The recovery is still robust but its pace is weakening

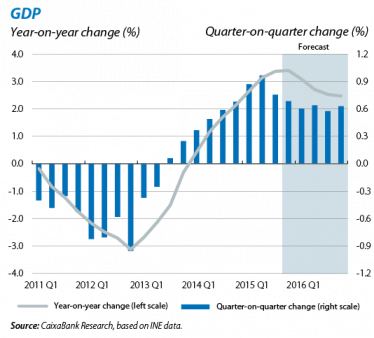

The Spanish economy has now embarked on a phase of more contained expansion after a first half of the year with dynamic growth. In Q3 the rate of growth in GDP stood at 0.8% quarter-on-quarter (in Q2 it was 1.0%). This slight slowdown, in line with expectations, is due to the temporary support factors that had boosted the recovery coming to a gradual end. Pending more details regarding the specific components, leading indicators point to domestic demand still being the main engine of growth although private consumption may have lost some of its energy due to a less dynamic labour market. In any case the good trend observed in fundamentals such as the revival in credit and the recovery of the real estate sector suggests that growth will remain above 2% in the medium term.

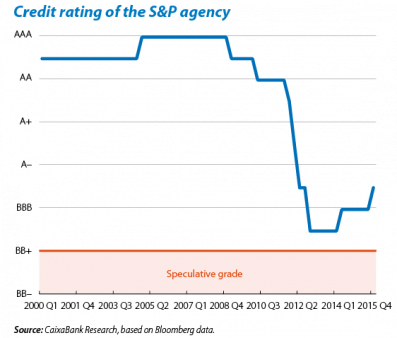

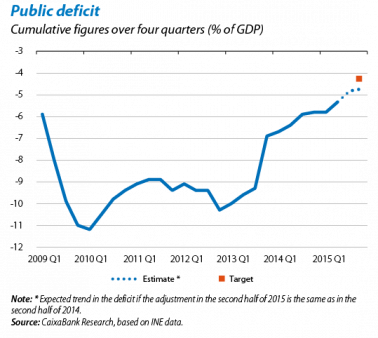

These good prospects have led the credit agency S&P to upgrade Spain's rating, also helped by a positive evaluation of the structural reforms carried out over the last few years, the improvements made in competitiveness and favourable developments in fiscal consolidation. However, it should be noted that some downside risks still remain, such as high debt, especially if this ends up exceeding 100% of GDP. This circumstance reminds us of just how important it is for the government not to relax its process of reducing the fiscal deficit.

Business indicators run out of steam in Q3 but are still at significant levels. On the supply side, industrial production grew by 2.4% year-on-year in August, a brisk rate of growth but lower than the figure posted in the preceding quarter (3.5%). Moreover the composite business sentiment index (PMI) fell to 57.2 points on average for Q3, also slightly below the average for Q2 (57.7 points), with the decline in manufacturing being more marked than in services. Demand indicators suggest that private consumption is running out of steam slightly: consumer confidence for Q3 (–1.3) was lower than in Q2 (1.6) although still far above the historical average (–13.6), so we expect consumption to continue supporting growth.

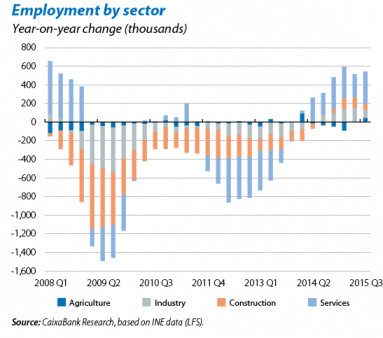

Employment saw a strong increase in Q3 in spite of a slowdown compared with Q2 (from 1.0% quarter-on-quarter to 0.6%, seasonally adjusted). In year-on-year terms the increase was 3.1%, slightly above the figure for Q2. Although the improvement was concentrated in services in Q3, for the year to date the net creation of jobs has consolidated in all sectors. Should this trend continue, the number of jobs created in 2015 might exceed half a million although the fact that these new jobs are largely temporary suggests that any gains in labour productivity are likely to be limited. Specifically, by type of contract, in Q3 the year-on-year growth rate for salaried workers with permanent contracts stabilised at 1.6% while the corresponding rate for temporary employees increased to 10.1%. Given this trend, the temporary employment ratio has risen by 1.6 pps since last year, up to 26.2%.

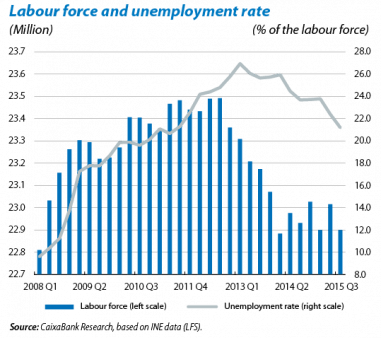

Unemployment fell by 1.2 pps in Q3 to 21.2%, thanks to an increase in employment but also helped by an unexpected reduction in the labour force (of 116,000 people). This decrease in the total labour force, interrupting the growth recorded during the first half of the year, has come as some surprise in a context of economic recovery. We should also note that this drop was not the result of an increase in retirement as most of the decrease took place in the age group of 26 to 55 year olds.

