Infrastructures and emerging economies: a cocktail for each development stage

In 2012, the global infrastructure investment per year was approximately 4 billion US dollars. This could rise to 9 billion dollars by 2025. 60% will be spent on infrastructures in the Asia-Pacific region.1 Demand for investment in the emerging economies will therefore drive global infrastructure development over the coming decades. One of the clearest examples is the initiative popularly dubbed the New Silk Road. Although this project has yet to be fully defined, the aim is to link 65 countries in Asia, Africa and Europe, either through a number of overland megaprojects or a series of maritime ports. It will include at least six large economic corridors, entails a total investment that could reach 6 trillion US dollars (approximately half China’s current GDP) and should be completed by around 2050. Its economic clout promises to be as colossal as the initiative itself, since it will improve trade flows in a potential market representing 40% of world GDP with around 4.4 billion people. In short, large-scale infrastructures will soon be more or less synonymous with the projects required by the emerging economies. And that is precisely the issue this article attempts to throw light on: are there any common features to emerging infrastructures that help them make a decisive contribution to socio-economic development?

But first we need to classify the emerging economies according to their degree of socio-economic development. The typical approaches range from using income per capita to group emerging countries to establishing categories according to qualitative traits. In this article we have decided to use the classification provided by the Global Competitiveness Report (GCR), which combines both approaches and identifies three large groups of countries based on their development.2 The three emerging economies which readers tend to think of are in the first two categories (which we will call «incipient emerging» and «consolidated emerging»), while the advanced economies are in the third group.

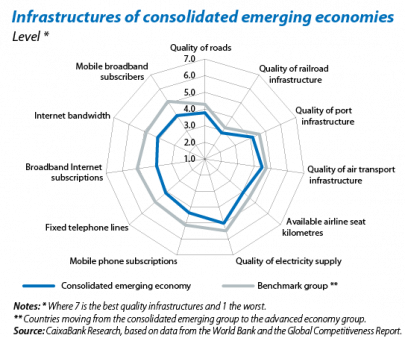

In addition to these broad categories, the GCR also identifies some economies which have managed to «escape» from their group and are moving towards the next development stage. For instance, while India is included in the stage of incipient emerging economies, the Philippines and Vietnam are transitioning towards the consolidated emerging stage. Using this classification, the question to be answered is: how different are the infrastructures of these transitioning economies compared with those of their previous group? The infrastructures were characterised by identifying 11 key dimensions, ranging from the quality of the roads to digital infrastructures (see the enclosed charts for the detailed categories). We can therefore compare the average infrastructures possessed by an incipient emerging economy with those, on average, of a country that is already moving towards the consolidated emerging stage, or compare the average infrastructures of the consolidated emerging stage with those of countries heading towards the advanced economy stage.

As expected, our analysis reveals that emerging economies must improve in all areas of infrastructure to improve their development status: the infrastructures of benchmark countries outclass their precursors in almost each and every one of these dimensions. But some details need to be added to this general assertion. Firstly, transitioning from an incipient to a consolidated emerging economy seems to involve a larger infrastructural jump than when escaping the category of consolidated emerging economies. Secondly, the need to improve infrastructures across the board does not necessarily mean all kinds of infrastructures are equally critical. The data show that each group of emerging countries is closer to the next development group in terms of what might be called the traditional infrastructures (roads, ports, energy, etc.) than in those related to the new information and communication technologies (ICTs). When developing, countries tend to act first in traditional areas, later on tackling the area of ICT infrastructures.

This being the trend for large groups, it is revealing to look at some particular examples of countries. India is currently in the group of incipient emerging economies. Indian governments have repeatedly stressed that infrastructures must be improved for it to move on from its current stage of development. What has been the outcome of this investment? The country now has better traditional infrastructures not only than the other countries in the same category but also than its benchmarks at the next development stage. Paradoxically, its ICT infrastructures are generally poor in quality although the country is renowned for its subcontracted work in this area.

Another revealing case is Russia, a country classified as transitioning from an incipient to a consolidated emerging economy. The general opinion is that Russia has run aground in this transition as it has failed to acquire the necessary elements to make the jump to the next stage. However, an examination of its infrastructures shows that the country seems to have made a significant effort to prioritise these. Russia now compares well, even with the best emerging economies, in aspects such as air transport, railways and some ICT infrastructures. The price? Accepting bad quality in infrastructures such as roads, for example.

And what about China? In our terminology, the Asian giant is a consolidated emerging economy. The country has based a large part of its traditional growth model on domestic investment. As a (predictable) result, its traditional infrastructures are good. But the country is one step behind in terms of ICT infrastructures, although perhaps not to the extent of India. If its plan for the future is to shift the onus onto services, especially high added value, investment must be channelled towards this kind of infrastructure.

A fourth emerging country that tends to attract attention in the area of infrastructures is Brazil. It has been repeatedly hit by production ergo infrastructure bottlenecks due to the economy overheating when its growth was accelerating. The data confirm this view. Brazil, a consolidated emerging economy, is far below its benchmarks, both in traditional and also in many ICT infrastructures, making any jump unlikely in the short term unless it acts decisively.

Finally, we should take a look at the singular case of Malaysia. Most emerging countries have infrastructures that are more or less in keeping with their income per capita. But this is not the case of Malaysia, whose infrastructures are clearly better than expected given its development stage. Its growth potential is therefore likely to improve. A key point to understanding this situation is that a large part of Malaysia’s strategy relies on strengthening its ties with one of the world’s most advanced economies, namely Singapore.

Having reviewed the mix of infrastructures in the emerging countries and identified the ideal composition, the question is now how to achieve this perfect cocktail and, in particular, how it can be made with limited resources. Although an in-depth analysis of the issue is beyond the scope of this article, the literature on infrastructure funding has stressed the growing importance for the emerging economies of a specific kind of financing, namely public-private partnerships (PPPs). Although totally public funding and development was the norm in the past, especially in developed countries, PPPs are now becoming increasingly popular in the emerging economies. According to World Bank figures, the stock of public capital financed by PPPs has gone from almost zero to the equivalent of 3% of GDP in the emerging countries in 2013, while in the advanced countries it is estimated to be 10 times less.

In summary, for most of the emerging countries studied, the «recipe», if we dare offer one, seems to be the following: once the basic traditional infrastructures are in place, ICT infrastructures should be enhanced to improve the country’s chances of making larger jumps in development. As investment in ICT infrastructures is riskier, and public funding is limited in many of these countries, some kind of private involvement is also required. In other words, in the perfect infrastructure cocktail, the more advanced the emerging country, the larger the proportion of ICTs and PPPs.

Àlex Ruiz

Macroeconomics Unit, Strategic Planning and Research Department, CaixaBank

1. PricewaterhouseCoopers (2015), «Capital project and infrastructure spending». Outlook 2025.

2. Stage 1 economies, which in GCR terminology are «factor-driven», are countries whose income per capita tends to be below 2,000 dollars; stage 2 economies («efficiency-driven») are between 3,000 and 9,000 dollars and, finally, stage 3 economies («innovation-driven») exceed 17,000 dollars.