Declining expectations and caution in the international economy

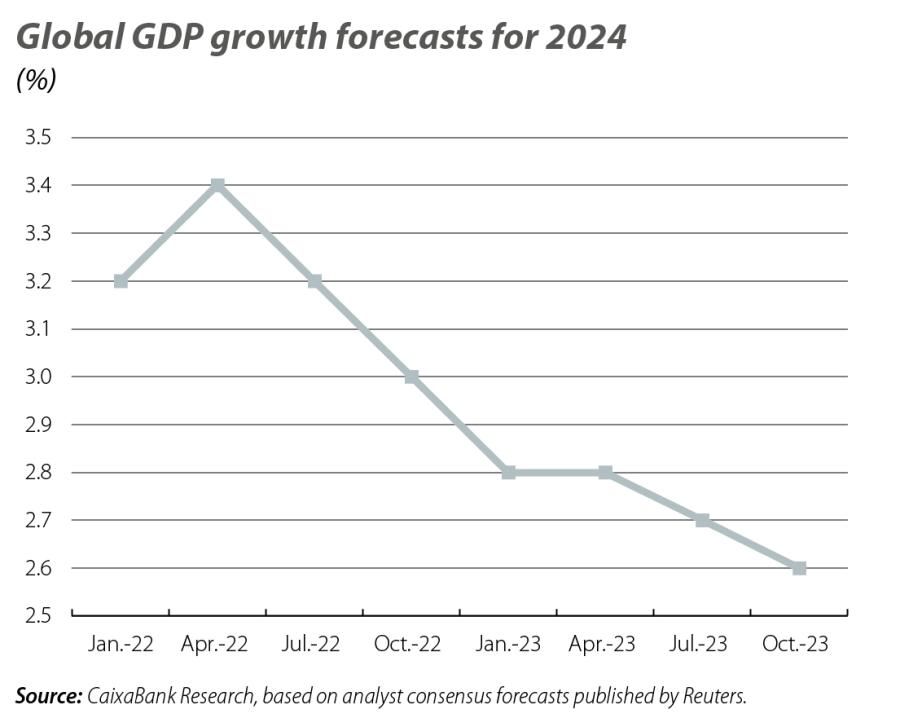

The world economy is experiencing a slowdown at different speeds as it heads into the 2023 year end and the beginning of 2024. This slowdown is particularly sharp in Europe, rather more gentle in the US, while China, despite meeting the authorities’ growth targets, finds itself entangled in the difficulties of its real estate sector. At this pivotal moment, the world economy is aiming for a smooth landing that would allow inflation to be reduced without excessively jeopardising growth, but it is doing so in an environment fraught with risks. In the geopolitical sphere, the already delicate situation due to the war in Ukraine has been compounded by the conflict between Israel and Hamas. In the more strictly economic sphere, meanwhile, inflation still has some way to go before reaching the central banks’ target rates, and although the cycle of monetary policy tightening appears to have peaked, its effects are still filtering through to the economy.

