The recovery in the euro area continues at a slow but firm pace

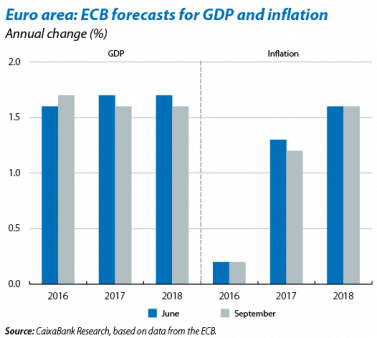

Growth in the euro area is consolidating at moderate levels with risks on the horizon. The upswing in uncertainty caused by Brexit has had a more subdued impact than anticipated on the euro area. The CaixaBank Research forecasts, and those of most analysts, therefore place GDP growth at around 1.5% in 2016 and 1.3% in 2017. Domestic demand and in particular household consumption are expected to continue forming the mainstay of the recovery although the foreign sector will gradually become more important. Another sign of the limited impact on the euro area expected for Brexit, at least in the short term, is that the ECB has kept its economic forecasts almost unchanged. In fact the institution revised slightly upwards its growth forecast for 2016 to 1.7%, just above the CaixaBank Research forecasts. However, it revised its forecasts for 2017 and 2018 downwards a little, to 1.6%. On the whole the euro area is therefore expected to continue growing in the medium term at similar rates to those observed in the last few quarters. Nevertheless uncertainty is still high and Brexit remains one of the major sources of risk. The UK Prime Minister, Theresa May, has announced that the country will officially apply to leave the EU before the end of March. Negotiations will begin from that moment on and it may effectively leave the EU in 2019. The economic impact of Brexit over the medium to long term (for the United Kingdom and the EU) will depend on how these negotiations are carried out and the new relationship finally agreed between the UK and the EU.

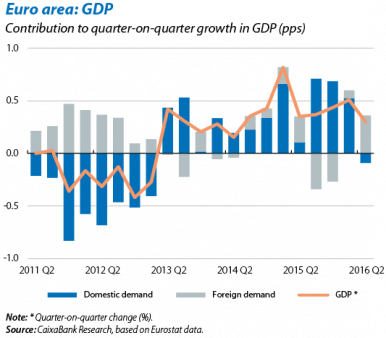

The foreign sector, key to growth in the euro area in Q2. Specifically, GDP growth was 0.3% quarter-on-quarter and the contribution made by exports to growth was 0.4 pps; the contribution made by the domestic demand was therefore –0.1 pps. These figures must be interpreted with caution, however. The negative contribution by domestic demand was particularly due to a fall in inventories while household consumption continued to rise at a notable rate. Given the high volatility usually observed in inventories and the greater inertia of household consumption, the bulk of the evidence available suggests that, in the coming quarters, domestic demand will continue to support growth. What should be noted, and as has been the case over the last few quarters, is the disparate pace of growth between countries, with Spain and Germany advancing at a much faster rate than Portugal, France or Italy.

Business indicators point to a similar rate of growth in the coming quarters. This has been suggested, for example, by the composite PMI for the euro area in Q3, standing at 52.9 points, a figure that’s almost identical to the one in Q2, namely 53.1 points. Another sign of this situation is provided by the economic sentiment index holding steady in Q3 at 104.3 points, a figure which is also very similar to the one in Q2. The downside risks, however, are not minor. The industrial production index, for instance, grew by 0.2% in July (average of the year-on-year change over the last three months), a slower rate than in the first few months of the year, while the underlying trend perceived in the industrial sector is one of a clear deceleration.

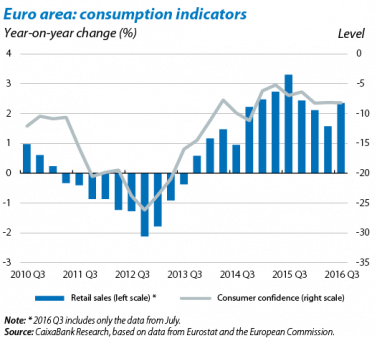

The good tone continues for household consumption. Retail sales in the euro area accelerated their growth to 2.4% year-on-year in July, a faster rate than the one seen in the first half of the year (1.8%) and its historical average (0.7%) while the consumer confidence index of the euro area in Q3 stood at –8.2 points, a level similar to that of the first half of the year (–8.1). The trend shown by these indicators is also expected to continue over the coming quarters seeing as the main factors of support (the rate of job creation continuing, confidence in the recovery and accommodative financial conditions) will still be active.

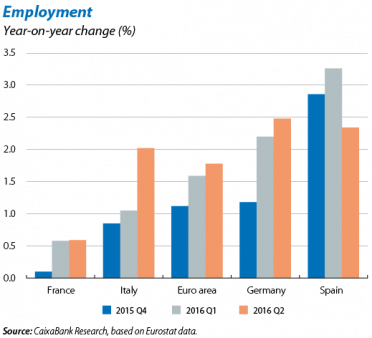

The recovery in the labour market consolidates, supporting growth in household consumption. In 2016 Q2 employment increased by 1.5% year-on-year in the euro area, a slightly higher rate than the previous two quarters. By country, of note is the job creation rate in Germany (2.5%) and Spain (2.3%), while in Italy (2.0%) and in particular France (0.5%) it is still rather sluggish. Unemployment, for its part, stood at 10.1% in August, 0.6 pps below the level of a year ago. Also in this case the levels are still very disparate between countries. With regard to wage costs, the year-on-year increase in 2016 Q2 was 0.9%, 1.3 pps below the previous quarter. This reduction was largely due to the surprising smaller increase in wages observed in Germany (from 2.7% in 2016 Q1 to 1.1% in 2016 Q2).

