The real estate sector seems to have started a change in direction. Sales have seen positive growth rates for several months now and house prices stopped falling in 2014 Q2. The improvement in economic activity is finally starting to affect the sector hardest hit by the recession. However, although the outlook is more favourable we must still remain cautious. The adjustment in prices and activity has been significant but there is still an excess supply of residential properties.

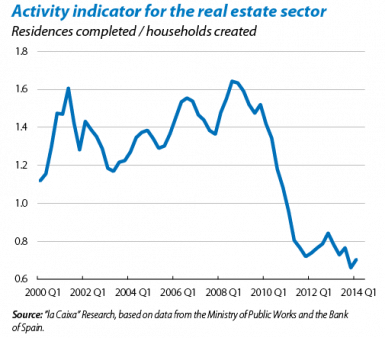

There has clearly been a dramatic slump in activity. In 2013, the residential properties completed totalled just 60,000, two thirds of the households created that same year. This ratio is far from the 1.3 residential properties completed per household created observed on average between 1999 and 2004. Undoubtedly such low rates are only sustainable due to the existence of a large stock of housing.

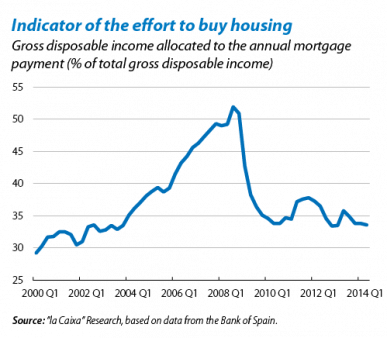

There has also been a significant adjustment in prices, falling by 38% in real terms since 2008. This can be seen in indicators that take into account households' capacity to pay. As seen in the second graph, the average household's share of gross disposable income used for the annual payment of a mortgage has changed substantially over the last few years, partly due to the fall in house prices although the drop in financing costs has also played a part. Nevertheless, this index is still slightly higher than what is considered to be the equilibrium level. House prices will need to increase at a slower rate than gross disposable household income for this adjustment to continue.

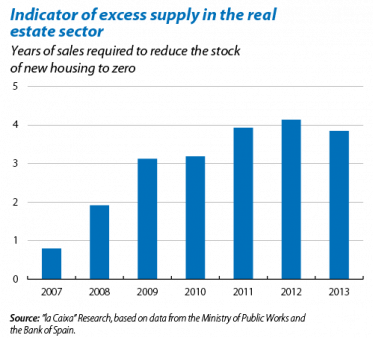

However, the most decisive factor for the sector's development over the coming years will be excess supply. According to our estimates, in 2013 Q4 the stock of new completed residential properties on sale was just above 600,000, which is 3.8 times the number of new residential property sales carried out in the last year, a figure very similar to the maximum posted in 2012. Although we expect the reduction in this ratio to speed up as the demand for housing improves, the large amount of stock accumulated will limit the extent to which activity and prices can recover in the short and medium term.

A broad analysis of the situation of the real estate sector must not forget the heterogeneous nature of this industry. A characteristic that is actually likely to intensify over the coming quarters. In those real estate sub-markets where excess supply is limited or non-existent, we are starting to see signs of upward pressure due to the recovery in demand and improved financing costs. However, in those sub-markets where supply is still excessive, the adjustment will continue to be slow.