The trends in the international economy continue

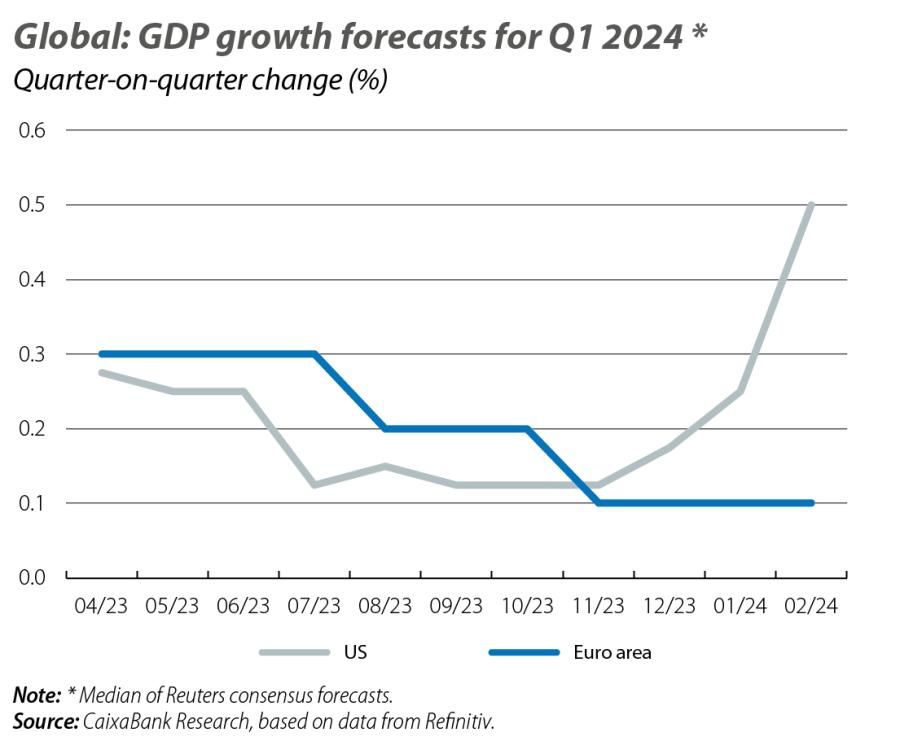

The latest data suggest that the dynamics experienced at the end of last year are persisting. Thus, the US economy continues to display a significant capacity for growth, while the euro area still struggles to find the necessary momentum to definitively ward off the spectre of recession. In China, meanwhile, the problems in the real estate sector are forcing the authorities to implement various measures to limit their impact on the growth of the economy as a whole.

