The economic recovery is consolidating. The flow of indicators published during the month of March continues to present a scenario of gradual recovery but with some nuances to bear in mind. Domestic demand, and particularly investment, is looking a little more robust than expected. The recovery in the periphery countries is also slightly better than forecast. Of note is the good trend in business indicators for the Portuguese economy which is likely to successfully complete its bail-out programme with the troika this June. At the same time, the recent advances made to reinforce the euro area's financial integration, with agreement regarding the bank resolution mechanism, once again show the commitment of European institutions to continue moving towards a greater level of integration. Nonetheless, the deleveraging still required by Europe's economy's and particular episodes of volatility related to the emerging countries remind us that this recovery is progressing along a narrow path that is not without its risks.

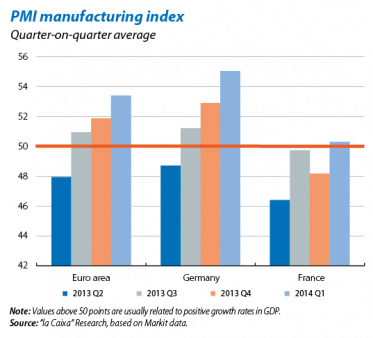

The economic rate of growth in the euro area accelerated in 2014 Q1. The PMI manufacturing index rose considerably this quarter up to 53.4 points. In addition to the usual solidity of Germany is a slight revival in France. The economic sentiment index produced by the European Commission also ended the first quarter of the year with a notable advance

and now stands at 101.5 points. Once again, of note is the considerable progress being made by the periphery countries: Italy, Spain and Portugal have achieved values close to their historical average. However, although picking up in March, France's economic sentiment index is still below its long-term level. On the whole, France's indicators are still fluctuating in line with a recovery that has yet to really pick up.

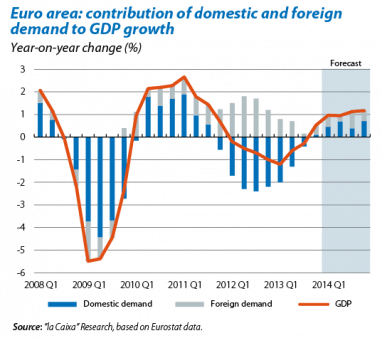

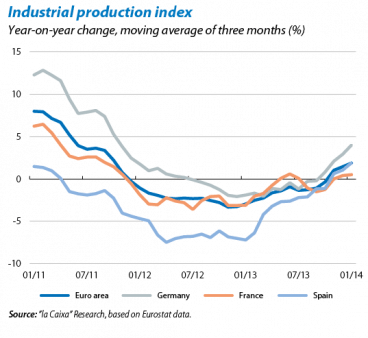

Domestic demand is taking on a more central role. Its contribution to GDP growth was positive for the first time in two years, specifically 0.1 p.p.. Of particular note is the advance made by household consumption and especially by investment (0.1% and 1.1% quarter-on-quarter, respectively). Moreover, available indicators for 2014 suggest that investment's rate of growth has not slowed up. For example, in January industrial production grew by 2.1% year-on-year thanks largely to the dynamism seen in the production of intermediate goods and also capital, up by 3.7% and 5.8%, respectively. A geographical breakdown shows that this trend is widespread among Europe's countries except for France, which is also lagging behind in this aspect. The development in production expectations for industry, which is continuing to improve and is now posting figures higher than its historical average, leads us to believe that this trend will continue over the coming months. The only element in domestic demand showing a negative trend is public expenditure, still suffering from the need to contain heavy public borrowing.

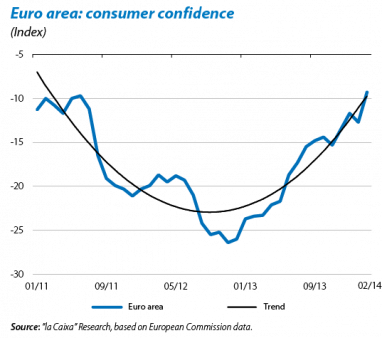

Household consumption continues to be positive. Consumer confidence advanced significantly in the month of March, placing the average for the first quarter of the year clearly above the figures recorded at the end of 2013. Moreover it is worth noting that, for the first time since mid-2011, consumer confidence has returned to levels above its long-term average. Once again this trend has been accompanied by a reduction in gaps between countries, with highly significant advances in the periphery which, until now, had been lagging behind. The recovery in household consumption has also been reflected in the trend in retail and consumer goods, growing in January by 1.1% year-on-year. In principle, over the coming months this upward trend in household consumption will be supported by the labour market, so it should not slow down: the index of employment expectations increased significantly during the first quarter of the year, particularly in the services sector; and confidence in the labour prospects of consumers has reached the levels of almost three years ago.

Portugal is leaving its political crisis behind and gaining ground to successfully complete its bail-out programme. The trend in Portugal's economic activity has pleasantly surprised analysts over the last few months. Overall, indicators show a clear positive path (industrial production, for example, increased by 4.2% in January). Particularly relevant is how Portuguese exports rallied in 2013, rising in real terms by 6.9% year-on-year (2.2% in Germany). This arrival of more positive news has started to provide credibility to the agenda of structural reforms carried out over the last few years and has particularly helped confidence to improve in the Portuguese economy's capacity to grow in the medium term. This has allowed Portugal to regain access to international financing markets and meet its gross borrowing needs predicted for this year. All the evidence therefore points to Portugal being able to successfully complete its bail-out programme with the troika by mid-2014.

