The significant drop of 25.4% year-on-year recorded by Chinese exports in nominal terms last February illustrates the deterioration in international trade in emerging Asia. Specifically, and in real terms, this fell by almost 4% in 2015 in contrast to the 0.6% growth posted by total world trade.1 The pattern of growth from just a few years ago has therefore been broken, when trade in emerging Asian countries grew by an average annual rate of 10.9%, doubling the already solid 5.4% growth enjoyed by world trade (see the first graph).2 One of the questions raised by this change is whether it is temporary or due to factors of a structural nature.

China joining the World Trade Organization in 2001 represented a watershed for the role played by emerging Asia in international trade. Thanks to its more open stance, a large value chain developed with China at its heart. The high degree of fragmentation of this chain brought about a sharp rise in trade flows between the region's countries3 and emerging Asia's share of total global trade flows, which in the 1990s had hardly grown from 6% to 8%, came close to 17% in 2010. Today the figure is around 19% and reaches 26% if we add the region's advanced economies (such as Japan and Korea), which also form part of this peculiar industrial and commercial structure.4

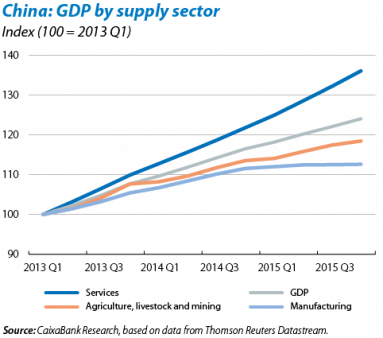

However, just as the boost provided by China was crucial for Asia's growth in trade in the first decade of the millennium, the transformations currently affecting the country go a long way to explaining the commercial slowdown in the region. In particular, Asian trade with China is facing a threefold problem. Firstly, the country has more fully integrated the production chain for its exports, lowering the demand for intermediate inputs from its neighbours. The slowdown in the Asian giant's domestic demand and greater share of the services sector as the country changes its production model are the other two elements resulting in weak Asian trade. This growth in services, much less tradable than the rest of the products, has come close to 11% year-on-year in the last three years compared with 4% for manufacturing (see the second graph).5

The structural nature of these three factors suggests that part of the slowdown in growth of Asian trade flows is not temporary. Moreover, in addition to this boom in services the region has also been affected by global financial volatility in the last few months which has been particularly intense in Asia due to doubts regarding China's growth. As this uncertainty diminishes trade flows will pick up again but we should not expect them to achieve the energy of the boom years in 2000-2007.

1. According to data from the CPB World Trade Monitor. It only considers manufacturing trade and we have calculated the growth with the average for flows of imports and exports by volume.

2. Annual average between 2000 and 2008 (before the sharp fall in trade).

3. For more details on the global Asian value chain see CaixaBank Research: «China, at the heart of «Factory Asia»», MR06/2014.

4. According to data from the IMF (DOTS) for exports of goods in current terms (measured in dollars).

5. See IIF, «EM Asia: The Trade Engine Has Broken», 11 February 2016.