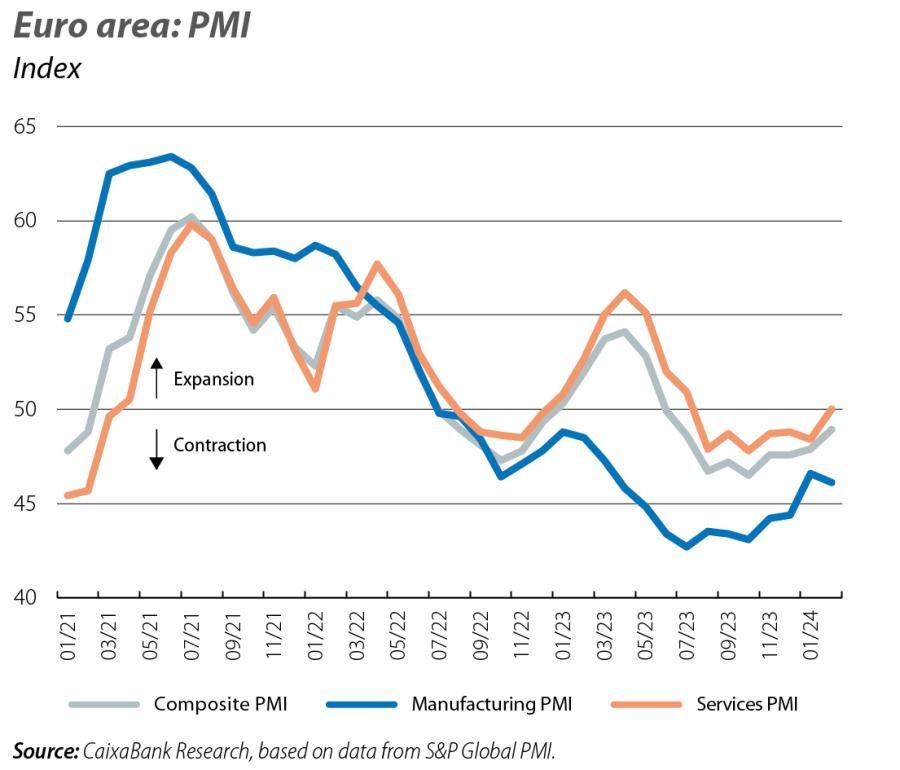

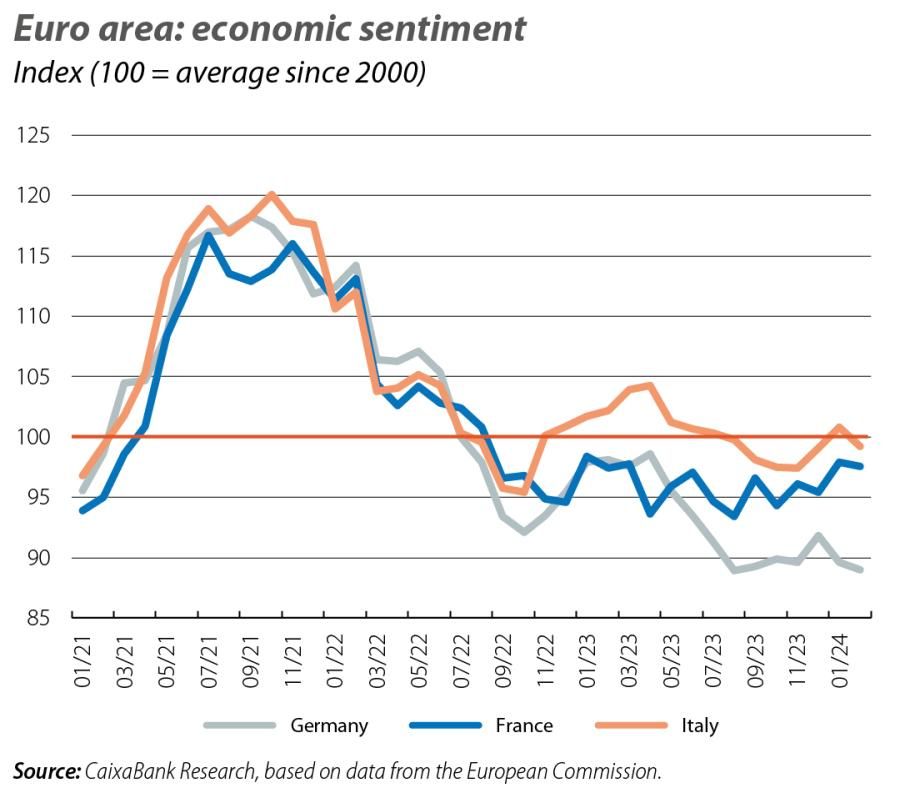

In fact, the PMIs for February confirm that economic activity remains somewhat apathetic (composite index +1 point, to 48.9, still below the 50-point threshold that indicates growth), weighed down by the difficulties in industry and the lack of momentum in the services sector. In addition, the economic sentiment index recorded its second consecutive fall in February (–0.7 points, to 95.4, well short of the 100-point mark that indicates growth at around the historical average), mainly due to the deterioration of the services sector. The performance of these indicators suggests that in the early stages of 2024 the euro area continues to suffer from the lack of momentum which characterised it in 2023. Moreover, all the indicators suggest that, once again, the economy will stagnate in Q1 and a fall in economic activity cannot yet be ruled out.

