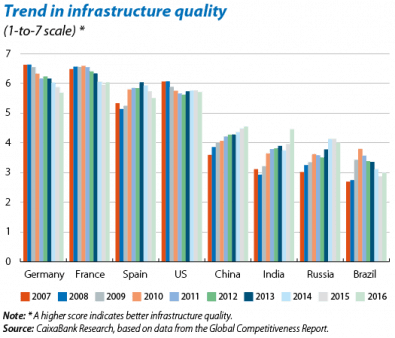

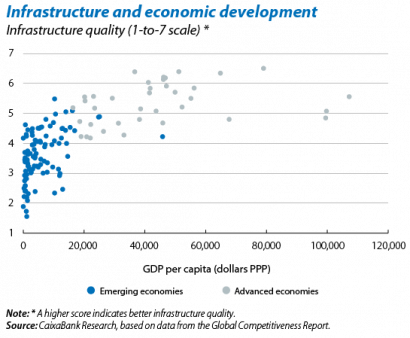

However, in spite of this common ground between economists and a potentially positive macroeconomic impact, the quality of infrastructures in the advanced economies has deteriorated over the past few years (see the second chart). For instance, as explained in the article «The US: to invest or not to invest, that is the question» in this Dossier, there has been a sharp decline in the quality of US roads, with growing congestion problems. Moreover, a considerable gap has been observed, both in the US and in Europe, between the investment planned and that required to keep infrastructures competitive. In response, Donald Trump proposes a one billion dollar investment programme over ten years but the what and the how are far from certain. The European Commission has implemented the Juncker Plan (see the article «Infrastructure in the European Union and the Juncker Plan» in this Dossier), with the added incentive of strengthening European integration. In the emerging economies, in contrast, infrastructure quality has steadily improved (with the notable exception of Brazil). Economic convergence is partly responsible: as shown by the third chart, development is related to higher infrastructure quality and this relationship is particularly strong in low-income economies. However, as explained in the article «Infrastructures and emerging economies: a cocktail for each development stage» in this Dossier, it remains to be seen whether the emerging economies are using the most efficient forms of investment to take advantage of the latest technological revolution, namely telecom and digital infrastructures.

Given this situation, and the investment proposed by the advanced and emerging economies, we are left with one key question: how can we identify and finance those infrastructures with the greatest impact on output? Infrastructures usually entail high initial costs and profits are spread over a long period. They also tend to generate externalities and have features that characterise them as public goods (no competition and no exclusion). As a consequence, the optimum level of infrastructure investment cannot be achieved by private initiative alone. The public sector has therefore tended to be responsible for infrastructure construction and even management. But the public sector has not always invested in the most productive projects either. Moreover, with the arrival of what could be termed the Fourth Industrial Revolution (digitalisation and automation) and underlying factors such as the ageing population and climate change, the precise nature of this optimum infrastructure for the future is far from certain. Given such problems of knowledge and efficient management, public-private partnerships (PPPs) have become more popular, especially in the emerging economies. In a typical PPP, the private firm provides the initial financing required and designs, builds, operates and maintains the infrastructure, making use of its know-how and ensuring an efficient use of resources. In exchange, it receives regular payments from the public sector for a specific period of time. However, PPPs are not always successful and have sometimes been used to dodge restrictions on public spending and to finance relatively unprofitable projects, especially in the emerging economies.

Ultimately the question is whether Trump in the US, the Juncker Plan in Europe or initiatives such as the New Silk Road in the emerging economies can identify and carry out high-return projects which, at the end of the day, are the ones that can produce a virtuous circle of growth. The answer? Come and take a look.

Adrià Morron Salmeron

Macroeconomics Unit, Strategic Planning and Research Department, CaixaBank

1. Some economists claim the weakness of the recovery is misleading and due to problems of measurement, underestimating actual growth. But they still believe infrastructure investment can boost growth potential.

2. In economics, the term «hysteresis» refers, for example, to the permanent loss of skills suffered by the long-term unemployed.

3. This argument is actually defended by both supply and demand-oriented economists. Olivier Blanchard, a top-flight demand-oriented economist, claims that a worse outlook in terms of future output leads to weak demand in the present.

4. IMF, 2014, «Is it time for an infrastructure push? The macroeconomic effects of public investment», World Economic Outlook, chapter 3.