The sector diversification of Spanish exports

Spanish exports of goods have performed exceptionally well over the past decade. It also looks like Spanish firms are now competitive in a wider range of sectors internationally as the diversification of these exports has also increased. This greater diversification makes the Spanish economy less vulnerable to shocks in specific sectors.

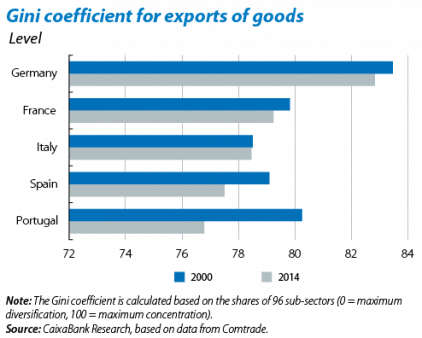

The diversification of a country’s exports can be measured by calculating the Gini coefficient. This provides a range from 0, maximum diversification, to 100, maximum concentration (when a country exports just one good). Based on data from Comtrade1 and using a degree of disaggregation of 96 sub-sectors, we can see that the main euro area countries enjoy a similar degree of sector concentration. In general, this has fallen since the euro was adopted in 2000. Portugal and Spain are the two European countries whose sector concentration reduced the most between 2000 and 2014. This also fell in Germany and France but to a lesser extent, while it remained unchanged in Italy, albeit starting from a lower level of concentration. As a result, Spain and Portugal now have a lower sector concentration for their exports than the other large countries in the euro area (France, Italy and Germany).

At a wider level of aggregation (27 sectors instead of 96 sub-sectors), the trend remains towards greater sector concentration between 2000 and 2014 in European countries. But Spain now has a similar concentration level to Germany and is more concentrated than France, Italy and Portugal. This suggests that Spanish exports have a high degree of intrasector diversification; i.e. between the sub-sectors in each sector.

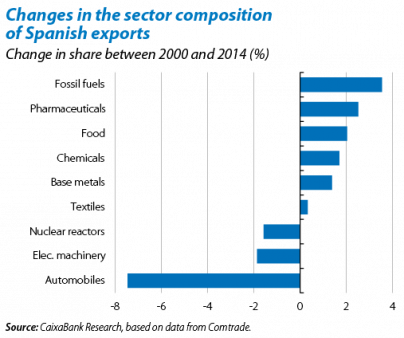

Beyond the degree of diversification it is also useful to analyse the changes in sector composition. One key point is that, between 2000 and 2014, the sector composition of Spanish exports altered more than in other large European economies. Those with the biggest increases in their share of all Spanish exports were chemicals, pharmaceuticals and food, which jointly went from a 25.0% share in 2000 to 31.2% in 2014. More importantly, they played a vital role in export growth, contributing 58.9%. The food sector made a particularly significant contribution of 26.8% to the total growth in exports. Although we need to take into account the fact that the food industry in general is gaining ground in the main European countries, as well as US and China, the Spanish case is more accentuated in quantitative terms. Within this industry, the largest gains were made in meat, fruit and vegetables while this growth was led by dairy and cereals in other countries.

The automobile industry was among those sectors losing share of Spanish exports, steadily falling from 23.7% in 2000 to 16.2% in 2014. But in spite of its smaller share, the industry is still competitive and contributed 21.9% to export growth between 2000 and 2014. This reduction in share had nothing to do with the industry’s performance (whose exports grew by 21.9% in the same period) but to the exceptional results of exports by the other sectors mentioned previously.

1. Data gathered by the United Nations. Exports measured in nominal terms.