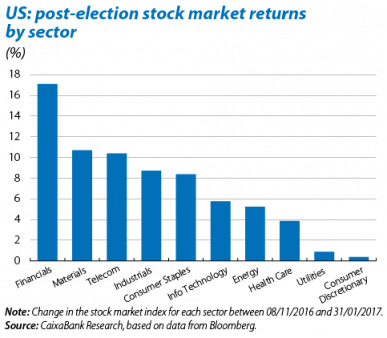

A sector-based view of the new macroeconomic scenario

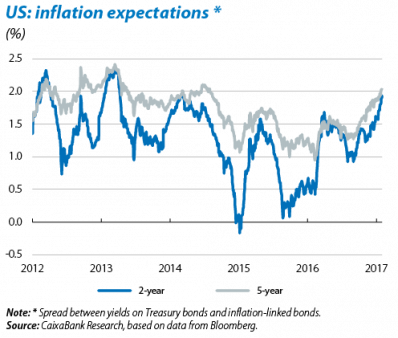

Since Donald Trump won the US presidential election, growth and inflation expectations have been revised upwards in the US, also reflected in bigger corporate profits being forecast. As a result, we have also witnessed significant gains in the major stock market indices. However, this «Trump Rally» hides a revealing disparity between sectors that is essentially due to three factors: markets discounting an economic boost thanks to fiscal expansion, an increase in risk-free Treasury returns due to higher inflation expectations and anticipation of more protectionist trade policies.

The sectors that benefit most from fiscal expansion are primarily related to infrastructure spending, such as materials, metals and mining. Investors have also anticipated an overall positive effect on earnings due to cuts in corporate taxes which could particularly boost those firms with greater domestic exposure. Faster growth and lower taxation could also free up space on balance sheets for more capex, which would have a positive effect on industry via larger manufacturing orders. Finally, investors also anticipate individual tax cuts, which would lift cyclical consumption. On the other hand, defensive sectors such as consumer discretionary, telecommunications1 and utilities tend to lag under such scenarios.

Another factor that will affect share price trends is the expectation of higher interest rates, especially in the long end of the curve. Both banks and insurance companies will benefit from a steeper curve as it means larger profits from interest payments. Financials valuations have also become more attractive (both in terms of price-to-earnings and also price-to-book). However, higher interest rates will particularly hurt those industries with greater leveraging and higher long-term debt, such as oil, metals and mining, telecommunications, airlines and automobiles.

Finally, the Trump administration’s protectionist stance appears to be achieving a scale that could end up hindering more import-dependent sectors (such as retail consumption and transport), as well as companies with a large share of their production overseas (e.g. Apple and Ford). The Fed’s interest rate hikes will also keep the dollar strong, which will hit exporting firms, mainly technological (with 60% of their income from abroad) but also industrial (especially car manufacturers, facing increased competition from Europe and Japan, and with higher valuations and weaker balance sheets than the technological sector).

1. Telecom shares have rallied because the sector’s regulation is likely to be reduced.