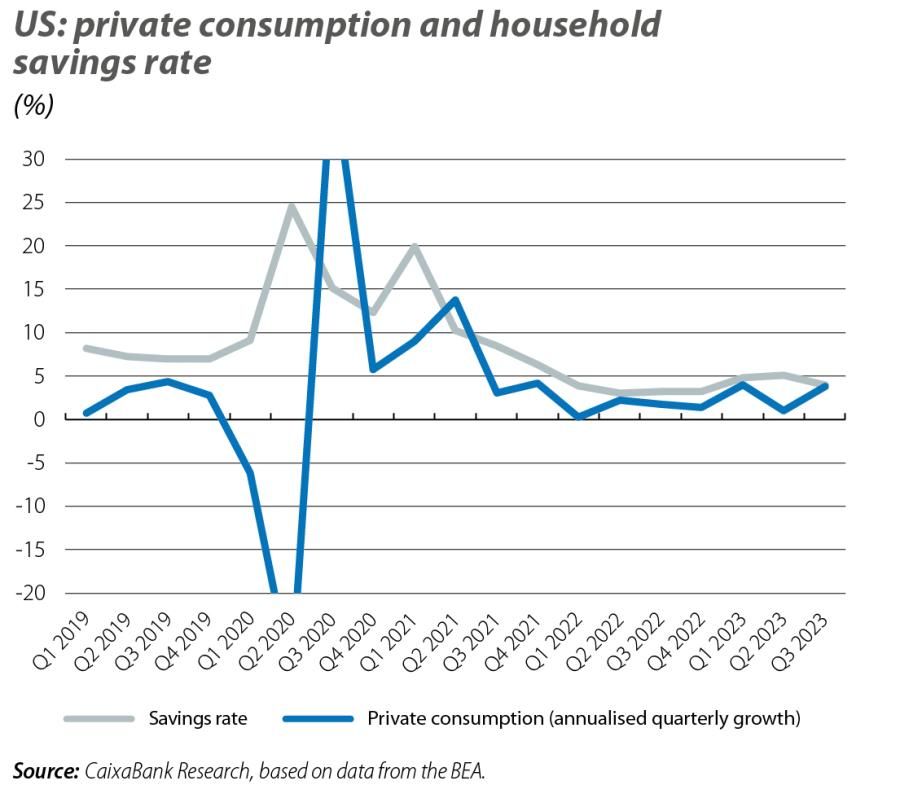

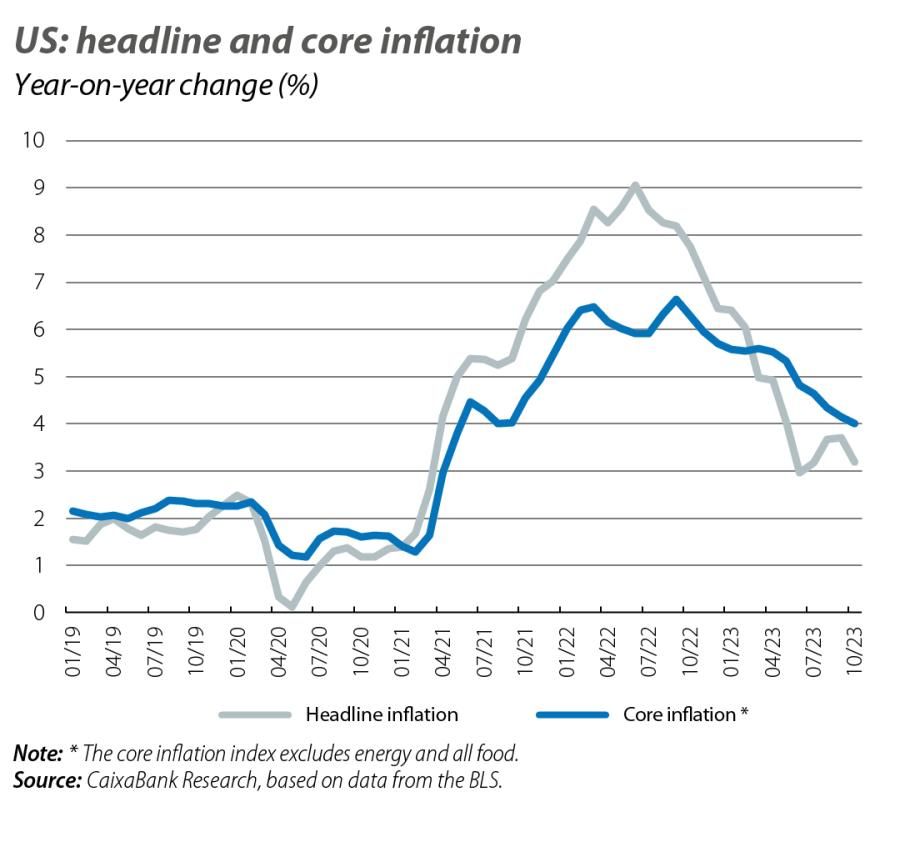

The rate hikes implemented by the Fed (525 bps since February 2022) are not yet fully visible in the macroeconomic data. In fact, in Q3 GDP was still growing at a robust rate of 1.3% quarter-on-quarter (more than double that of the first half of the year), thanks to the buoyancy of private consumption (0.9% vs. 0.2%) and at the expense of savings (4.0% of disposable income vs. 5.1% in Q2). However, in Q4, various trackers are suggesting that GDP may slow to 0.5% quarter-on-quarter, and while the economy seems to be achieving a smooth landing, we cannot rule out an even sharper slowdown during the first half of 2024. Indeed, the available indicators are suggesting just that. In October, retail sales and industrial production fell (–0.1% and –0.6% month-on-month, respectively), while the industrial climate and confidence indicators make the likelihood of a rebound seem remote: the ISM index for October once again stood at levels compatible with a shrinking of the manufacturing sector (46.7 vs. 49.0) and confirmed the exhaustion of the service sector (51.8 vs. 53.6), while consumer confidence fell in November for the fourth consecutive month (61.3 vs. 63.8) and the composite PMI was at levels compatible with economic activity close to stagnation (50.7 in November). Inflation, for its part, accentuated its decline in October, especially the headline index (3.2% vs. 3.7%), while the correction in the core index remains less pronounced (4.0% vs. 4.1%). The disinflationary evidence also observed in other indicators (production prices at 2.4% year-on-year, compared to 5.0% at the beginning of the year; or freight costs already below their pre-COVID average) suggest that the Fed’s 2.0% target could potentially be reached sometime during the second half of 2024.

