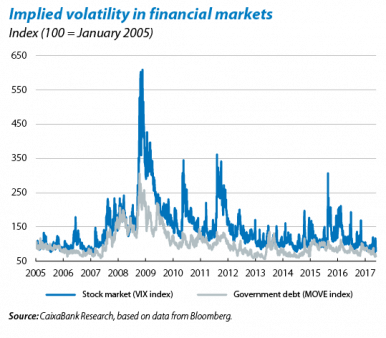

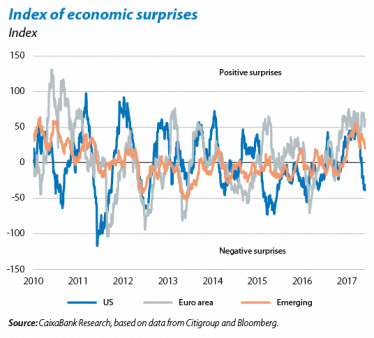

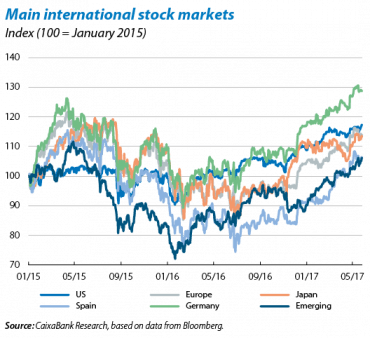

The global financial climate is still calm. In general, risky assets (stock markets and corporate bonds) have performed well in month-on-month terms, especially in Europe. Volatility in financial assets has continued to fall, reaching levels not seen for some time. The main reason for this situation has been the favourable outcome of the French elections, putting an end to a significant tail risk for the euro area’s future. But it has also been helped by other factors, such as growth speeding up in the euro area and the positive corporate earnings reported for Q1 2017. On the negative side, commodities have looked unstable and Brazil is also a cause for concern. Towards the end of May Brazilian assets were hit hard by an outbreak in political instability. The impact from this episode has been limited in scope, mostly affecting Brazil’s stock market and currency.

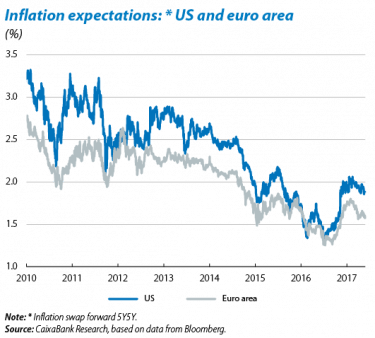

The factors underlying the present boom will remain in force, albeit with some provisos. The combination of controlled inflation rates (both current and expected) and support from central banks has been vital in sustaining the good performance by asset markets. These factors are likely to remain in the short term but their impact will tend to fade over the medium term, especially regarding central banks. Known sources of risk seem to be under control, such as the rise of populism and fears of a hard landing for the Chinese economy. However, we should still keep a close eye on less well-known or emerging risks. The list is long but at the top are signs of the financial cycle weakening in the US and its overvalued stock market.

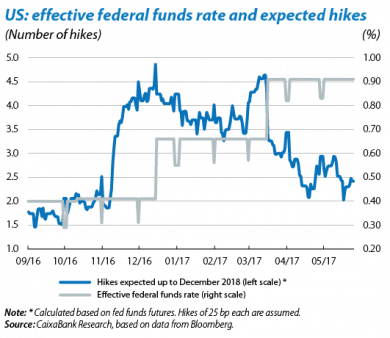

Regarding central banks, the Federal Reserve (Fed) has not altered its guidance in spite of the weak GDP figures in Q1 2017. The official statement from the Fed’s last meeting adopted a «glass half-full» approach. Although the institution noted the poor GDP figures in Q1 2017 and recent slowdown in inflation, it classed the first development as «transitory». The Fed also stressed that inflation was still close to its objective (2%), in spite of recent weakness. The central bank’s positive view of fundamentals and risks to the US macroeconomic scenario suggest the next interest rate hike will take place in June, as predicted by the CaixaBank Research forecasts. This likelihood became even stronger after the publication of the FOMC meeting’s minutes. These also disclosed information on the next steps to be taken regarding the Fed’s balance sheet. Specifically, most Fed members believe it is appropriate to stop reinvesting all principal payments from its bond portfolio this year, reducing securities holdings «in a gradual and predictable manner». Given this situation, we expect this change in approach to the Fed’s balance sheet to be announced in Q4 2017.

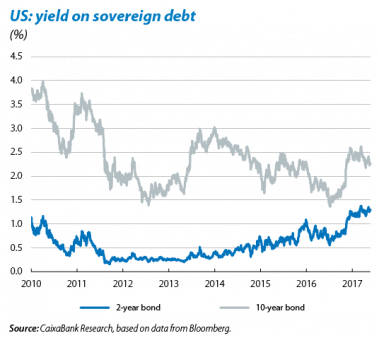

The US Treasury bond market remains unclear. The Fed’s firm messages did not alter the Treasury bond market to any great extent. In fact, yields on the 10-year Treasury note slipped to 2.20% while 2-year bonds, more affected by official interest rate expectations, remained at around 1.30%. There seem to be several reasons for the recent apathy observed in Treasury yields. On the one hand, increasing doubts regarding the ability of Trump’s administration to implement its agenda of reforms. On the other, the somewhat weaker trend than expected in inflation. The doubts of bond market agents can also be seen in their expectations of official interest rates. Fed funds futures contracts assume between two and three cumulative hikes up to December 2018. A scenario which, according to the CaixaBank Research forecasts, should gradually converge until the market prices in four or five fed funds hikes.

