Surprise was the order of the day at the monetary policy meeting of the Federal Reserve (Fed) on 18 September. Against an almost unanimous prediction by analysts who had expected the first step to reducing the amount of monthly bond purchases, the monetary authority announced that it would not be making any changes for the time being.

We need to go back a little in time to interpret this unexpected decision. One year ago, in September 2012, the Fed started up a programme to purchase mortgage-backed securities totalling 40 billion dollars a month, with the overall aim of underpinning the economic recovery. In December 2012, it decided to extend this programme by acquiring 45 billion dollars a month of Treasury bonds. Subsequently, in June this year, it modified its «forward guidance», adopting a new stance in which the steps it planned to take would depend on trends and the achievement of certain thresholds in the rate of unemployment and/or inflation. Among other benchmarks, the Fed announced that it will gradually taper its bond purchases, stopping once unemployment falls to 7%. However, the requirements for starting this process were not as detailed, hence the discrepancy between analysts and the Fed. On the one hand, the Fed indicated that, if the economy continued to evolve favourably, it would start reducing purchases before the end of 2013. Obviously this included the September meeting but also the ones in October and December. On the other hand, it added a generic benchmark to the need to preserve financial stability. Perhaps analysts did not pay enough attention to this «joker» which the Fed had kept up its sleeve.

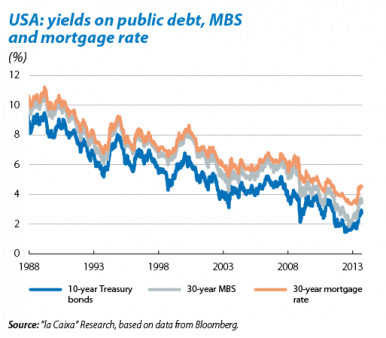

To assess the importance assigned by the Fed to financial market stability, we only need to examine, albeit retrospectively, the statements made by Ben Bernanke and other members of the institution over the last few months, repeatedly attempting to calm the mood of investors. Since it was revealed that the Fed was thinking about reducing its bond purchases, investors brought the expected date for the first rise in the official interest rate forward slightly. There was also a very sudden surge in yields on long-term public debt which spread to the rest of the fixed income segments. One particularly sensitive area is that of mortgage loans which, if they get more expensive too quickly, could wipe out the recovery in the real estate market, an important engine for growth. The Fed seems to have decided that both the change in expectations regarding the official interest rate and the trend in yields were not expedient, given that they were moving dangerously away from its desired scenario of a smooth and gradual normalisation in financial conditions. The content of the statement from its meeting on the 18th confirms this impression. Firstly, it explicitly states that «the Committee sees the downside risks to the outlook for the economy and the labor market as having diminished», suggesting that now would be the time to moderate stimuli, as analysts expected. However, the Fed then warns that «the tightening of financial conditions [...] could slow the

pace of improvement in the economy and labor market», a circumstance that has actually come about and has led to its decision to wait.

Initially, the market reaction was in line with the Fed's wishes: a drop in monetary interest rates, in yields on Treasury bonds and in the dollar, as well as stock market gains. But this is not, by any means, the end of the story. Similar chapters might be repeated in what promises to be a path full of potholes in the Fed's exit strategy.

The threat is that markets will become volatile or that the Fed's reputation will be damaged and investors will demand a higher risk premium for financial assets. We trust, however, that the Fed will handle this situation properly, combining a firm hand and agility, as it has to date. The next date: the Committee meeting on

30 October.