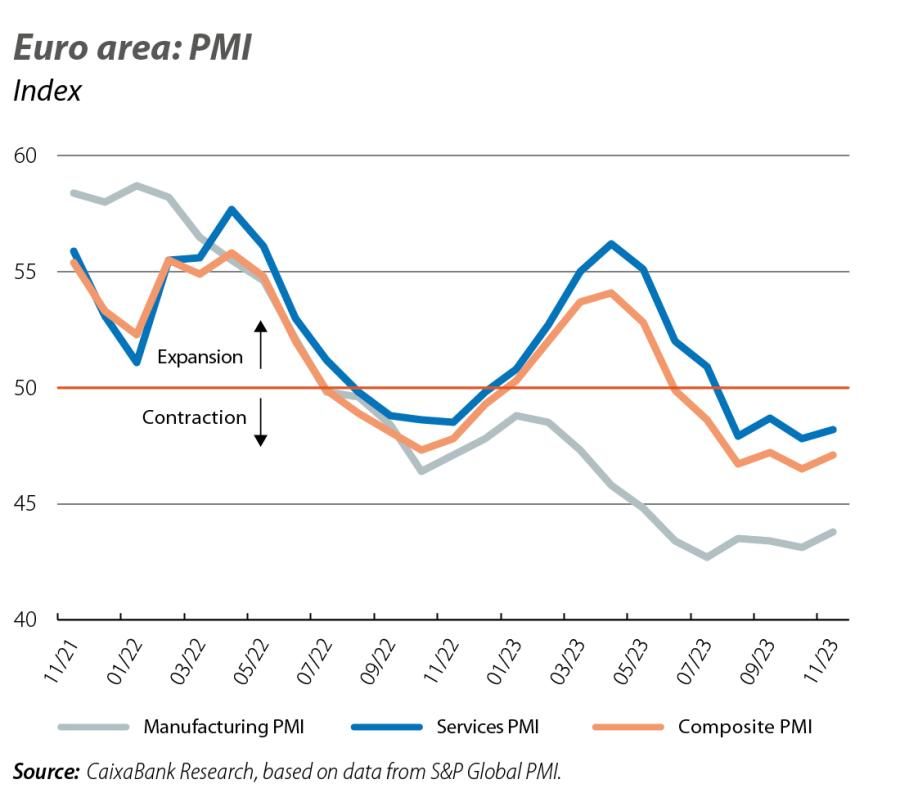

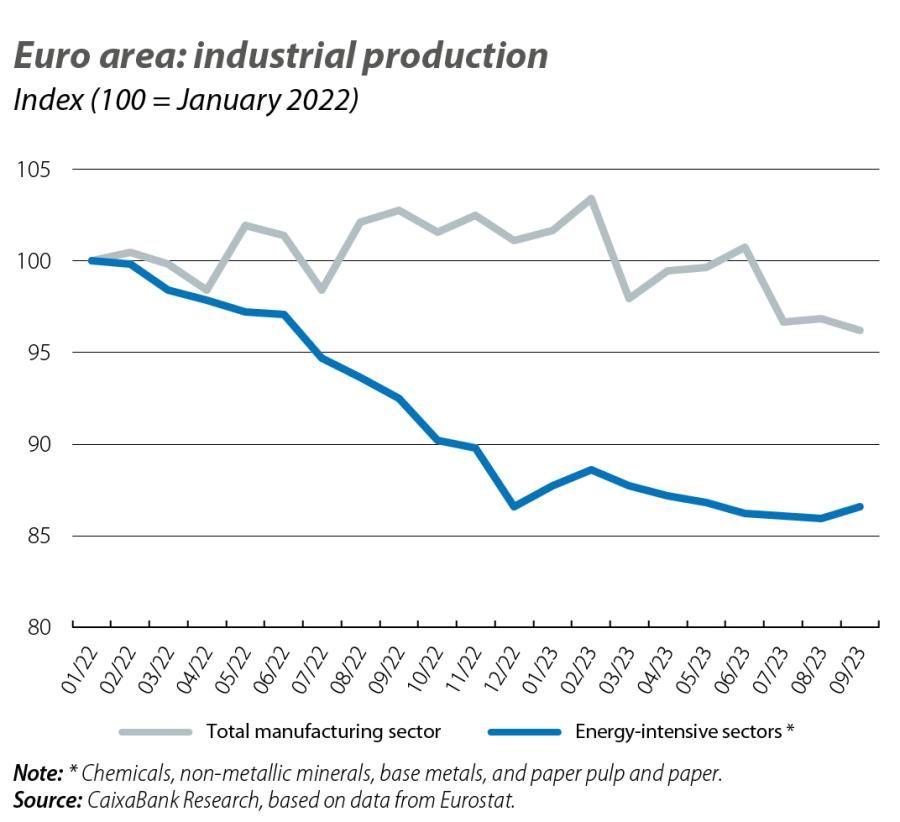

The economy shrank in Q3 (–0.1% quarter-on-quarter) and the outlook for the following months shows no signs of improvement. In fact, the consolidation of the PMI below the 50-point threshold in November for the sixth consecutive month increases the possibility of a further, moderate fall in GDP at the end of the year – a risk also hinted at by the European Commission’s economic sentiment indicator. In its autumn report, the Commission also points out that the rise in the cost of living (inflation has risen by more than 12% since January 2022), weak foreign demand and the tightening of monetary conditions have taken a toll on economic activity, and this explains the further cuts to its growth forecasts for the region as a whole, now at 0.6% for 2023 and 1.2% for 2024. In this context of economic slowdown, the moderation in inflation intensified in November, both for the headline index (2.4% vs. 2.9%) and for core inflation (3.6% vs. 4.2%). In fact, headline inflation fell to the lows seen in the summer of 2021, while core inflation reached its lowest point since the spring of 2022. The breakdown by component revealed a particularly sharp moderation in services (–0.6 pps, to 4.0%) and in non-energy industrial goods (2.9%, finally reflecting the normalisation of the global bottlenecks in final prices). In addition, the moderation of inflation was widespread among the large economies and the seasonally adjusted data published by the ECB place the momentum at 3.0% for headline inflation and at 2.0% for the core index (momentum is defined as the annualised quarter-on-quarter change in the HICP and is a better reflection of recent inflation trends than year-on-year rates).

Aware that their economy has cooled the most, the German authorities were planning to reallocate some 60 billion euros that were initially earmarked for alleviating the consequences of the pandemic to projects related to climate change. However, the German Constitutional Court declared this «transfer» unconstitutional, while simultaneously reviving the «debt brake» rule (which limits borrowing to 0.35% of GDP per year). This decision forced the government to draw up a supplementary budget of around 43 billion euros for the remainder of 2023 and it will appeal to parliament to maintain the suspension of the debt brake for the fourth consecutive year, claiming that a «state of emergency» persists in 2023, thus delaying its reintroduction until 2024.