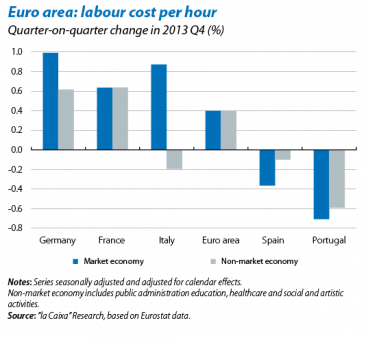

Contained labour costs support the periphery's improved competitiveness. In Spain and Portugal, hourly labour costs, seasonally adjusted, shrank in 2013 Q4 by 0.2% and 0.6% quarter-on-quarter, respectively. Italy, however, is experiencing a different trend from the rest of the periphery countries with its index increasing by 0.5% quarter- on-quarter. France and Germany, however, remain at clearly positive quarter-on-quarter rates of change, namely 0.9% and 0.6%, respectively. This disparate performance between the core and periphery countries can also be seen in inflation. In the euro area as a whole, this slowed down again, reaching 0.5% in March (compared with 0.7% in February) although it is likely to start rallying soon as a result of the recovery in domestic demand. In Spain and Italy, March's inflation rates, namely –0.2% and 0.3%, respectively, were lower than those of the euro area as a whole.

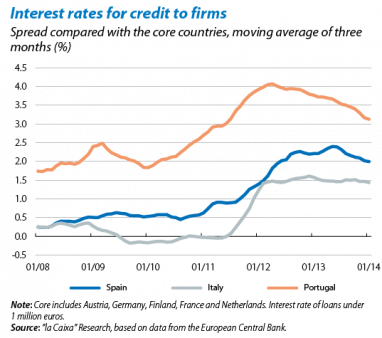

The fragmentation of financial markets: pending resolution but on the right track. The interest rate spread for loans to companies of less than 1 million euros between Spain and the average of the core countries has gradually narrowed since June 2013; Portugal has also seen a narrowing trend. In Italy, this spread has remained at 1.5% but has not widened in spite of the political instability the country has seen in the last few months. It therefore appears that the measures taken by the European Central Bank (ECB) and improved confidence in the growth capacity of the periphery are helping to slowly reduce the fragmentation of financing terms between the countries of the euro area. However, pressure on the ECB has increased over the last few months, particularly due to the downward trend in inflation and the recent appreciation of the euro against the dollar. In this respect, the declarations made by the President of the Bundesbank and member of the ECB's Governing Council, Jens Weidmann, came as some surprise insofar as he did not rule out the ECB buying up public and private debt to reactivate the economy and diminish deflationary pressures.

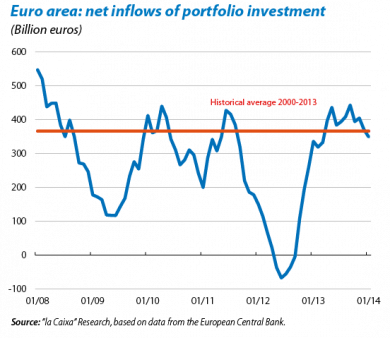

The euro area once again attracts investors. Over the last few months, the constructive tone dominating the debate regarding the process of constructing Europe and improved confidence in the growth capacity of the periphery countries are presenting a macroeconomic scenario that is once again attracting investors, who are attempting to readjust the composition of their portfolios after risk-return trade-off in the emerging countries has altered. Net inflows in portfolio products are a good reflection of this. After reaching very low levels by mid-2012, they have now regained the levels of the last few years.

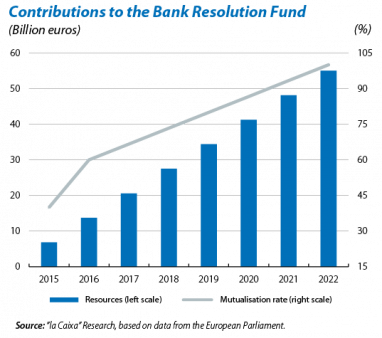

The agreement on the Single Resolution Mechanism strengthens the Banking Union. With this agreement, Europe's new system has been defined to restructure or close problematic banks through a central authority. Negotiations between the European Council and Parliament have introduced amendments to the initial proposal: the time given to provide the Single Resolution Fund with its funds totalling 55 billion euros has been shortened (from 10 to 8 years) and the rate of mutualisation has been speeded up (60% constituted after 2 years, 100% after maximum 8 years); decision-making has been streamlined; and, during the transition period, the fund will be able to borrow from the markets. Each bank will contribute to the common fund according to its risk-weighted assets and proportion of wholesale funding, although the details have yet to be specified. This agreement represents a fundamental pillar in the process of banking union, together with the sole supervision that will be carried out by the ECB as from November this year. These new steps are positive and help to forge, little by little, a more robust economic and monetary union that is essential in order to re-establish the mechanisms to pass on monetary policy and put an end to the fragmentation of financial markets.