Spain’s public accounts are still in the red. By the end of the year, the fiscal balance will be almost –4.6% of GDP, meaning that the country will once again post a budget deficit, in fact for the ninth consecutive year, and the level of debt of public administrations will therefore remain close to 100% of GDP.

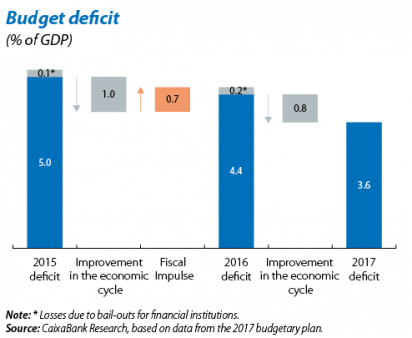

With the year about to end, it is a good time for the country to concentrate on preparing the accounts for 2017. In this respect, in October the caretaker government presented the budgetary plan (PGE in Spanish) for 2017, which is an extension of the 2016 budget, leaving the work of reducing the fiscal balance to economic growth. Specifically, according to the PGE, the 2.3% GDP growth forecast will help to reduce the fiscal balance by 0.8 pps to 3.6% of GDP.1

This improvement in the public accounts will come both from revenue and expenditure. In the case of revenue, the government estimates that the good trend in employment (2.2% in 2017) will boost Social Security contributions, which will grow by 2.5% in 2017, somewhat below the growth expected for 2016 but in line with the economic growth predicted. Regarding tax revenue, the PGE estimates that taxation on production and imports (mainly VAT) will increase by 3.7%, therefore maintaining a similar trend to the one observed in 2016 and in line with the macroeconomic scenario predicted by the PGE. The PGE also estimates that taxation on income and wealth will recover in 2017 after falling in 2016 due to the tax reforms passed in 2015. In this respect, the recently approved increase in advance payments of corporate tax will boost the recovery in the tax revenue collected in 2017 and will also offset the drop in revenue experienced in 2016.2

In the case of expenditure, the almost 2 pps drop in unemployment will reduce spending on unemployment assistance by 7% according to the 2017 budgetary plan, a figure somewhat lower than the one recorded up to September 2016 (–10%) but which is also in line with the expected trend in economic activity. Another item that is expected to decrease is expenditure on interest payments. Specifically, the government estimates this will fall by 0.3%. This forecast is actually quite conservative given that the average maturity of the country’s public debt is seven years and interest rates are at a considerably lower level than those observed several years ago. In fact, up to September 2016, central government expenditure on interest payments had fallen by 5% compared with the same period in 2015.

In short, the estimates contained in the PGE, according to which economic growth will help to reduce the general government deficit to 3.6% of GDP in 2017, seem plausible. Moreover, with the aim of achieving the 3.1% target agreed with the European Commission, the government has passed a further package of budgetary measures to reduce spending and increase revenue, valuing the whole of these measures at 7.5 billion euros.

It should be noted that measures to reduce the fiscal balance are necessary in order for public debt to begin to fall. It is therefore prudent to take advantage of the good momentum enjoyed by the Spanish economy at present to sort out the country’s accounts and thereby have more margin to tackle any future storms.

1. In December the government presented an update of the macroeconomic situation which includes an upward revision of GDP growth in 2017 to 2.7%.

2. In 2016 this measure was applied as from the second advance payment. In 2017 the measure will affect all three payments.