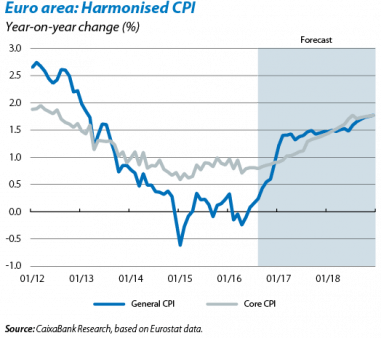

Inflation in the euro area consolidates its advance. The harmonised index of consumer prices (HICP) for the euro area grew in September by 0.4% year-on-year, a figure 0.2 pps higher than the previous month due especially to a smaller drop in the energy component. Core inflation, however, remained stable at 0.8% for the fifth consecutive month. CaixaBank Research forecasts point to inflation continuing to recover, supported by the progressive rise in oil prices and the recovery in domestic demand.

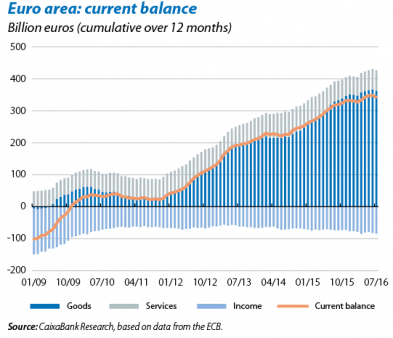

The current account surplus is still at high levels. Specifically, this reached 343 billion euros in July (cumulative over 12 months), a figure that places it slightly above the average for the first half of the year and which still shows an upward trend similar to that of the last few years. This strength in the current balance is particularly thanks to the increase in the goods account surplus (362 billion euros in July) which has partly been boosted in the last few quarters by the drop in oil prices. Another element promoting European exports is the euro’s depreciation. While the effect of oil prices is likely to begin reversing in the coming quarters given that we expect a gradual upward trend to become established, the effect of the euro’s depreciation will remain active, to some extent because of the ECB continuing its ultra-accommodative monetary policy. Moreover, global demand will gradually recover the energy lost in the last few quarters. On the whole, therefore, we expect the foreign sector to take a leading role once again.

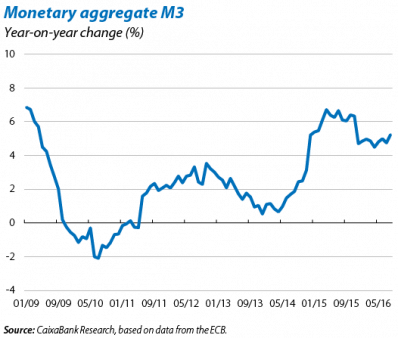

The ECB will maintain accommodative monetary conditions. At its September meeting the ECB left its monetary policy unchanged and insisted that the accommodative environment would remain over the coming quarters. Although growth in the euro area is still relatively limited, the impact of the ECB’s measures is significant. The M3, for example, has been growing by more than 5% year- on-year, on average, since January 2015. Another sign of the effect of the ECB’s measures is the relaxation in conditions to be eligible for credit, leading to more loans being granted. However, it is too early to claim that the policies promoted by the ECB are free from risk as they may result in a bad allocation of resources and excessive risk-taking. Moreover, it is increasingly evident that the ECB has very little room left to manoeuvre. Most action regarding economic policy is therefore likely to shift towards fiscal policy in those few countries that still have some margin, and especially towards structural reforms, an area in which all countries could improve.

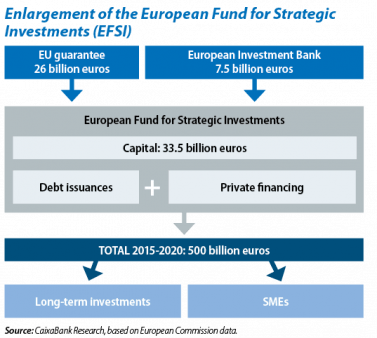

The European Commission has asked for more emphasis on structural reforms and for an adequate use of the fiscal margin available. Specifically, the European Commission has suggested that one element that could boost growth in the short and medium term is investment in infrastructures. That is why it has extended both the duration and size of the European Fund for Strategic Investments (EFSI), also known as the Juncker plan. This prolongation of the EFSI, which is managed by the European Investment Bank (EIB), should increase its lending capacity to 500 billion euros by 2020. The ultimate success of the plan will depend on the investments chosen and how effectively it attracts private financing. However, the measure illustrates the will of the European Commission to give more weight to investment as a means of increasing the euro area’s economic prospects.