Hong Kong: good prospects, in spite of everything

Recent demonstrations in the streets of Hong Kong demanding greater democratic commitment from the Beijing government have once again highlighted the fragility of the Hong Kong-China set-up, in spite of these events having ended peacefully. Hong Kong has a special relationship with China, encapsulated in the slogan «one country, two systems», that originates in the Chinese-British agreement of 1984 to agree the return of the colony to China in 1997, establishing a favourable institutional framework for business that co-exists with its rule by the Chinese authorities.

This special relationship has been decisive in the economy's success and a determining factor for a considerable number of international investors choosing Hong Kong as their entry point to mainland China. Such success has undeniably also been influenced by its capitalist system, its highly skilled population, a GDP per capita that equals Japan's (around 40,000 dollars a year), the fact that it is one of Asia's main commercial ports (and the world's third cargo port) and that it has the fourth largest stock market in the world in terms of company market value.

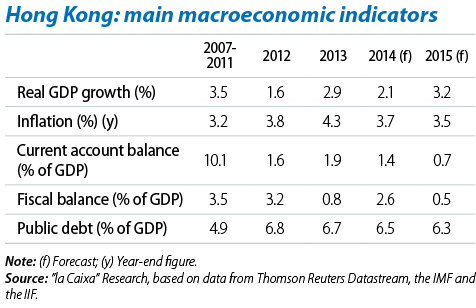

Nonetheless, this small country of 7.2 million inhabitants is now facing significant challenges. In the short term, it is thought that the economic consequences of the recent protests will be limited. Apart from concentrating on the tourism industry (which accounts for a small 3% of GDP), the close cultural ties and common interests that unite Hong Kong and China should help both sides to come quickly to an understanding. But there are other, particularly important challenges that must be overcome by Hong Kong's economy in the coming months, such as the Fed's normalisation strategy for its monetary policy.

For the last three decades, the Hong Kong dollar has been pegged to the US dollar, thereby subjecting the country's monetary policy to the decisions taken by the Fed and, by extension, the US economic cycle. Over the last four years, Hong Kong has «virtually» imported a more expansionary monetary policy than the one required by the state of its economy and this has led to notorious excesses, fundamentally in real estate (house prices increased by 75% between 2008 and 2013). Given this situation, the Fed's interest rate hike will cool down the real estate market, a process which should be gentle and have no dire consequences for the country's financial sector (its NPL ratio is below 1%). Perhaps the greatest cause for concern are the episodes of volatility in international flows that may accompany the United States' monetary normalisation. Nonetheless, should these occur they are likely to be temporary and limited in scope as the central bank's extensive reserves, its strict bank supervision and Hong Kong's high fiscal surplus place the country in a relative strong position compared with other Asian economies.

In the long term the country's economic development will be affected, and necessarily so, by its relations with its bigger brother. In this respect China's slowdown (going from annual growth of around 10% to figures close to 7%) has been reflected in the growth rates of Hong Kong's economy. However, the gradual liberalisation and modernisation of China's financial system will help to reinforce the already existing synergies (such as Hong Kong being the main offshore centre for the Chinese renminbi) and produce new ones (such as the recent agreement to simultaneously list companies on the Hong Kong and Shanghai stock markets). In short, the Asian giant's shift towards a «more market-driven» economy should strengthen the existing ties between both countries.