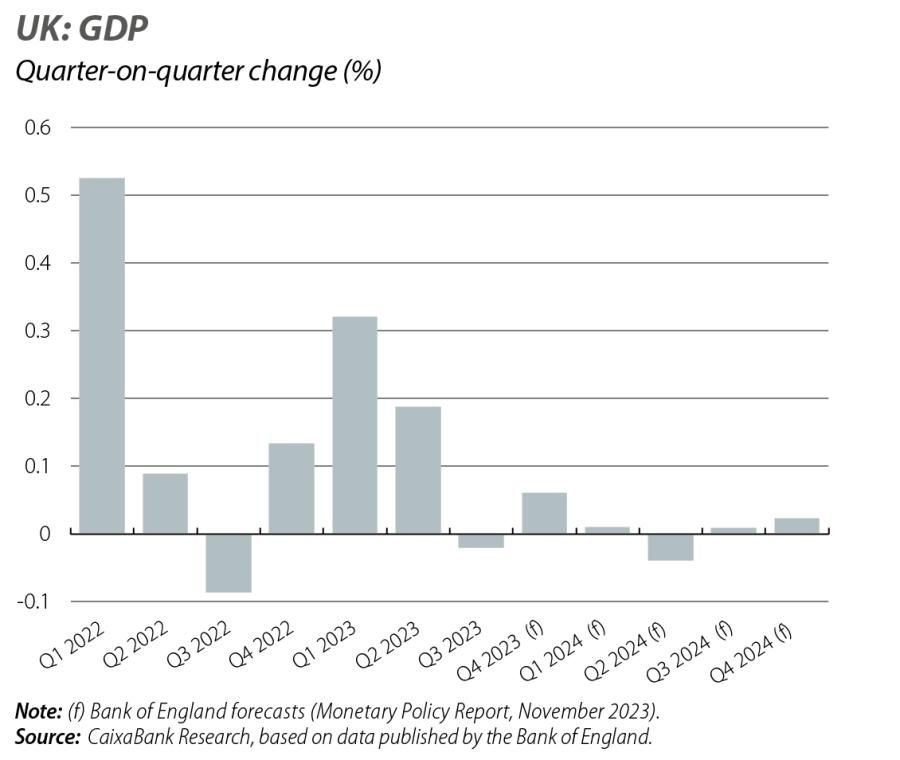

GDP stagnated in Q3 (0.0% quarter-on-quarter vs. 0.2%), after a more buoyant than expected first half of the year, and the Bank of England itself anticipates that economic activity will remain virtually stagnant until the end of 2024. This weakness in the economy led Finance Minister Jeremy Hunt to present measures aimed at reviving growth (including tax cuts for individuals and businesses) at an estimated cost of 15.6 billion pounds a year through to 2029 (around 0.5% of GDP). It is estimated that these measures will have a modest impact on growth (less than 0.3 pps on average per year through to 2029), which explains why the country’s Office for Budget Responsibility itself has cut its forecast for potential growth by 0.2 pps to 1.6%.

Japan’s GDP fell more than expected (–0.5% quarter-on-quarter vs. 1.1%), weighed down by the weakness of its domestic demand, while Russia’s GDP managed to accelerate (1.3% quarter-on-quarter vs. 0.8% previously), driven by the arms industry and the more than 30% increase in oil prices in the period. On the other hand, Latin American economies experienced a good Q3: Mexico registered 1.1% quarter-on-quarter growth vs. 0.8%; Chile, 0.3% vs. –0.3%; and Colombia, 0.2% vs. –1.0%. In Asia, the acceleration of economic activity was also widespread in Q3: China registered 1.3% growth vs. 0.5%; Philippines, 3.3% vs. –0.7%; Malaysia 2.6% vs. 1.5%, and Singapore, 1.4% vs. 0.1%.