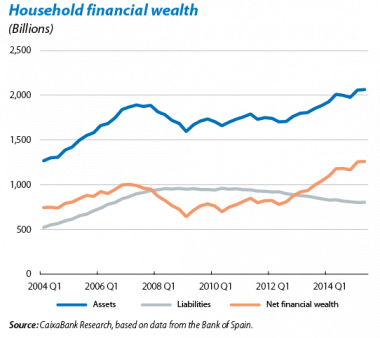

The pace of job creation improves the net financial wealth of households. This grew by 6.8% year-on-year in Q2, totalling 1.26 trillion euros (close to the levels of 2000). On the one hand, the rise in the number of employees has helped to increase the wage income, the most important income received by households. Households have made use of this higher income to acquire financial assets (especially stock prices and investment funds) and this circumstance, together with gains in shares over the same period, has considerably pushed up the value of financial assets and, consequently, net wealth. To a lesser extent households also used their improved income to reduce their mortgage debt so that long-term financial liabilities continued to fall (for a more detailed discussion of this area, see the Focus «Perspectives on household consumption and savings» in this same Report).

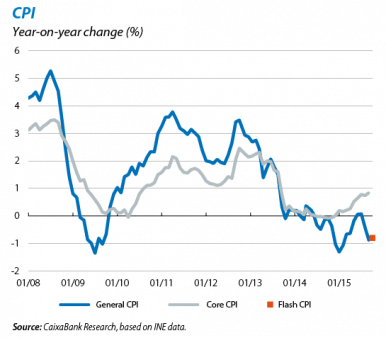

The drop in inflation slows down, with the CPI shrinking by 0.7% in October, 0.2 pps less than the previous month. This progress is probably due to fuels and lubricants whose prices will have fallen less than in 2014. Core inflation, unaffected by fluctuations in energy and fresh foods, is likely to have risen slightly. With the announcement of these figures, the risks of the inflation forecast for the whole of 2015 have remained balanced (–0.4% for the general rate and 0.6% for core inflation). Judging by the non-energy component of industrial prices, to some extent an approximation of the trend in the CPI for the coming months, inflation will continue to recover but only gradually. Specifically, in September the rate of year-on-year growth for this indicator fell by 0.2 pps to 0.4% although it has been in positive figures since February (–0.4% in September 2014). Nonetheless, it should be noted that, with the disappearance of the base effect from the slump in oil prices that occurred in December 2014, the inflation rate will rise considerably at the end of this year and reach clearly positive figures (0.9% in December).

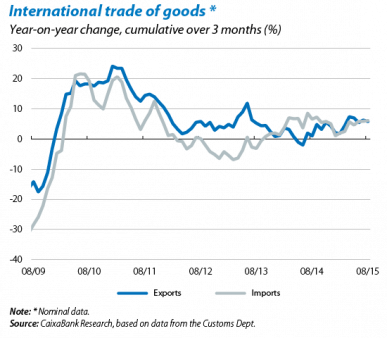

Exports continue to provide good news, growing by 5.8% year-on-year in August in cumulative terms over the last three months, even though the most recent figure, corresponding to the month of August, was slightly weaker than expected due to the strong negative contribution to export growth from the sector of energy products. In August, the boost for demand provided by industrial orders from the euro area suggests that foreign sales should go on growing considerably. On the other hand tourism continued its exceptional performance in September with 7.2 million international tourists coming to Spain, 2.2% more than in September 2014. This good performance by the foreign sector should continue, supported by the expected depreciation in the euro after the ECB announced its readiness to make use, if necessary, of the flexibility offered by the current asset purchase programme regarding its size, composition and duration.

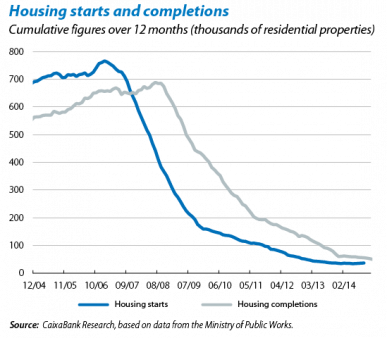

The recovery in the real estate market is becoming increasingly evident. According to data from the Ministry of Public Works, 35,790 residential properties were started in 2014, representing growth of 0.1% compared with the previous year, the first advance since the start of the crisis. Nonetheless the same improvement has yet to be seen in the number of housing completions, which is still shrinking (falling by 25% year-on-year in June (cumulative over 12 months). This factor, together with the upswing in sales (growing in August by 12.8% year-on-year, cumulative over 12 months), is helping the excess stock of empty housing for sale to gradually decrease (see the Focus «The upswing in demand for real estate is reviving activity in construction» in this same Report). The trend in mortgages is another sign that the recovery in the real estate sector is consolidating. The number of mortgages for residential properties was 25.8% higher in August than the figure for the same month in 2014, albeit still at a low level (19,272 compared with 90,763 in August 2007).

Considerable adjustment in the deficit, although not enough to meet the target. The public deficit stood at 2.4% of GDP in September (compared with 3.1% in the same month of 2014). This is largely due to higher tax revenue and, to a lesser extent, spending cuts. For its part, the deficit of the autonomous communities, 0.7% in August, was also lower than its 2014 counterpart. Nevertheless, in spite of this improvement in the deficit for different public administrations, the rate of adjustment might not be enough to meet the target agreed with Brussels. For instance, if the public deficit fell at the same rate in the second half of 2015 as it did in the second half of 2014, it would end the year at 4.7% (when the target is 4.2%). Given this situation, the European Commission has warned of the risks of deviating from this target and has criticised the government for the lack of structural measures in the 2016 Budget. Moreover, the downward revision of the historical GDP series and the limited increase in the GDP deflator are additional risk factors for meeting this target.