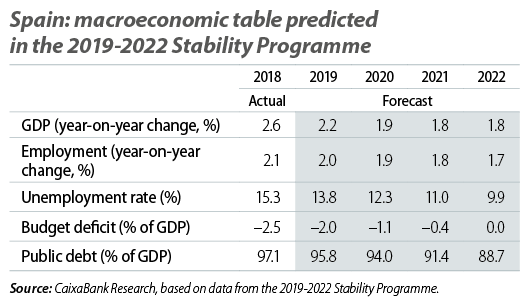

The Spanish economy postpones its growth slowdown. With the fading of the tailwinds that supported the strong growth of recent years, the Spanish economy faces a transition to more moderate growth rates that are more consistent with the maturity of the cycle. However, this moderation of growth is occurring somewhat slower than expected. For instance, in Q1 GDP grew by 0.7% quarter-on-quarter (2.4% year-on-year), 0.1 pp faster than in the previous quarter. For 2019 as a whole, we expect the Spanish economy to grow by 2.3% (2.6% in 2018), before slowing down to 1.9% in 2020 and 1.7% in 2021. In terms of components, domestic demand will remain the main driver of growth in Spain, especially due to the contributions of domestic consumption and investment. Foreign demand, meanwhile, has been penalised in recent quarters by trade tensions and lower growth in the euro area, and it will probably continue to make a modest contribution while these restrictions continue to weigh down the external environment. A very similar growth scenario can be found in the Government’s macroeconomic table, presented in the update of the Stability Plan for 2019-2022. As for the public accounts, the Stability Programme foresees a very gradual reduction of the budget deficit, supported by the cyclical momentum and the new revenue measures that are due to be included in the budgets for 2020. These measures (minimum taxation for corporation tax, digital services tax, tax on financial transactions, etc.) would allow revenues to be increased from 39.1% of GDP in 2019 to 40.7% in 2022, although the details are still too patchy to assess their impact with precision.

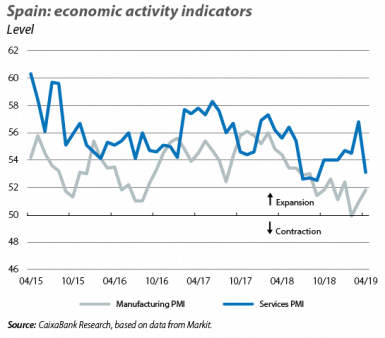

The indicators suggest that the growth rate remains steady. In particular, in March, the turnover of the services sector grew by 5.1% year-on-year (three-month moving average) and that of the industrial sector, by 2.2% year-on-year, both higher than in the previous month. In addition, in April the manufacturing and services PMIs stood at 51.8 and 53.1 points, respectively, well within expansionary territory (above 50 points). As such, we expect GDP growth in the second quarter of the year to remain similar to that of Q1. Specifically, our short-term GDP forecast model indicates growth of 0.7% quarter-on-quarter in Q2 2019.

The labour market shows dynamic performance. In the same vein as GDP, in the labour market the anticipated moderation in the growth of employment also continues to be pushed back. In April, employment rose by 2.95% year-on-year (in seasonally adjusted terms), somewhat above the Q1 average (2.9%). The total number of registered workers affiliated to Social Security, meanwhile, reached 19.2 million, the highest figure since July 2008. Registered unemployment fell by 5.2% year-on-year (the same rate as the average for Q1) and the total number of unemployed people stood at 3.2 million. In addition, besides this improvement in employment we are beginning to observe a gradual increase in workers’ earnings, which should help to underpin the recovery of household incomes and economic sentiment among consumers. In particular, in April, the wage increase agreed in collective labour agreements was 2.21% (2.25% in new agreements signed in 2019), higher than the 1.75% registered in December 2018.

Inflation remains contained. Specifically, in May headline inflation stood at 0.8% year-on-year. As such, there was a reversal of the upswing seen in April (when it had increased to 1.5%), a figure that was influenced by calendar effects related to Easter. With regard to core inflation, we still do not know the figure for May, but in April it remained at a contained 0.9% and all the indicators suggest that the recovery of the underlying inflationary pressures will be very gradual. On the one hand, the recovery in wages is proving to be particularly gradual. In fact, it is lower than that experienced in other euro area countries, which allows the Spanish economy to remain competitive (for more details, see the Focus «Spanish labour competitiveness: a history of ups and downs» in this same Monthly Report). On the other hand, the recent moderation in business profits is contributing to the containment of core inflation.

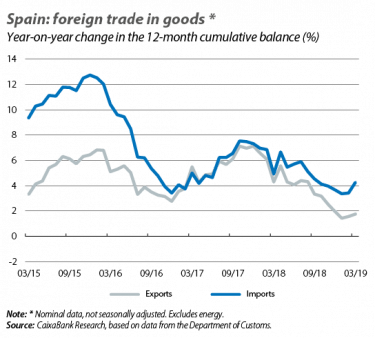

Dark clouds form in the foreign sector, despite the heat of tourism. Trade tensions and the slowdown in the euro area are taking their toll on the Spanish foreign sector and in March the current account balance fell to 0.74% of GDP (12-month cumulative balance), 1.03 pps below the figure for March 2018. Most of this deterioration can be attributed to the decline in the balance of goods (which stood at –3.0% and accounts for 0.9 pps of the deterioration), in particular to non-energy goods (accounting for 0.5 pps of the deterioration). Nevertheless, in this rather less favourable external context, the tourism sector continues to perform well. In March, 5.6 million international tourists entered Spain, 4.7% more than in the same month of 2018. In addition, their total expenditure was 2.7% higher than a year ago.

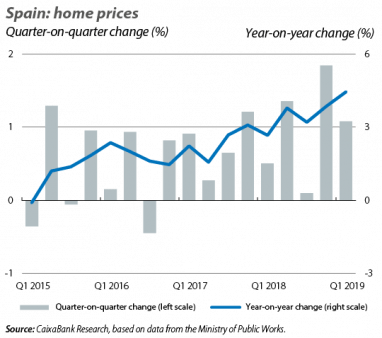

The real estate sector, experiencing a more sustainable and enduring expansion. The growth in home sales slowed slightly in March, with 8.1% year-on-year growth (12-month cumulative figure) compared to 10.3% in 2018. On the other hand, home valuations rose by 1.1% quarter-on-quarter (4.4% year-on-year) in Q1 2019, consolidating the upward trend that began in 2015. As these figures show, the Spanish real estate sector is entering a more mature phase of the cycle, characterised by an easing of growth in demand and in prices. In this phase, we expect sales and housing prices to continue to grow at a steady pace throughout 2019, albeit at more moderate rates than last year, in line with the slight loss of buoyancy we expect to see in the factors that support the expansion of the real estate market (job creation, favourable financial conditions and high foreign demand).

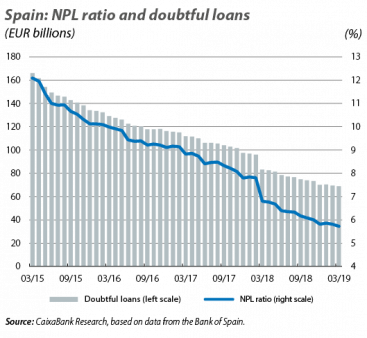

The strength of economic activity facilitates the reduction of non-performing loans. In particular, the NPL ratio fell by 0.09 pps in March down to 5.73%, continuing the reduction that began four years ago and following a trend that will continue over the coming months. In the last 12 months, defaults have reduced by 1.07 pps, favoured by the good pace of economic growth and the resulting lower rate of new defaults, as well as due to sales of doubtful loans.