The GDP of the largest economy in the region already ended 2023 with a setback (–0.3% quarter-on-quarter in Q4) and risks starting 2024 the same way, as the Bundesbank is warning. In fact, in February, the composite PMI fell to 46.1 points, weighed down by a manufacturing sector that has been in contractionary territory for 20 consecutive months and a services PMI that recorded its fifth consecutive month below the 50-point threshold in February. In addition, the low levels of the Ifo in February (85.5, compared to the value of 100 that is compatible with growth at around its long-term average) and the persistent weakness in consumer confidence suggest that Q1 will bring few positive surprises. With regard to France and Italy, various business climate indicators suggest that the situation is somewhat better than in Germany, but in February they remain at levels compatible with practically stagnant economic activity. Against this backdrop of weak economic activity, euro area inflation declined slightly in February (headline inflation at 2.6% and the core index at 3.1%).

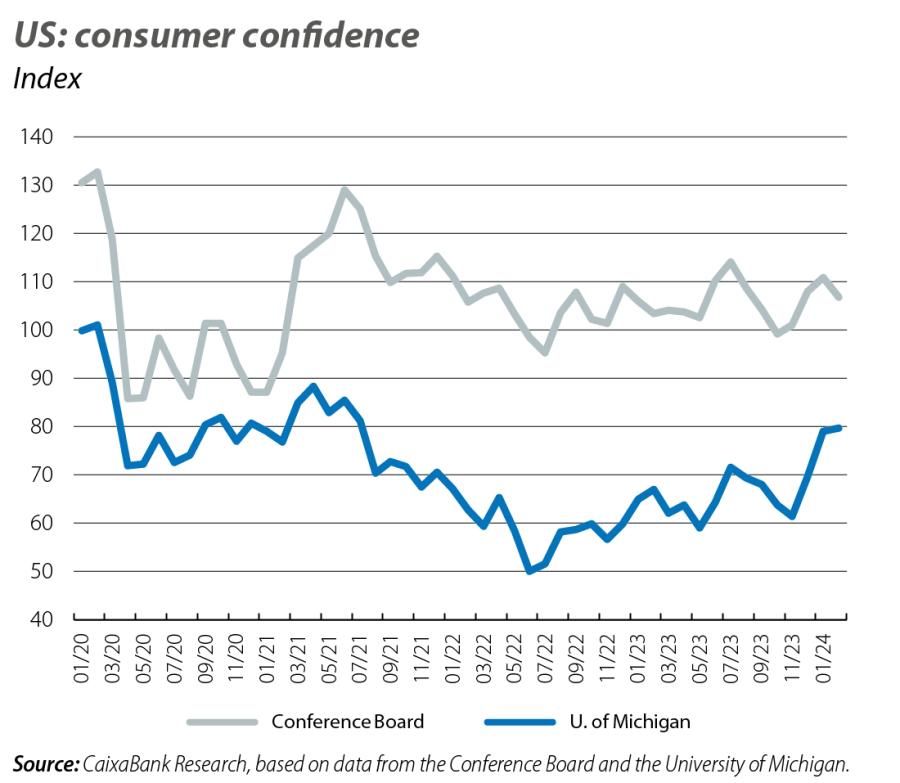

Expectations for the economy remain broadly positive and have not been altered by the poor performance shown in January by some indicators. In this regard, the setbacks suffered in January by retail sales (–0.8% month-on-month vs. +0.4% previously) and industrial production (–0.1% vs. 0.0%) are largely explained by rather adverse weather conditions. Also, the sharp drop in orders of durable goods in January (–6.1% vs. –0.3%) is due to the decline in orders of transport equipment (orders for commercial aircraft were down almost 60%), whilst orders for non-defence capital goods (a proxy for investment in capital goods) grew by 0.8%. Therefore, this weak start to the year does not appear to be a sign of an imminent change of trend. In fact, the PMIs for February were well above the 50-point threshold that indicates growth, both at the aggregate level (51.4) and individually for manufacturing (51.5) and services (51.3). As for household spending, the Conference Board’s Consumer Confidence Index, despite falling in February (106.7 vs. 110.9), is showing a January-February average that is well above the previous quarter’s average. The buoyancy still shown by the labour market (in January 353,000 jobs were created, with an unemployment rate that remained at 3.6%) supports the prospect that household spending is likely to remain robust in the short term.

