Caution, the US stock market reaches historic levels

Since 2009 the S&P 500 has been enjoying one of its longest win streaks ever and is now exhibiting considerably high valuations. The price/earnings ratio for the past 12 months is 23 while the historical average is 15.6. The CAPE index is also far above its historical average of 16.7 at around 29.1 This level has only been exceeded on two occasions: during the bubbles of 1929 and 1999-2001. This has led to intense debate on how far the rally can run and the likelihood of a sudden dip.

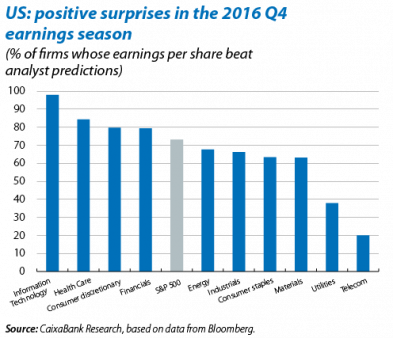

Some of the factors firing up the stock market in the past few months have been the positive corporate earnings season, the recovery in mergers and acquisitions, the gradual return of retail investors to the stock market and some of President Trump’s promises. Regarding the first factor, 73% of the companies published higher than expected earnings for 2016 Q4. The earnings season was particularly good for firms in the technology sector, health and finance. Analysts are therefore increasing their profit forecasts for the coming years. This change in investor perspective is also helped by the Fed’s confidence in how the US economy will perform in the future.

Regarding the potential impact of Trump’s economic agenda, although some measures may have a positive effect on share prices others will certainly offset these gains to a large extent. The new administration’s fiscal policy (lower corporation tax, more infrastructure spending...) and regulatory measures (deregulating some key sectors such as energy and financial services) might boost share prices in the short to medium term. But increased protectionism or immigration controls could considerably harm US businesses. The stock market may also be hit by fiscal stimuli that ultimately push up inflation more than expected, which could lead to a significant rise in long-term interest rates.

Gauging the impact of Trump’s economic agenda on the stock market is not only difficult because the different measures cancel each other out. It is also because the details have yet to be specified for most of them. As shown by the enclosed chart, uncertainty remains high in the area of economic policy. But what really catches the attention is the historically low volatility of the US stock market, both the figure recorded in the past few months and also the forecast. The VIX index is widely used to gauge this volatility and is currently around 11.3 compared with a historical average of 19.6.

The VIX index and the economic policy uncertainty index have tended to mirror each other in the past. This time, however, it seems as if investors in the US stock market have taken sides and expect Trump’s programme to ultimately serve their interests. But it will not be easy to substantially boost an economy so close to full employment. They may also be underestimating certain risks associated with other controversial aspects of Trump’s agenda. While uncertainty remains, caution is advisable as such high share prices could be very vulnerable to possible setbacks.

1. The CAPE index is the ratio between price and the average earnings over the previous 10 years.