The ECB is getting ready to shift towards an increasingly balanced stance but will nevertheless keep the scale of monetary stimuli unchanged. At its April meeting, the ECB’s Governing Council noted the signs pointing to a stronger recovery for the region. It also improved its assessment of the risks surrounding the economic scenario, although these are still tilted to the downside. But there can be no doubt that the reduction in political risk thanks to the outcome of France’s election has reduced the uncertainty of the ECB’s main scenario being achieved. The monetary authority will therefore probably improve its view of the configuration of risks and suggest they are «balanced». This is likely to be a precursor to announcing a gradual withdrawal of bond purchases, which we expect will occur in December.

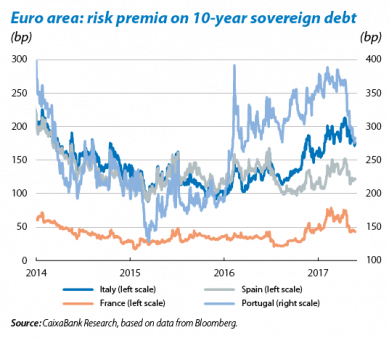

Storm clouds clear from Europe’s sovereign debt market thanks to waning political risk. The victory of the central Macron candidate in France’s presidential elections has clearly boosted periphery debt. In the last month and a half Spain’s risk premium has fallen from 150 bp to 120 bp, Italy’s from 210 bp to 170 bp and France’s from 75 bp to 40 bp. Yields on the German bund, the euro area’s safe haven par excellence, gained almost 10 bp up to 0.40%. The current expansion in the euro area, together with doubts regarding the US political scenario, has led to the euro appreciating considerably over the past month, both against the dollar (3%) and other currencies as a whole (1.5%).

The Old Continent’s shares stand out on international stock markets. Stock exchanges such as Europe’s (Eurostoxx 50) and Spain’s (Ibex 35) enjoyed cumulative gains for the year (up to May) of 10% and 17%, respectively. Their performance has also been good in comparative terms as the US stock market performed less well over the same period (7%). In addition to the aforementioned factors behind this stock market surge are the solid corporate earnings reported for Q1 2017. The good figures presented by the energy and banking sectors were particularly surprising. Plus the absence of any notable shocks (implied volatility is at an all-time low) has helped emerging stock markets to more or less follow the same pattern. Specifically, the emerging MSCI performed particularly well, up by 16% YTD. The US stock market’s performance has been more hesitant, although it is still at an all-time high. Investor doubts regarding reforms with the most potential to affect the stock market have weighed heavily on investors, as well as the ever-rising share prices in the US. Should the Fed make explicit warnings about stock market complacency or decide to speed up its normalisation strategy, the US stock market will be vulnerable.

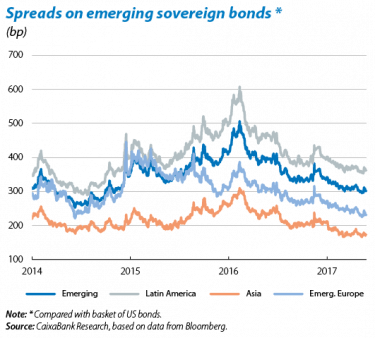

The emerging financial environment is solid but has its weak spots. In addition to the stock markets, emerging spreads and currencies have also performed well on the whole. Looking more closely at this positive situation we can see that internal factors such as good business activity indicators are not the only reason. The dollar’s loss of steam and market expectations of a very prudent normalisation of US interest rates are also having an effect. However, this context of stability was marred slightly towards the end of May by an outbreak of political instability in Brazil. The country’s financial assets suffered: the São Paulo stock market plummeted by 10% and the real lost 7% against the dollar. It is difficult to predict the implications and extent of this episode although it looks like having a very limited effect on the rest of the emerging economies. Moody’s downgrading of China’s sovereign debt rating by one notch, from Aa3 to A1, created less of a stir and the country’s financial markets were undisturbed by this decision.

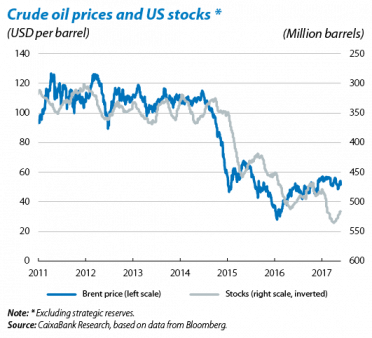

Oil looks volatile both before and after the OPEC meeting. During the weeks prior to the oil cartel’s biannual meeting in Vienna, the Brent barrel price rose by 10% to USD 54 given expectations of OPEC extending its production cuts. However, the price of crude fell again, by almost 5%, after the oil-producing countries decided to prolong output caps until March 2018. In spite of this initial reaction, we believe the cartel’s decision will be effective in the medium term and act as a moderate boost for oil prices. The Focus «Crude oil prices: the puzzle of the impact of OPEC’s cut» in this Monthly Report examines this view more closely.