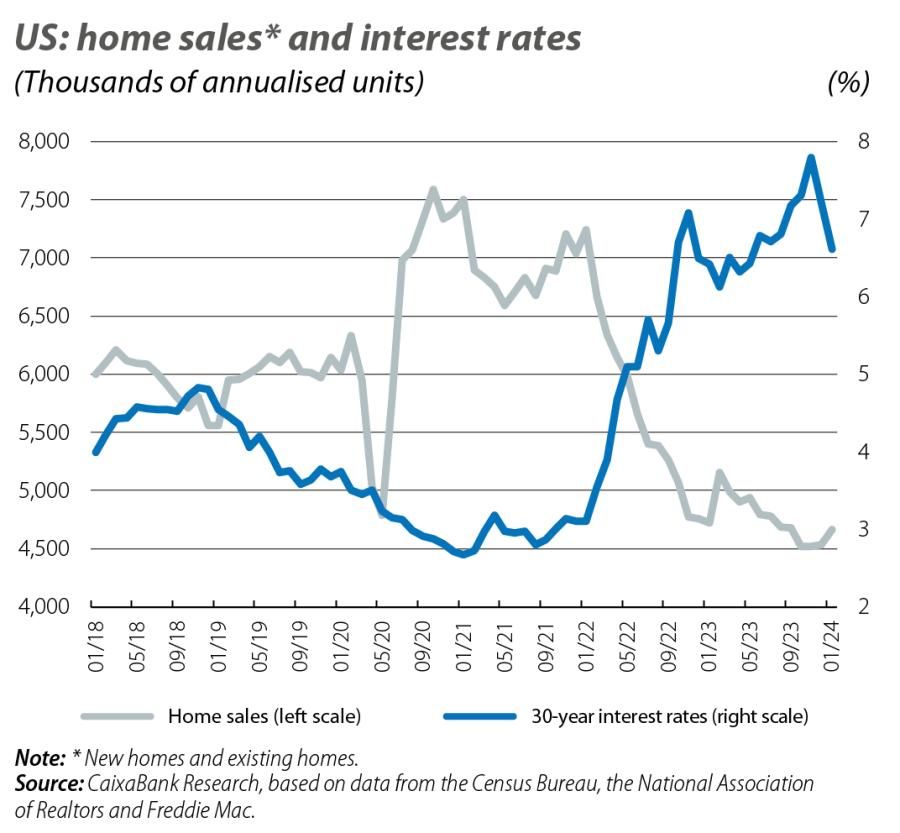

On

the other hand, the situation in the residential sector on the demand side is improving timidly. Sales of existing homes increased by 3.1% in January, reaching 4.0 million units in annualised terms, and sales of new homes rose by 1.5% in January, to 661,000 annualised units. In any case, these figures are still 25% and 6.5% lower, respectively, than their pre-COVID long-term averages, highlighting the margin for improvement that exists as 30-year interest rates (the main benchmark used for mortgages) gradually converge with the outlook for US rates. In this context of economic buoyancy, inflation is falling, but more slowly than in previous quarters due to the resistance of the shelter component (which accounts for over 35% of the headline CPI): in January, headline inflation dropped 0.3 pps, to 3.1%, while the core index remained unchanged at 3.9%. The evidence of strength in the US economy, coupled with the slow correction of inflation, explain the sharp movements in the financial markets in recent weeks and the adjustments in market expectations regarding when the Fed will carry out its first rate cut in over two years (see the Financial Markets Economic Outlook section).

The celebration of the Lunar New Year (LNY) in China affects the publication of the monthly indicators, limiting our ability to analyse the Chinese economy at the beginning of this year. Among the limited available indicators, those related to domestic spending during the LNY holidays, such as retail sales and spending at restaurants, grew by a robust 8.5% year-on-year. On the other hand, the problems in the residential sector persist: home sales fell in January by 35% year-on-year, further increasing the already high inventories of housing and pushing down prices, which in January fell at a year-on-year rate of 1.2% (–0.9% previously). The official composite PMI, meanwhile, remained stable at 50.9 points in February, only marginally in expansive territory. In this context, the People’s Bank of China continues to take measures to stimulate credit (the mortgage benchmark rate has been reduced by 150 bps since last year) and to boost liquidity in the system by cutting back the cash ratio. However, in addition to the problems in the residential sector, consumption and investment decisions could be impacted by the deterioration of the deflationary situation in the economy: in January, the year-on-year change in consumer prices was –0.8% (–0.3% previously) and in the case of production prices, –2.5% (–2.7% previously).